Investor’s inertia and ways to beat it: put idle money to work

As Dale Carnegie said:

“Inaction breeds doubt and fear. Action breeds confidence and courage. If you want to conquer fear, do not sit home and think about it. Go out and get busy.” This quote sets the tone for inertia or inactivity which means to have a tendency to do nothing or to remain unchanged. This is what investor’s like you and me face, when we make a decision to invest our money, but get caught up in the middle due to thousands of schemes, paperwork and limited knowledge about the world of investing.

I would like to ask you all an honest question, how many times have you decided to invest, but failed to follow through? I am pretty sure that many of you would have experienced this. As Inertia can be your worst enemy when it comes to self-managing money. In this article, we discuss why we suffer from inertia. We also discuss how you can moderate such behavior and beat inertia to achieve your financial goals.

First things first, let's start with the meaning of investor’s inertia and how it acts as a hindrance in our way of achieving our financial goals?

What is investor’s inertia?

Sometimes it feels like we are not doing enough. We had decided to begin that SIP, activate the PPF, invest in that equity share, and increase those tax savings. However, as we prepare to file our tax returns, we find those plans remain only on paper. This problem is commonly referred to as investor’s inertia.“Investor inertia” is a well-documented phenomenon in which investors get comfortable doing nothing due to being overwhelmed by too many choices, paperwork, fear of making a poor decision or just being too comfortable with the status quo. This behavior has caused many people to struggle in their retirement years, despite high incomes and successful careers.

Have you ever wondered as to why this behavior strikes?

Many investors suffer from financial inertia due to the fear of making the wrong financial decision. Some investors might be confused about some financial details and may have limited knowledge of investing. Due to which they keep on prolonging their investment journey. Because of these following reasons this type of behavior may strike you as being comfortable doing nothing, you plan your investments but that only remains on the paper and never brought out into implementation.

For instance, you may find many citizens with financial knowledge leaving their money lying idle in a savings bank account. Moreover, you may have even seen some wealth managers and CXOs not bothering to invest in the right financial products because of the fear of making the wrong investment decisions. This fear makes us lose many opportunities that have the potential to turn out really well.

Fear in different stages of being invested

For example, a new investor entering the market for the first time has a lot of preconceived ideas about it. The fear of complexity in investing, timing the market, understanding the market psychology and stakeholders. Investor’s who hold a lump sum amount of money to invest in the market, have the fear of losing that money in totality due to the volatile nature of the stock market. They are afraid to fail as a result of a wrong decision, as failing here would result in a loss of money which many of them cannot afford. Investors who have already faced a crashed market or recession fear the same situation and opt for fixed income instruments.

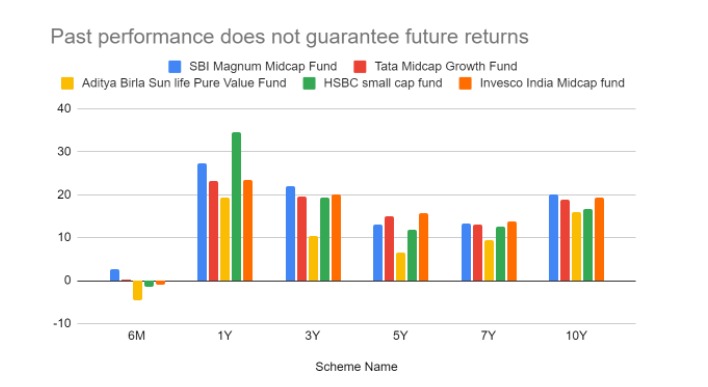

Due to this fear of losing money, investor’s start being more sure and as a consequence start believing in those concepts which eventually pull them down. Like the concept that past performance guarantees them handsome future returns. But, this is not true as the past performance of a fund or a stock will not guarantee how it will perform in the future as future performance is not only affected by fundamentals but also by certain unforeseen risks and macro events. For a Mutual fund, it is majorly affected by a fund manager’s track record and the reputation of the fund house. These concepts play a major role in creating investor inertia as it shuns the confidence of the investor as they lose money believing onto one of these and once their trust is broken from the particular investment they never invest into it again and inertia strikes them. Due to this fear of losing. Let's take an example to understand this phenomenon better.

We take five Mutual Fund schemes to track its performance to make a comparison between the past and future performance of the schemes to evaluate if a good past performance can guarantee future performance of these funds. Fund returns have been taken as a metric to measure performance of a fund.

| Scheme Name | 6M | 1Y | 3Y | 5Y | 7Y | 10Y |

|---|---|---|---|---|---|---|

| SBI Magnum Midcap Fund | 2.59 | 27.3 | 22 | 13.15 | 13.22 | 20.1 |

| Tata Midcap Growth | 0.2 | 23.12 | 19.49 | 15.03 | 12.94 | 18.85 |

| Aditya Birla Sun life Pure Value Fund | -4.48 | 19.43 | 10.32 | 6.59 | 9.4 | 15.85 |

| HSBC small cap fund | -1.38 | 34.6 | 19.27 | 11.84 | 12.66 | 16.63 |

| Invesco India Midcap fund | -0.91 | 23.51 | 19.92 | 15.72 | 13.71 | 19.32 |

*source: Author’s calculations.

