LIC IPO — The mother of all Indian IPO’s is here!

The biggest ever Indian IPO is here, to sweep you off your feet. Government-owned Insurance behemoth LIC has launched its IPO today.

The public issue of LIC will open for subscription from today, 4th May 2022 and it will remain open for bidding till 9th May 2022. The government plans to raise Rs 20,557 crore through the issue by diluting 3.5 percent stake in the state-run Insurance behemoth.

Let’s have a look at some of the important details of the IPO:

| IPO Opening Date | May 4, 2022 |

| IPO Closing Date | May 9, 2022 |

| Issue Type | ₹10 per equity share |

| IPO Price | 15 Shares |

| Min Order Quantity | 15 Shares |

| Listing At | BSE, NSE |

| Issue Size | 31,62,49,885 (31.62 crore) equity shares |

| Offer for Sale | 31,62,49,885 (31.62 crore) equity shares |

| Retail Discount | Rs 45 per share |

| Employee Discount | Rs 45 per share |

| QIB Shares Offered | Not more than 50% of the Net Offer |

| Retail Shares Offered | Not less than 35% of the Net Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Net Offer |

| May 4, 2022 | May 9, 2022 | ₹10 per equity share | 15 Shares | 15 Shares | BSE, NSE | 31,62,49,885 (31.62 crore) equity shares | 31,62,49,885 (31.62 crore) equity shares | Rs 45 per share | Rs 45 per share | Not more than 50% of the Net Offer | Not less than 35% of the Net Offer | Not less than 15% of the Net Offer |

The Government of India has fixed the LIC IPO price band at ₹902 to ₹949 per equity share. They have put up an offer of sale of 31,62,49,885 (31.62 crore) equity shares by the promoter, which holds a 100 percent stake in the insurance behemoth. The shares will be allocated in the ratio of 50% to qualified institutional buyers (QIB), 35% to retail investors and 15% to non-institutional investors. The Government of India has also announced a discount of ₹45 per equity share to retail and eligible employee category and of ₹60 per equity share to policy holder category.

| Category | Bidding at | Discount | Final Price |

|---|---|---|---|

| HNI | At price | No | Rs 949 |

| Retail | Cut-off | Rs 45 per share | Rs 904 |

| Employee | Cut-off | Rs 45 per share | Rs 904 |

| Policy Holders | Cut-off | Rs 60 per share | Rs 889 |

source: LIC DRHP

LIC IPO Lot Size:

The LIC IPO market lot size is 15 shares. A retail-individual investor can apply for up to 14 lots (210 shares or ₹199,290).

| Application | Lots | Shares | Amount (cut-off) |

|---|---|---|---|

| Minimum | 1 | 15 | Rs 14,235 |

| Maximum | 14 | 210 | Rs 199,290 |

source: LIC DRHP

The government’s stake sale in India’s largest insurer is still much lower than the minimum 5% stake sale it had initially planned.

The government has decided not to sell more than a 3.5% stake for at least a year from the listing date to give investors enough time to discover the Share Price after the listing. Hence, LIC’s IPO will be the first in the country to offer a 3.5% stake to the public, lower than the 5% regulatory minimum stipulated by the Securities and Exchange Board of India (Sebi).

Why should we subscribe to LIC’s IPO?

