Are Banking and PSU debt funds safe?

Banking and PSU funds belongs to debt category of mutual funds and these are mandated to invest 80% of their assets in debt instruments of banks and top-rated Public-Sector Undertakings. Banking and PSU Funds’ portfolio consists of government, quasi-government securities and top-rated banks of Indian banking industry.

In December 2017, SEBI also included debt securities issued by municipal bodies that include companies which are AAA rated from top credit agencies. Banking and PSU debt funds eye on top-rated PSUs like - Housing & Urban Development Corporation, Indian Oil Corp, Indian Railway Finance Corp , Power Fin Corp, Power Grid Corp, Rural Electrification Corp, etc. and other financial institutions like LIC Housing Finance, NABARD,EXIM, SIDBI etc. because these institutions are highly rated by top credit rating agencies.

Why should you invest in this category?

The most interesting fact about these funds is that their performance is inversely related to interest rates in the country. Whenever RBI cuts policy rates, returns on these funds go up since these funds get benefited from capital appreciation.

As repo rate goes south, banks can borrow from RBI at lower rates therefore it injects liquidity in the market as it allows investors to borrow from banks for their investment purposes at cheaper rates. This eases the flow of money and strengthen the performance of banks and PSUs which gets reflected in their growth. Hence, investors start pouring money into banking and PSU debt funds to reap higher profits.

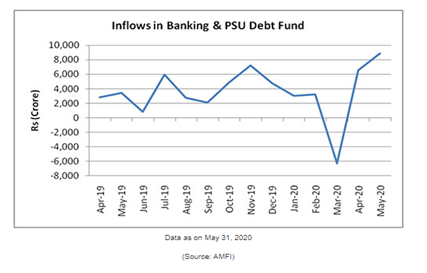

Secondly, many investors have pulled out money from the equity portfolios when nationwide lockdown was announced amidst Covid-19. However, PSU and banking debt funds experienced an inflow of ₹ 8,873 crore in May which is considered as the highest since April 2019. It can be clearly seen from the graph that May 2020 saw a huge influx of funds into Banking and PSU debt funds after an outflow of money in month of March 2020.

This sudden increase in the inflow of PSU funds in the month of May 2020 can be accounted to the safety aspect of these funds and interest rate cut by RBI. Since these funds comprise of top-rated government institutions, these are less prone to credit risk.

Lastly, Small Saving Schemes and bank deposits have been losing their shine as an investment tool for investors because of falling interest rates over the years. Investors can earn higher returns by investing in PSU and banking debt funds and that too with financial safety as credit risk is minimal in these funds. These funds are the safest debt instruments of mutual fund market.

Are these funds safe?

Looking at the banking and PSU debt funds structure as of May 2020.

Assets in AAA rated instruments- 80.1%

Sovereign rated instruments – 9.4 %

Around in cash equivalents. - 5%

And low rated instruments - 5%

It can be easily concluded from the above structure that these funds are safe since a major portion i.e., 80.1 % of their assets is locked in highly rated instruments where default risk is exceptionally low. These are government backed securities which instill confidence among investors to choose these funds when interest rates are low. These funds have limited their exposure to only 5% for low rated and cash related instruments. Investors who have invested in these funds via a fund manager who have good track record can earn higher returns on these funds. Banking and PSU fund category has given returns of 11.05% on an average in 2019 and in 2020 they have offered 9.50% returns. They have comparatively outperformed all other debt fund returns.

It is known that these funds are safest in debt mutual funds but there are certain points which need investors’ attention. These funds do not perform well when interest rates go up in the economy. Banking and PSU debt funds are affected by fluctuations in the interest rates. As interest rates increases, NAV of these funds comes down which means lower returns for investors. However, RBI has been trimming interest rates since 2019 to revive the stalled Indian economy. Additionally, experts are of the opinion that interest rates could come down further in coming years since economy desperately needs revival. Having said that, no one can predict what could happen with interest rates in coming years with certainty. Therefore, these funds are for investors having short term horizon. Investors should aim for high quality portfolios while investing in Banking and PSU debt funds.

Suitability

Banking and PSU debt funds are open ended scheme of debt mutual funds and these are for shorter time horizon. Investors who have low risk appetite and short-term horizon (1-4 years) can choose this category to park their surplus funds. These funds have the ability to provide higher returns than fixed deposits and therefore investors who want higher returns with a little more risk can opt for these funds. These funds provide great opportunity to reap returns by investing in high credit quality debentures.

The top performing Banking and PSU debt funds with their performance is given below as on 2nd Feb 2021

| Scheme Name | 1Y | 2Y | 3Y | 5Y | Duration | YTM (%) | Govt (%) | Low Risk (%) |

|---|---|---|---|---|---|---|---|---|

| DSP Banking & PSU Debt Fund | 3.00% | 9.00% | 14.00% | 23.00% | 1.99 | 4.34% | 67.88% | 79.98% |

| IDFC Banking & PSU Debt Fund | 4.00% | 9.00% | 16.00% | 25.00% | 1.90 | 4.44% | 50.71% | 94.27% |

| Axis Banking & PSU Debt Fund | 3.00% | 9.00% | 14.00% | 24.00% | 1.50 | 4.27% | 50.95% | 93.58% |

Yield to Maturity

Yield to Maturity is the total expected returns on the bonds held till maturity. Banking and PSU debt funds are giving YTM approximately around 5% to 6% which is higher than other debt funds.

Time frame

Banking and PSU debt schemes are usually for shorter time frame. Investors who want to invest for shorter time can choose these funds as money will be locked maximum up to 1 year. These schemes are good option for meeting your short-term financial goals.

Conclusion

There is a wide variety of mutual funds in the market for all kind of investors. Banking and PSU debt funds are good option to diversify your portfolio provided you are willing to park your funds for shorter duration. These funds are safer as investment goes in all the government PSU and Banks. The good credit quality papers and credible businesses make this fund suitable alternative to Bank Fixed Deposits. The funds returns are sensitive to the interest rates movement but if your investment time horizon is 2-3 years which matches with the underlying papers in these funds then the volatility of the funds returns does not play a major role.