Systematic Investment Plan

Calculators

- SIP for Future Return

- SIP as Retirement Investment

- SIP for Financial Goal

- SIP for Parking Money

- SIP as Child Gift

If you have some short term cash requirements and you are saving some funds from your salary every month so that you can spend on that car you always wanted or you are saving for upfront deposit to buy your house, start setting aside a portion of salary in SIP. We recommend parking this money in Liquid funds though regular SIP instead of leaving it your bank account.

Plan Your Goal

Investment Plans

Top Rated Funds

Make Own Plans

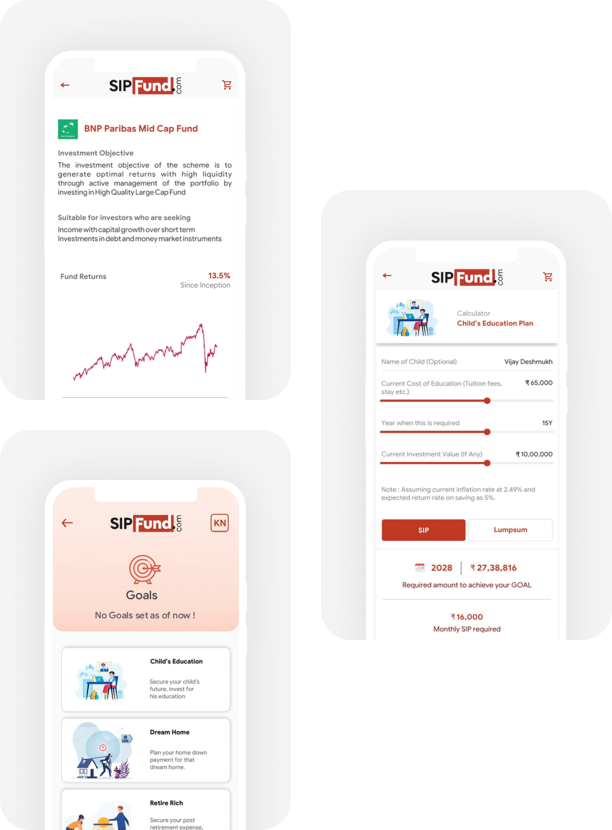

You can do all the fund management on mobile app

- Track your goals

- Switch between funds

- Get investment reviews

- Check funds details on app

- Download reports

- Talk to expert

Frequently Asked Questions

All your Questions Answered in one place.

Minimum Amount

Lockin

Flexibility

Payment Methods

Easy Withdrawal

What is the minimal amount for investing in Mutual Funds?

The minimum amount required to invest in mutual funds is very low. You can start investing in Systematic Investment Plan (SIP) with an amount of ₹ 500 only.

What is lock-in period in Mutual Funds?

A lock-in period is a specific period during which an investor is not allowed to redeem the units of the mutual fund either partially or fully.In an ELSS fund, the lock-in period is 3 years.

What is the flexibility that Mutual Funds offer?

Mutual Funds offer flexibility to investors by means of Systematic Investment Plan(SIP), Systematic Withdrawal Plan (SWP), Systematic Transfer Plan(STP), Growth Plan, Dividend Payout or Reinvestment Plans.They are also affordable as they allow investors to start investing with a little amount as low as ₹ 500.

What are the various payment methods available for an investor for making investments?

Using SIPfund.com app/portal, an investor can make purchases under the following methods.

- NET Banking

- NEFT/RTGS

- UPI

- Debit Mandate

- Cheque

Do Mutual Funds allow easy withdrawal of amount?

Both Equity and Debt Mutual Funds can be technically withdrawn as soon as fund is available for daily sale and repurchase. Of course liquidity is one of the biggest advantages of investing in Mutual Funds which is not available in many other asset classes. Amount redeemed or withdrawn will be credited to investor's bank account within 1-4 working days depending on the type of mutual funds.