This analysis suggests that all the funds taken into consideration have performed well in the past but have underperformed in the recent period of the last six months. This proves the fact that past performance of a fund does not guarantee future returns.

This is where investors tend to get blindsided, and they think that this is the end of the world as the schemes that they invested into did not perform well today, but performed well in the past. The great financial inertia strikes them here, as one of their decisions failed. If you fail once since you did not get your expected returns from an investment, look back again and learn from your mistakes. But if you stop trying then that would be a disaster as you would also be putting a stop to achieving your set financial goals in the near term.

Investing is learning another skill, you may make mistakes in this process of learning but you have to learn from these mistakes, gain some knowledge whenever you feel like you have to and don't ever repeat your past history.

Apart from this, the biggest culprit to investor inertia is the habit of giving up easily after your investment goes south. This habit has to be changed, as if you don't take risks you will never be the next Warren Buffet!

Due to this behavior you would be in a position to lose on to many opportunities:

People who are too comfortable in their skin or their current status quo resist any and every change that comes their way even if that means losing onto a golden chance.

Imagine a scenario when you and your friend tracked a particular stock to buy and waited for it to come its lowest price, your friend made a swift move and bought 100 shares of that stock and you are still waiting for a day to come when the lowest price won't be the lowest price and a new lowest price would arrive( while the stocks are already rising). To your good luck, a few months later the stocks fell again, even lower than the price your friend bought at but you still are not sure if you must buy it now? While you are still waiting; the markets have again entered the bull phase and the same share price reflects green now. And you would still be wondering what just happened?

It is sheer indecisiveness on the grounds of fear, uncertainty and procrastination. Not only did you lose a golden opportunity to invest in the stock you wanted to, but you have fallen prey to the bad investment behavior and investor inertia.

Let's take an example to understand this better, You are considering investing in a Mutual fund. You have done a lot of research around it, as to which is the best fund house and if the fund manager has a consistent track record and has generated good returns.But you are still uncertain as to how that scheme will perform in the future and you do not want to take any risk at all. And you then evaluate that investing in fixed income instruments would yield better returns and it is less risky.

But after five years, you see that the scheme you had considered to invest in i.e. TATA midcap growth fund has outperformed its benchmark with a return of 24.56%. As inertia stroked you five years ago, you made a decision where you incurred a loss of about 24.56% by not investing in the scheme. By investing in fixed income instead you just earned a return of 18.5% in five years.

Hence, as we have seen from the above example that if you let this inertia continue you will be left with nothing but regrets later as losing such good opportunities would lead to stagnation of your wealth in the later stage of your retirement.

Ways used to beat investor inertia

By definition, inertia is broken by some force or push which is stronger than inertia itself. Investor inertia also requires some intervention which may be either external or internal or both. One of the most strongest interventions are self-motivation internally and competition externally.

We suggest a few ways to overcome this inertia using these interventions:

Fix a date to manage your money

- You may consider overcoming investor inertia through simple techniques. You must allot a particular day every month to get your finances in order. It helps you arrange financial documents and you can study your investments in PPF, fixed deposits , mutual funds, stocks and so on.

- You could also list out your life and health insurance plans. Do not wait for the end of the year to start your tax planning. Start investing in ELSS through SIP at the start of the financial year if it matches your risk profile. Get all your tax saving documents ready well before the deadline to save on tax deducted at source (TDS).

Understand the amount you need to meet financial goals

- You must set financial goals and calculate how much you need to invest to achieve them. Otherwise, you will never start saving and investing to attain your long-term financial goals.

- You must draw estimates on how much money you will need for important financial goals such as buying a house or a car, children’s education and marriage and retirement planning

- You can choose the right investment and put in small amounts regularly over some time to build your portfolio. It helps if you stay invested for the long run to enjoy the benefits of the power of compounding.

- Consider using various online financial calculators to determine the SIP amount to attain long-term financial goals. It also helps if you choose investments that offer inflation-beating returns over the long run based on your risk appetite.

Create an emergency corpus

- You need money for a financial emergency or a sudden hospitalization. You may find investor inertia costly if you don’t build an emergency corpus. It will force you to avail of a high-interest rate loan or borrow from friends and relatives.

- You cannot postpone availing of a term life insurance plan and health insurance if you want to protect yourself and your family. It also helps if you avail car insurance and householders package policy to protect important assets such as a car and a house.

- Invest systematically to attain financial goals. Don’t postpone important investment decisions as the actual loss is worse than fearing a loss. It would be prudent to act when you have the time and the money rather than allowing financial inertia to overpower you.

In closing

You can overcome investor inertia by taking well informed decisions at the right time. As in the investing world timing is very necessary, it decides whether you have the capability to achieve your financial goals at the right time at which you have decided. It's worth giving time to a process which can give you financial security for the rest of your life.