Jensen’s Alpha in Mutual Funds:

Jensen’s Alpha in Mutual Funds: How should investors evaluate it, why is it essential?

Did you just hear a fund manager or a fundamental investor talking about Alpha? You must be wondering, as to how this concept is related to investments in mutual funds?

Investing is similar to grocery shopping, where you have to choose between apples and oranges based on your taste and preferences and take the one which gives the utmost satisfaction to your taste buds while keeping your health in shape. Even here, as an investor, the first thing you look at while choosing any investment product is its returns. Out of a thousand mutual fund schemes you will look at choosing the one which gives the utmost satisfaction in terms of returns generated. To assess returns of mutual fund schemes, investors tend to look at the history of the return of a fund very closely before investing in it.

But have you ever given a thought to this, if it is the right way to evaluate the returns of a scheme?

The past performance of a scheme does not guarantee how it will perform in the future. Past returns of a scheme cannot be used as a metric to determine its future performance. As returns can be misleading if you only look at the absolute returns of a scheme.

The ideal way to evaluate the returns of a scheme is to compare the returns of one fund against its benchmark or other schemes in this category. But a good scheme also witnesses up and down in its returns. A good scheme falls less than its benchmark during tough times and rises more than its benchmark during market rallies.

Alpha is one of five standard performance ratios that are commonly used to evaluate a fund or an investment portfolio, with the other four being beta, standard deviation, R- squared, and the Sharpe ratio.

Here is a quick rundown on what alpha is all about?

What is the meaning of Alpha?

Alpha measures the difference between a fund's actual returns and its expected performance, given its level of risk which is measured using the beta. Simply put, Alpha is used to measure how a mutual fund scheme has performed as compared to its benchmark index given its level of risk tolerance.

Would you like to invest in those funds that would generate the same returns as the benchmark index?

No right? You are going to start thinking about what the fund manager is doing, as you expected higher returns as compared to the benchmark index. Now to attract you as an investor, the fund manager must be able to generate excess returns. That means he will be able to generate more returns than you expect to make the scheme popular. This excess return is termed as Alpha. In other words, Alpha is the excess return that the fund manager generates compared to what is expected of the fund manager. That is easier said than done because we don’t know what the investors expect. That can be understood by going a little into the concept of Beta.

Why is it important to know about Beta when we are talking about Alpha?

That is because it is not possible to understand Alpha unless you understand Beta. Let us look at a more practical perspective to understand this better. Beta is a measure of the Systematic risk of a fund. What is Systematic Risk in Mutual funds? It refers to the risks that uniformly impacts all underlying stock holdings in a fund and there is not much a fund manager can do about it. This systematic risk cannot be diversified by changing the underlying stock holdings. If the fund holds Tata Motors and the fund manager expects the chip shortage to hit auto production, he can shift out of Tata Motors. However, if the US raises interest rates or if the Evergrande crisis blows up in China, then all the companies are going to be hit badly. That is systematic risk and cannot be diversified away. This systematic risk is measured by Beta.

Why are we talking so much about beta, in our discussion about Alpha? Now alpha is the excess return that the fund earns over and above of what the fund is expected to earn. To calculate what the fund is expected to earn you use the Capital Asset Pricing Model or CAPM. The Beta is at the core of the CAPM.

Expected Return (ER) = Rf + Beta x (Rm – Rf), where

ER = The return you expect on a stock or portfolio

Rf = Rm – Market return on the Nifty

Beta – systematic risk (less than 1 is defensive and more than 1 is aggressive)

Now you can understand Alpha as follows:

Alpha = R – {Rf + Beta x (Rm – Rf)}

Whenever the beta is high the riskiness of the fund tends to increase while keeping the risk-free returns low, as a result of which we get a lower Alpha value. In short, if you have a higher beta then the expected returns on your portfolio will be higher and if you have a lower beta then the expected returns on your portfolio will be lower. That will impact your alpha too.