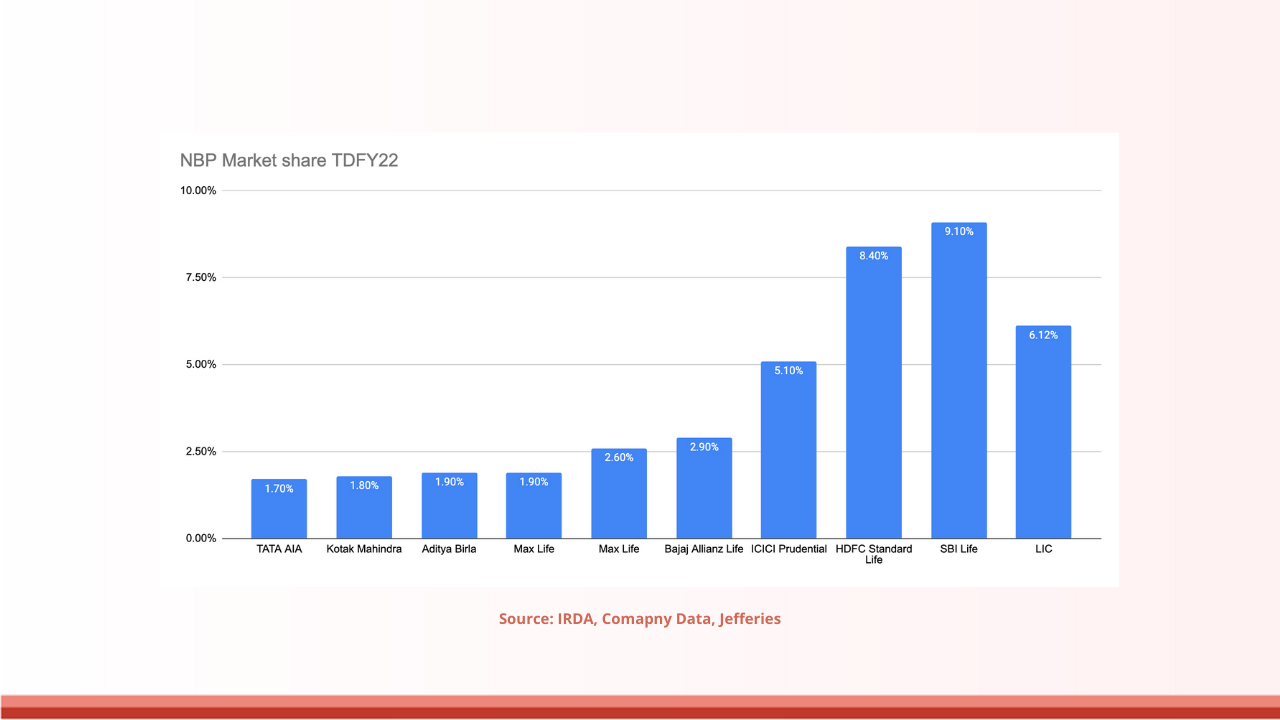

LIC is the largest insurance provider company in India. It has a market share of 66.2% in new business premium. The premium earned from the new contracts in a given financial year is referred to as the new business premium for an insurance company.

As of 30 Sep 2021, it has a total AUM of Rs. 39 lakh crore. LIC operates through 2048 branches, 113 divisional offices, and 1,554 Satellite Offices. It operates globally in Fiji, Mauritius, Bangladesh, Nepal, Singapore, Sri Lanka, UAE, Bahrain, Qatar, Kuwait, and the United Kingdom.

The sheer heft of LIC is unbeatable. Even after twenty years since the entry of the private insurance companies, LIC still sells over 70% of the life insurance policies sold in the country and receives 65% of the total new premiums. Its assets under management are nearly 16 times that of the next largest insurer and more than 1.1 times of the entire AUM of the mutual fund industry.

Key positive factors to invest:

- LIC is a part insurance and part investment products company. Their plans are a combination of insurance and investment with a guaranteed return.

- LIC has over 13.5 lakh agents, who seek to bring most of the new business . LIC plans offer 'fixed returns' along with life insurance coverage. This makes it easy to sell by agents and brings peace of mind to the insurers.

- LIC has high trust in the public for both life insurance as well as investment done with them. LIC is synonymous with insurance in India.

