How mutual funds are better than stock investing?

With so many different options available in the market, it can be a daunting and overwhelming decision when investing. From stocks and bonds to money market accounts and real estate, you have plenty of options to choose from.

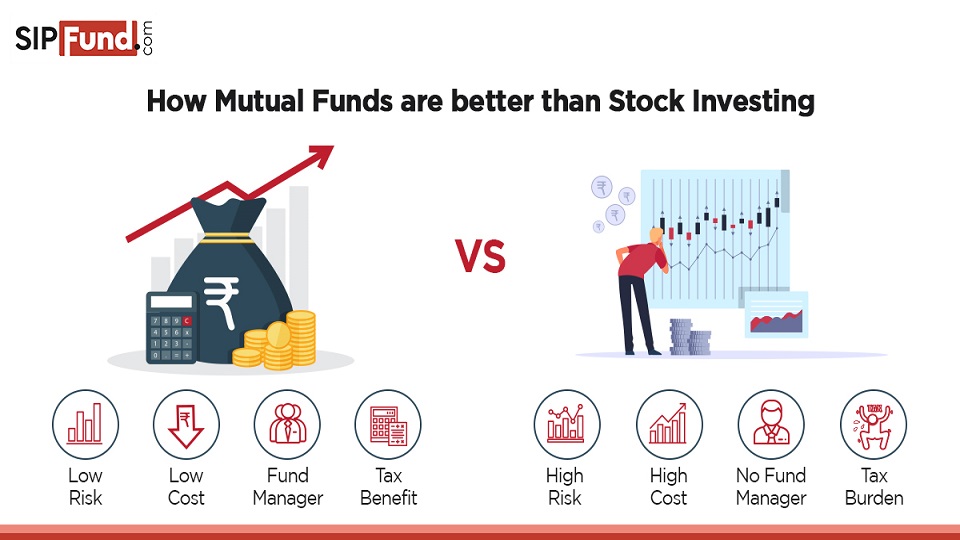

Even though mutual funds are subject to market risks, they are highly rewarding and have relatively less risk than the stock market in the long-term. Hence, pooling your money into the vehicle of the mutual fund will be a better option. The level of risk is more in stocks, and that's the whole game.

Now, one overly critical question that arises is how the mutual fund is better than stock investing. You can certainly build wealth by stock investing, but a mutual fund is much safer than stocks. To understand this better, we have integrated some of the facts and knowledge to understand this better.

Keep Reading!

What are the significant differences between a mutual fund and stock?

Let us see how mutual funds are different from stock investment.

(1) Risk

Risk and volatility in a mutual fund are lower than that of stock investment. The risk in mutual funds can be managed in the portfolio, but the same is not possible with stocks. Stocks tend to be of high risk and are highly volatile.

(2) Cost of trading

The cost of trading in stock investment is generally too high as compared to that of mutual fund. This happens because the cost of stock prices is cancelled out by the value of completing a single sale. However, in mutual funds, the trading costs are spread all over the investors in the funds. This makes sure that the cost per individual is lowered. This whole system helps to keep the trading cost in the mutual funds comparatively lower.

(3) Management

Here is the main difference. In mutual funds, you let professionals known as "fund managers" to manage your portfolio on behalf of you and the level of risk you are willing to take.

On the other hand, in stock investments, you will not get the same privilege. Here, you will have to make your own decision, which has a high chance of going wrong if you are not an expert in this field.

(4) Tax saving benefits

Tax is also one of the big reasons you should opt for mutual funds compared to the stock investment. You can get high tax-saving benefits in a mutual fund that you will not get in the stock investment. Hence, this is one of the next big reason you will always want to opt for mutual funds instead of stock investment.

How much can you make through mutual fund investment?

Before investing in anything, you should always prepare for the worst-case scenario. The below table shows some of the best mutual fund schemes:

| Scheme | 5 Year Returns |

|---|---|

| Axis Bluechip Fund | 13.31% |

| Canara Robeco Equity Diversified Fund | 11.82% |

| Invesco India Multicap Fund | 8.90% |

| Parag Parikh Long Term Equity Fund | 14.15% |

| SBI FOCUSED EQUITY FUND | 12.65% |

Mutual funds give a much lower return in the short term. However, the percentage of returns get better with time as fund managers adjust the portfolios towards better-performing companies in the mutual fund. This is the speciality of the mutual funds. You can always shift your portfolio to a better performing asset.

How much money can you lose to stock investment?