Importance of Alpha in mutual fund investments:

It is considered to be a very important metric to assess Mutual funds and compare between them as to which scheme has performed better in terms of returns relative to its benchmark index.

It lets us know, the fund outperformed or underperformed the benchmark. Through this information the investors can assess the fund's performance over the years and evaluate how much extra returns the fund manager was able to give relative to the benchmark.

But as we saw earlier, it also correlates with the amount of risk the fund manager is willing to take which will decide the extra returns gained. It all depends on the value of Beta, how will the value of Alpha turn out to be. Jensen's Alpha tries to explain whether an investment has performed better or worse than its beta value would suggest.

Alpha relative to the benchmark:

From our discussion above, we conclude that alpha gives us a measure of the performance of a fund relative to its benchmark.

To better understand, this concept we take a small example:

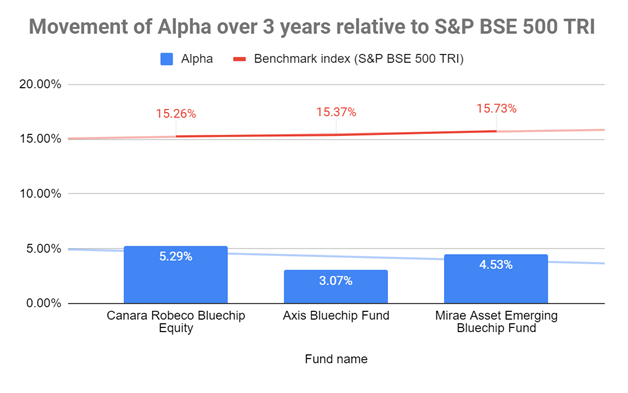

Here, we have taken a few funds from our recommended list, to see how Alpha has moved relative to its benchmark i.e S&P BSE TRI.

| Fund Name | Category | Years | Alpha | Benchmark index (S&P BSE 500 TRI) |

|---|---|---|---|---|

| Canara Robeco Bluechip Equity | Large Cap | 3Y | 5.29% | 15.26% |

| Axis Bluechip Fund | Large Cap | 3Y | 3.07% | 15.37% |

| Mirae Asset Emerging Bluechip Fund | Large Cap | 3Y | 4.53% | 15.73% |

* Alpha is calculated based on 3 years return.

Source: Value research.

The analysis suggests that the funds have outperformed the benchmark. As here, the alpha values are positive and the fund manager's stock selection skill has delivered a superior risk-adjusted return. The alpha value is representing the extra return percent the funds have achieved as compared to the benchmark S&P BSE TRI given the amount of risk taken by the fund manager.

These funds have outperformed the benchmark for 3 years, for the time the alpha has been calculated.

As an investor, how do I benefit from the use of this concept of Alpha?

- Always seek a positive value of alpha as it tells you that the portfolio’s return exceeded the benchmark index’s performance.

- Staying away from a negative alpha number that reflects an investment that is underperforming as compared to the market average is a prudent decision that will help you to get a better return on investment (ROI%) in the long term and preserve your investment average.

- Use Alpha as a rear-view mirror, which makes us cautious of the performance of the fund manager and tells you if you are earning enough for the risk that you are taking. For example, there may be 2 funds that may have given returns of 22% and 29% in the last 1 year. You may conclude that the fund that returned 29% is better than the fund that generated 22%. But the fund that generated 29%, did it with a Beta of 1.5 while the fund that gave 22% did it with a Beta of 1.1.

- Here alpha comes into the picture. Alpha allows you to calculate your risk-adjusted returns and that enables you to compare funds across the equity categories. You don’t compare apples and oranges. Instead, you have a proper basis to compare fund performance and fund manager performance, thanks to Alpha.

In closing

Alpha has proved to be the most important metric to assess mutual fund's performance. A thing to remember about Alpha is that it is based on historical data and changes from time to time. So you should treat its past performance as an indication of what the fund is capable of rather than taking it as a guarantee of future results.