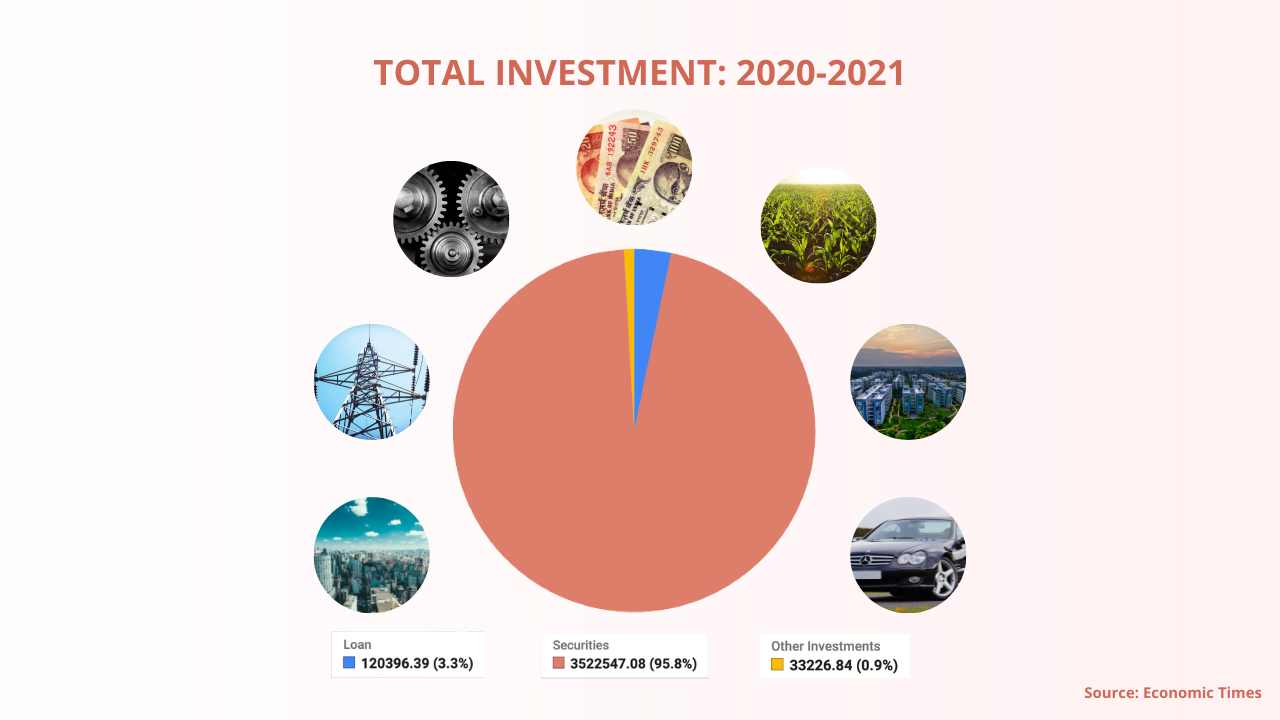

- LIC manages assets of Rs 39 lakh crores. They invest these funds across stocks and bonds. They own 4% of all listed stocks in India and more government bonds than the RBI.

- Leading insurance provider company in India and fifth largest global insurer by Gross Written Premium.

- A range of life insurance products to meet varied insurance needs of individuals.

Possible risks as per DRHP:

- lower attractiveness of recalibrated par products,

- higher surrenders and lower persistences

- an unanticipated intensity in mortality claims from ongoing pandemic

- sharp fluctuations in interest rate

- an inability to retain, recruit individual agents

- any union unrest, slowdown, increased wage cost etc.

- It's very difficult to value LIC as the business model is unlike any other company. LIC collects money upfront and then promises to compensate policyholders at a later stage. The premiums they collect (part insurance and part investment) cannot be recognized as revenue.

LIC IPO Analysis

Consistent track record of financial performance

The company has seen growth in its premiums earned in FY21, increasing from ₹3,400,000 million in FY19 to ₹4,000,000 million in FY21, at a CAGR of 9.2%. The company’s EBITDA increased from ₹26,400 million in FY19 to ₹29,800 million in FY21. The company’s profit increased from ₹26,300 million in FY19 to ₹29,700 million in FY21. The corporation has seen the 49th month Persistency Ratio in India for individual products (%) increasing from 73% to 79%.

LIC India has the highest market share in terms of New Business Premium and No of Policies/Schemes is concerned. As of December 2021, LIC's market share for the New Business Premium stood at 66% which was significantly higher than the total market shares of the private players and also commanding the market share of the number of policies by 74%. LIC saw 25% YoY growth in total APE (Annual Premium Equivalent), with retail APE up 22% YoY off a favorable base affecting the market share of LIC which decreased from 43% to 40 in FY21. LIC saw a growth of 12% YoY in the sum assured and reflected an increase in the market share to 18% in FY 21 from 17% in FY20.

