Bank Mandate and its importance

Introduction

Investors who use Systematic Investment Plans (SIPs) must have heard the word “debit mandate”, “bank mandate” while investing. Investors who are entering in the investing world for the first time, they may need guidance on bank mandate. Therefore, in this article, we are going to read about bank mandate in a detail. So, read along!

What is bank Mandate?

Bank mandate also known as debit mandate is a legal right which you entrust on the third party to deduct a specific amount from your bank account at regular intervals. Mutual fund investors entrust this authority by registering for bank mandate to automatically debit a sum of money from their bank accounts to the Asset Management Companies (AMCs) on specific dates. Bank mandate also known as NACH mandate.

What is NACH?

National Automated Clearing House or NACH was introduced by National Payment Corporation of India (NPCI) with the aim of catering to higher volume of periodic inter-bank electronic transactions. NACH has consolidated multiple Electronic Clearing Service (ECS) systems which are running across the country. It could be used in bulk distribution of subsidies, dividends, interest, salary, pension, etc. and used where large number of transactions required towards the collection of various bills like telephone, electricity, water, loans, or for investments in mutual funds, insurance premium, etc. With the advent of NACH, the turn-around time for mandate activation has been reduced to 10 days from 30 days in case of ECS. Customers are provided with an UMRN i.e., Unique Mandate Reference Number for validating each mandate.

How is NACH better than ECS?

⦁ The process of ECS is manual and time taking whereas NACH is more efficient as it has reduced the turnaround time to 10 days from 30 days.

⦁ NACH provides a unique UMRN code which is particularly useful in verification which was not there in ECS.

⦁ NACH has reduced the paperwork to a great extent and therefore rejection of application is lesser than ECS.

⦁ Settlement of payment can be done on same day with NACH but ECS generally takes 3-4 days

⦁ NACH has a proper system for dispute redressal whereas there was no provision of dispute settlement in ECS.

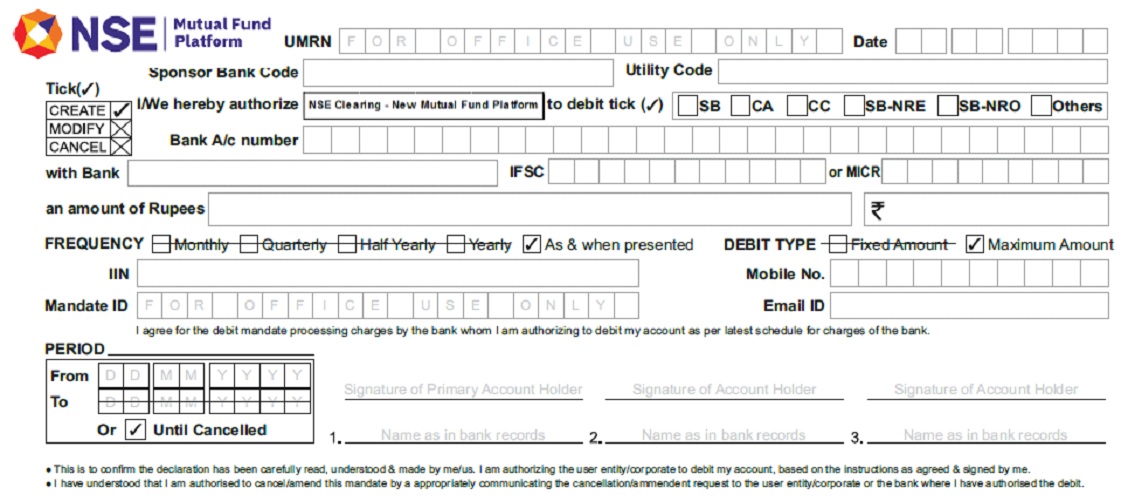

The picture below shows the structure of NACH mandate form

The procedure of getting bank mandate

Investors can download the form from their respective service providers like SIPfund.com. The structure of the form will exactly be like the above inserted picture. After downloading it, investors are required to fill in all the details asked in the form. Investors should recheck their details to be sure that they have filled in correct details and then they should sign it and send it back to their service providers.

Then, the service provider will further send the form to your bank branch on your behalf for the purpose of authorization. Bank will validate the details and authorize the bank mandate for debiting the required amount on regular intervals towards mutual fund scheme. Once you get authorization by NACH and UMRN is assigned to you through an SMS or email, you can easily invest in mutual fund scheme with no paperwork hassles.

For example, if an investor has chosen 8th of every month as SIP date, then the specific amount will be automatically debited from his/her bank account and mutual fund will invest that amount towards the scheme chosen by the investor.

Also, to simplify the paper works in getting the debit mandates registered, some service providers like NSENMF have come up with the facility of E-mandate through which the investors can register their mandates online through debit card or net banking. E-mandate is totally a paperless mandate registration system.

How do Mutual Funds and Banks coordinate between themselves?

Before the due date of SIP, a debit request is to be sent to the investor’s bank and then the bank will validate the request by initiating the debit transfer to the respective mutual fund. Once debit confirmation is received by the mutual fund house, it will invest the same amount in the said scheme. Investor can track the investment on his dashboard provided to him by the service provider like SIPfund.com.

How is bank mandate useful in Mutual Funds?

Mutual funds provide a very flexible method of investing by allowing the investors to avail the option of monthly SIPs. With Systematic Investment Plans, an amount is being debited from investors’ account towards the mutual fund scheme chosen by investors over regular intervals. It is completely an online procedure which reduces the hassles of paperwork and reduces the burden of administrative costs. Fund houses can track all the transactions easily since records are properly maintained. All transactions are safe and secure as per the norms laid down by NPCI and thereby provide sense of safety to investors.

Conclusion

Investors are required to go through the process of bank mandate only once. It is a simple, convenient, less time taking process which makes your investing experience much easier. Investors do not have to issue checks for SIPs each month since auto debit facility is there for them. The process of accounting becomes less complicated for mutual funds when customers avail bank mandate facility. Therefore, the bank mandate plays an important role for mutual fund investors who prefer SIP mode by making their investing experience simple and convenient.