Why Blue Chip funds are in important in your portfolio?

Introduction

The term blue-chip to describe the high-priced stocks was first coined by Mr. Oliver Gingold, an employee of Dow Jones in the year 1923. Since then, the phrase is being used not only to refer high priced stocks but also commonly used today to refer to high-quality stocks. Mutual fund schemes that are investing most of the corpus in these stocks are referred to as blue chip funds.

In this article, we will study about the blue-chip funds and their importance in your portfolio. So, read along!

Blue chip Funds

People save money and invest into mutual funds so that they can accumulate wealth for rainy days. Investing is related to investors’ financial goals which varies from investor to investor. Investors want to choose best investment avenue which deliver higher returns. Blue chip funds are one of the categories of mutual funds that invest in the shares of best performing companies which are ranked extremely high in terms of performance, leadership, profitability, dividend pay outs, and excellent goodwill than their peers in the industry. Investors prefer blue chip funds as these are less volatile and therefore give stable returns. Since blue chip companies are well established with sound financials, they can even sustain the market downturns without having a much impact on their businesses. Their resilience and proven past track records make them the best avenues for investment. These stocks also have a history of delivering good returns to their shareholders. The companies also have resources, like quality manpower, funds, knowledge, brand and market share which gives confidence to the investors that these are stable companies.

Having a portfolio of blue-chip funds can create a multiplier effect on your wealth. How?

A passive fund is a type of investment vehicle that religiously tracks a market index, intending to fetch maximum gains. The fund managers are not actively engaged in investing. Rather they let the investments to track the indexes. Passive funds are easier to invest in and are best suited to investors who do not have time to do research and calculation of a fund regularly.

Blue chip mutual funds schemes are open ended equity funds which invest a minimum of 80% of their wealth in the stocks of large-cap companies. Large cap companies are top 100 companies in terms of market capitalization listed on the stock exchanges. The fund manager undertakes a rigorous research to select the stocks in order to reap higher returns. They use technology for studying the past trends in order to be sure of their bets. Having said that, investing in blue chip funds can improve your financial condition and standard of living as mentioned in below points:

Capital appreciation

Everyone desires to accumulate money in order to fulfill their financial goals and meet economic standard of living. Blue chip funds can help you attain that luxurious life which you often dreamt of. Blue chip funds are known for their potential to generate higher returns which will assist in wealth creation for investors. Portfolio managers choose best amongst the top 100 performing stocks in order to assure higher returns to their investors. Therefore, investors can experience their appreciation of capital over a period by investing in blue chip funds.

Financial Stability

There is no denying that life is uncertain so is the world due to many factors. Mounting the finances becomes a hard nut to crack in times of economic emergencies therefore having a corpus which promises huge returns can cushion you in times of need. Blue chip funds provide that stability to your portfolio as volatility of these funds is lower compared to small or mid cap funds. Therefore, investing in blue chips schemes can make you financially stable to lead a happy life.

Safety of Funds

Mutual funds are the safest avenues for multiplying your wealth as regulatory bodies like SEBI and AMFI have laid down strict rules for protecting investors interests. Hence, when an investor is investing in blue chips funds, he/she can be assured that their money is efficiently managed by the fund managers who devote lot of time in researching and analyzing the trends before taking a bet on stocks.

Taxation

The gains accumulated via selling of mutual fund units in India come under capital gains taxation. The short-term capital gains are taxed at the rate of 15% irrespective of one’s income tax slab. Long-term capital gains up to ₹ 1 Lakh are tax exempt. Long term capital gains above ₹ 1 Lakh are taxed at the rate of 10% without indexation benefits.

Are Blue chip funds for all?

Since blue chip schemes belongs to open ended equity class of mutual funds, a long term horizon and appetite for risks are the two factors which determine the investors’ decision to invest in blue chip funds. Investors who are willing to lock their money for longer tenure in order to meet long term financial goals like retirement corpus, children’ marriages etc. can opt blue chip funds since these schemes give better return over a longer period. Secondly, investors who want higher returns from their investment with a tolerance to bear the market risks can choose blue chip funds.

How did blue-chip fund perform in 2020?

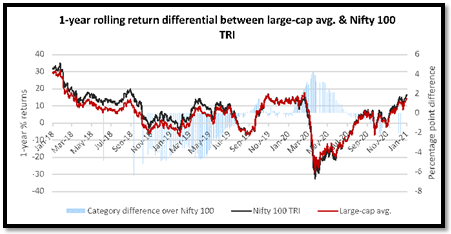

Due to the Covid-19 induced global sell off, the early part of the year 2020 saw the Indian indices crashing over 30% in a matter of few weeks between Feb 2020 and March 2020. March 2020 was the month of the steepest fall when Nifty 100 was down by 33%. After May 2020, the markets stabilized and took off. The below graph compiled by Prime InvestorPrime Investor depicts the 1 year rolling returns for the large cap average and nifty 100 for a 3-year period.

It can be understood that the Blue-chip funds did not perform well during the 1st half of the year 2020. However, they regained the momentum in the 2nd half of the year. They performed well since beginning of year 2021 due to vaccine news and meeting of budget expectations that raised hopes of economic rebound. It shows that returns on blue chip funds are sensitive to the performance of country’s economy and hence they are subject to market volatility although they could recover faster once things stabilize. Stocks like Aurobindo Pharma, Tata Consumer, Info Edge, Cadila Healthcare, Mahindra & Mahindra, Tata Steel etc. performed well but these were not held by most of the mutual funds or were held in smaller quantities. Therefore, mutual funds were not able to reap the benefits. On the contrary, stocks like ICICI Bank, HDFC Bank, HDFC, ITC, Bajaj Finance etc. constituted higher proportion but unfortunately did not perform well during the year 2020 as last year remained highly volatile due to the impact of Covid-19. Blue chips funds are expected to deliver higher returns in coming years too as economy is likely to recover at a faster pace. Therefore, investors are requested to stay put and avoid knee jerk reactions so that they can reap higher profits.

Given below is the list of some of the top performing blue-chip mutual funds (returns as on 16-Feb 2021):

| Fund Name | 1 Year Return | 3 Year Return | 5 Year Return |

|---|---|---|---|

| Axis Bluechip Fund Growth | 22.17% | 18.16% | 19.39% |

| Canara Robeco Bluechip Equity Fund Growth | 29.29% | 17.68% | 19.65% |

| IDFC Large Cap Fund Growth | 24.51% | 12.16% | 16.43% |

| LIC MF Large Cap Fund Growth | 17.70% | 13.35% | 15.37% |

| Edelweiss Large Cap Fund Growth | 24.46% | 13.72% | 16.87% |

Conclusion

Blue chips funds are known for delivering stable returns compared to other funds like small, mid or multi cap funds. These funds are typically recommended for conservative investors. As part of their overall portfolio, investors who have a time horizon of 3 to 5 years, should invest in blue-chip funds. These funds have the best companies in the country and chances of all the blue chip companies delivering low returns or failing are very slim which makes these funds lowest risk funds amongst all equity fund categories.