SWOT Analysis of the LIC IPO

The SWOT Analysis of LIC ( Life Of Corporation Of India ) includes its strengths, weaknesses, opportunities, and threats. And in this reading of the SWOT Analysis of LIC ( Life Of Corporation Of India ) we analyze the IPO by its collective strengths, weaknesses and threats.

Competitive analysis:

LIC, India's largest life insurance policy provider, has some noteworthy competitors. As of February 24, 2022, following competitors exist.

| Competitors | Market Capitalisation |

|---|---|

| HDFC Life Insurance | Rs 1,13,000 crore |

| SBI Life Insurance | Rs 105,000 crore |

| ICICI Lombard General Insurance Company | Rs 67,170 crore |

| ICICI Prudential Life Insurance | Rs 60,980 crore |

| General Insurance Corporation of India | Rs 19,470 crore |

| New India Assurance Company | Rs 18,820 crore |

Source: Bloomberg, Money control

Strengths

- India’s largest insurance company: LIC currently operates across India with 2048 fully computerized branches, 8 zonal offices, about 113 divisional offices, 2,048 branch offices and 1381 satellite offices and corporate offices. For Fiscal 2021, the Corporation’s market share in the Indian life insurance industry was 66.2% based on NBP i.e. New Business Premium, and its NBP was 1.96 times the total private life insurance sector.

- Brand Image: LIC has a strong brand image in India. Its tagline Yogakshemam Mahamyaham, which means welfare for all, is widely known.

- Asset base: LIC has huge assets of around USD 150 billion and is also India’s largest investor, giving it enormous power in India’s financial sector.

- Network of agents: LIC has 1,400,000 individual agents, 242 corporate agents, 89 referral agents, 98 brokers and 42 banks across India, covering every corner of the country.

- Strong Employees: LIC has over 1,15,000 employees across India.

Weakness

- Organizational Culture: LIC is strongly tied to the government and thus follows a very loose and slow work culture.

- Poor Advertising Strategy: compared to the private providers, LIC does not spend too much money on advertising.

- Too Many Restrictions: Since LIC is a government-owned company, it is subject to many restrictions and this makes decision making at LIC slow.

- Overburdened: LIC has a large number of staff and most of them work in their own offices. Paying their salaries and managing the issues is often a big challenge for the company.

Opportunities:

- Online Services: with the growth of online services, people have started looking more into options like insurance and also awareness about it is now higher than before. This provides an opportunity for providers like LIC, who are labor-intensive, to reduce costs by deploying innovation in technology.

- More Disposable Income: Insurance is now seen as a form of investment rather than just protection ths can help in developing new products.

Threats:

- Government Policies: LIC has to abide by the rules and regulations laid down by the government. This puts limitations on the growth of the company.

- Mis-Selling Can Affect Persistency: LIC does not have a complete hold on their agents through which they sell a maximum number of policies. Agents mis selling affect the LIC trust element amongst the customers.

- Lack of Flexibility: LIC does not have a liberty to garner new technologies and means of distribution. The company continues to follow traditional methods and restricts its chance to cater to the young urban population.

- Shift From Protection To Prevention: There is a general trend shift from protection to prevention, which is an indication for insurance companies to now focus on risk prevention rather than risk mitigation measures.

Recommendation:

If we look at the company’s Indian Embedded Value of ₹5,40,000 crores as on September 30, 2021, they are offering it at 1.1x embedded value to market cap ratio. Insurance companies cannot be valued at a price to earnings multiple. Globally, they are valued at a price to EV as the embedded value of a life insurance company is the present value of the future profits adjusted to net asset value. According to which the LIC is coming at a significant discount. Its peers like HDFC Life Insurance and SBI Life Insurance are trading at an EV multiple of 4.05x and 3.10x, while ICICI Prudential Life trades at 2.5x EV multiple. Looking at the strong brand value, market leadership, extensive distribution networks and plans of diversifying the product mix, it might be good to subscribe to the issue with a long term perspective. LIC is reasonably valued in the context of its size and dominance of the insurance market.