KYC requirements for mutual fund investors

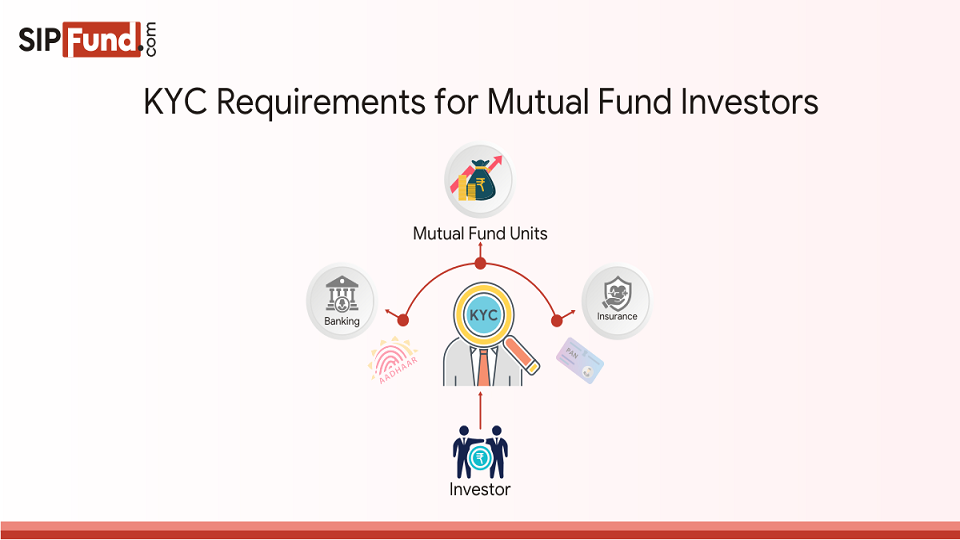

Whenever a person intend to buy some financial product or avail any financial service such as opening a bank account with the bank; purchasing insurance plan from insurance firm; getting a loan from the bank ; purchasing units of mutual funds etc. then he/she is liable to undergo the process of Know Your Customer i.e. KYC process. KYC is specifically done to ensure that the investor is not indulging in any kind of unlawful activities. KYC is short for ‘Know your customer’ which simply means a customer identification process carried out by all financial institutions where customers/investors are required to provide all the mandatory documents for completing the verification process.

Mutual funds conduct KYC process in order to crosscheck the identity of their investors. KYC in mutual funds is mandatory as per Prevention of Money laundering Act 2002. Reserve Bank of India issued guidelines for KYC in 2002 which are supplemented by the master circular of securities and Exchange Board of India. With effect from January 1, 2012, centralized KYC registration process through SEBI registered KYC Registration Agencies (KRAs) has been implemented. Each investor must undergo a uniform KYC process only once in the securities market.

What is the role of KYC process in Mutual Funds investing?

Investors are obliged to go through KYC process while investing in mutual funds because fund house must be sure of the nature of money that is being invested through their platforms. It is done to ensure that investments made in mutual funds are as per the law. Mutual funds want to be satisfied that investors investing in their units are not corrupt hence investors are asked to furnish some identity proofs to get authority’s approval for investing. An asset management company has its credibility in mutual funds domain as it has won the trust of its investors therefore it cannot tolerate any kind of inefficiency in KYC process on the part of its investors. Investors’ history is checked to know their past financial records and defaults.

Documents required for KYC

At the time of KYC process, Individual investors are required to submit some documents in order to establish their identity with the fund house. The list of documents is mentioned below:

PAN card

PAN is acronym for Permanent Account Number which is a 10-digit number issued by Indian income tax department. PAN card is used to track information related to income tax payments and other financial accounts are also linked with it. Mutual funds ask for PAN card copy to make sure that you are not in default list category and to ensure that sources of income are genuine.

Address proof

Investors wanting to invest in mutual funds must have address proof in order to establish their nationality and citizenship. Electricity bill, passport, Aadhar card can be used for address proof.

Proof of Name

It can be authenticated by furnishing Aadhar card photocopy.

Bank Account details

Mutual funds ask for bank account details in order to verify your income and account which will be used for investing in mutual funds.