There is no guarantee of anything. Even if you have invested your money in renowned companies, there are chances of your money turning to zero. For example, prominent companies which have lost their stock values are Jet Airways, Yes Bank, DHFL, and Vodafone Idea. Some companies have lost around 70-80% of their stock values in a single year.

However, the opposite is always a possibility. If you happen to invest in the right company, your money can multiply several times over a year. Yet, your probability of picking up the right stock is relatively low. It is unpredictable of the time and speed at which you can lose money in stocks.

Why to choose mutual funds over stock investment?

Now that you already know how mutual funds and stock investment are different and how much money you can lose, it is time to learn more about it.

The below are the essential reasons why you, as an investor, should choose mutual funds over direct equity stocks:

(1) Managing funds professionally

One of the primary reasons you should invest in mutual funds is to use a professional fund manager's leverage, knowledge, and expertise to get rewarded with good returns.

Investment without any prior knowledge about how the financial market works can give you disastrous returns and quickly eat up all your investments. So, if you want your money to be safe, it is always wise that you invest in mutual funds through with the help of an experienced fund manager.

(2) Using Diversification for your benefit

One of the best practices to reduce your risk in mutual funds is through Diversification. A lot of people understand the lesson of Diversification after a financial crisis. Instead of investing in a single stock, a mutual fund invests in various assets to hedge the investment portfolio in the turbulent market condition.

Equity oriented mutual funds also tend to invest a few portions of their asset in a fixed income or low-risk security to mitigate the market risk.

Mutual funds also tend to invest in a variety of different sectors. Therefore, a large-cap fund might be invested across diverse industries like financial, tech, or material.

If you look for something similar in stocks, you'll have to invest a lot of money to get a similar result.

(3) Get tax saving benefit

If you are in stock investment, you should know that there is a short-term capital gains tax, which is at the rate of 15% if you're selling your stocks within a year from the date of purchase. However, do note that income from equity is taxable.

Altogether, some mutual fund schemes provide you with tax-benefit, under Section 80(C) of the Income Tax Act, 1961. This section lets you claim benefit from your taxable income if your taxable income is invested in mutual funds. Equity Linked Saving Scheme (ELSS) is an example of an equity mutual fund where investment is up to ₹ 1.5 lakh is entitled for a tax deduction.

If you are looking to save some tax in your payable income, here are some of the best ELSS mutual funds you can consider

| FUND SCHEMES NAME | 1 Year Return | 3 Year Return | 5 Year Return |

|---|---|---|---|

| Axis Long Term Equity Fund | 13.69% | 10.95% | 12.90% |

| DSP Tax Saver Fund | 7.86% | 5.33% | 11.57% |

| ICICI Prudential Long-Term Equity Fund | 6.38% | 5.53% | 8.45% |

| Invesco India Tax Plan | 11.20% | 6.88% | 11.09% |

| Mirae Asset Tax Saver Fund | 14.94% | 9.26% | NA |

(4) Convenience

Convenience is one of the main reasons why investors opt for mutual funds rather than buying individual stocks. Investors find it easy to buy a few units of the mutual fund that meets their basic investment criteria rather than finding out what the companies the fund invests in. They prefer to leave the research and decision making to the Asset Management Company and the Fund Manager.

In mutual funds, the results are fruitful and sweeter in the long run. You can keep the money in the scheme for the long term and earn a rewarding return.

(5) Unsystematic risk

Unsystematic risk can be defined as the inherent uncertainty of an investment in a firm or industry. Types of unsystematic risk comprise a new market competitor with the ability to take substantial market share from the company being invested in, a regulatory change (which could bring down business sales), a management shift, and/or a product recall.

Unsystematic risks are the risks that can be diversified. For example, owing only one stock, you carry a risk that may not be applying to some other company in the same sector. There can be any mishappening with one company but is not likely to happen to all the companies simultaneously. In mutual funds, unsystematic risks are mitigated by the fund managers through better research and investment decisions. They also, diversify the portfolio.

Over to you

Stock investment needs a lot of your time, effort, and research. If you're not in the financial and economic field, it can still be a very daunting process for you. However, in the mutual fund, you can be a passive investor. It is the fund manager who is going to manage your portfolio.

The above are some of the parameters that compel us to believe that mutual funds are better than stock investment. As mutual funds provide the riskometer for each of the schemes, investors are aware of the risk they are willing to take while investing in a mutual fund scheme. But in stock investing, one does not get to know much about the risk involved in a stock.

So, it's always better to take expert advice before you put your money in the market. And for that reason, mutual funds are the first thing you get in your mind as you get a fund manager to manage your funds.

So, happy investing!