Photographs

Investors are asked to submit some copies of their passport size photographs as an identity proof to mutual fund house.

Note: These are the suggested documents for verifying identity of an individual investor however there may be other documents or formalities in case of Trusts, HUFs, corporates etc.

When an investor is not an individual then

Joint accounts/Applicants

All the participants are required to complete the KYC at individual level.

Power of Attorney

Both the investor and power of attorney are obliged to complete the KYC process

NRIs/PIOs

Non-Resident Indians or Persons of Indian Origin are also required to complete KYC process as per Indian rules.

Minors

As the minor reaches the age of 18, he/she should complete the KYC process. However, at the time investment parent/legal guardian are allowed to complete the KYC process.

The Process of KYC for Mutual Fund

KYC process for investing in mutual funds in India can be done either in offline mode or online mode.

Offline mode for KYC

Through offline mode, investors can submit the duly filled up and signed KYC form along with attested copies of photograph, ID proof, Address proof and PAN to the KYC Registration Agencies (KRAs) such as CVL, NSDL, CAMS, KARVY, NSE (DotEx). Once the KYC form and documents are submitted to the KRA, investor can track the status of KYC through the respective KRA website. For example, if an investor’s KYC form has been submitted to CAMS KRA, the status of the KYC can be checked using the URL https://camskra.com/. Here investor must enter his/her pan number under My KYC Status and click the submit button which will show the status of the KYC. Once the KYC has been successfully processed, investor can start his/her investment with any of the mutual fund houses in India or through online mutual fund platforms such as https://sipfund.com/.

Alternatively, investors can do offline KYC through an Intermediary or Platform. The fund house or the investment platform will be registered with a KRA. They verify the investor’s physical documents, get the filled-up KYC form and the necessary self-attested documents from investors, put the In-Person Verification (IPV) seal on the documents and submit the same to the KRAs for completing the investor’s KYC.

Online mode for KYC

The online process of KYC for mutual fund is easier as it can be done easily by sitting at home. Investors do not have to physically visit the offices. Investors want to invest in a mutual fund can just log in to Fund’s website or the KRA’s website and fill in all the details in KYC form by creating their account. Self -attested copies of required documents can be uploaded easily with the form. Despite providing Aadhaar copy for KYC is not compulsory, investors still prefer to do KYC through Aadhaar route. Many Mutual fund houses and investment platforms continue to provide Aadhaar based KYC services.

How can an investor do KYC through SIP fund?

Through SIPfund.com android app, investors have the convenience to complete their KYC process electronically within few minutes and start their online investment. Given below are the steps for Online KYC through SIPfund.com

1. Download SIPfund.com android app by clicking the link: https://play.google.com/store/apps/details?id=com.octrax.sipfund

2. Sign up and create your account by inputting all the required information. By entering the complete the details, you will get an investor identification number (IIN)

3. After your IIN number is created, press on the menu (3-stripe) > E-KYC to start doing your online KYC.

4. If your current mobile number is linked to your Aadhaar and if you can enter the OTP received to the linked mobile number, you can opt for Offline Aadhaar XML based KYC where your KYC will get registered instantly upon completing the entire process.

5. If your mobile number is not linked with Aadhar, you can proceed with Non-Aadhaar based KYC. Upon completing the entire process, your KYC will get registered within 48 hours.

KYC for Banks and KYC for Investment

Whereas KYC is a process to ensure that customer does not bring in illegal funds into the financial system, PMLA defines the process very clearly on identification method to be followed. However, RBI and Banking KYC and SEBI/Investing KYC and Insurance KYC are done by respective product manufacturers and KRA’s. The banking KYC or Insurance KYC or Investment KYC are to be done separately and there was no central KYC until 2017 when proposal to bring central KYC was brought in. The process to register Central KYC or CKYC never took off and therefore the end user must do separate KYC’s for each product. A robust central CKYC process will help in increasing the penetration of the financial services to masses by reducing multiple procedural steps.

Conclusion

Providing your identification information for getting your KYC compliant may seem cumbersome but it an inevitable and important one-time activity that can be done through online or offline as per your convenience. Remember, by becoming KYC verified investor, you are only enabling higher levels of security and you can start stress free mutual fund investing.

Happy Investing!