RBI Policy Review 8th April 2022 : Turning hawkish [Report]

The RBI’s policy was distinctly more hawkish than the last policy. The governor in his post policy press conference said that the “sequence of priorities has changed with inflation now in front of growth” --- a deviation from the strategy of preferring growth over the last two years. While the repo and reverse repo rates were kept on hold, there are a number of hawkish signals that were delivered in this policy.

Normalization of policy corridor and introduction of SDF: The central bank normalized the policy corridor to pre-pandemic levels at 50bps with the lower bound now defined by the new Standard Deposit Facility (SDF) at 3.75% and the upper bound determined by the Marginal Standing Facility (MSF) at 4.25%.

- The move towards the SDF seems to be driven by the greater flexibility it provides in the sense that the RBI is not constrained by collateral requirements to conduct liquidity operations (during absorption of liquidity). The SDF is a window through which banks can park money overnight with the RBI without being provided with collateral in return.

- The fixed rate reverse repo was however kept unchanged at 3.35% and the RBI said in its post policy conference that it is now not relevant in the context of the liquidity adjustment facility (LAF).

A new mid-way stance -- Gradual move away from accommodation: While the RBI kept its monetary policy stance unchanged, it changed its wording to “remain accommodative while focusing on withdrawal of accommodation”. This signals that the central bank is perhaps gearing up to change its stance to neutral in the next policy. According to RBI and as mentioned in the policy document, the escalation of the geopolitical situation and the accompanying surge in international crude oil and other commodity prices, tightening of global financial conditions, persistence of supply-side disruptions and significantly weaker external demand pose downside risks to the outlook. The future course of the pandemic and the uncertainties about the pace of monetary policy normalisation in major advanced economies also weigh on the outlook. Given the evolving risks and uncertainties RBI has decided to maintain status quo on key rates as well as maintain accommodative stance for now, while also focusing on withdrawal to calm the inflation down in the near term.

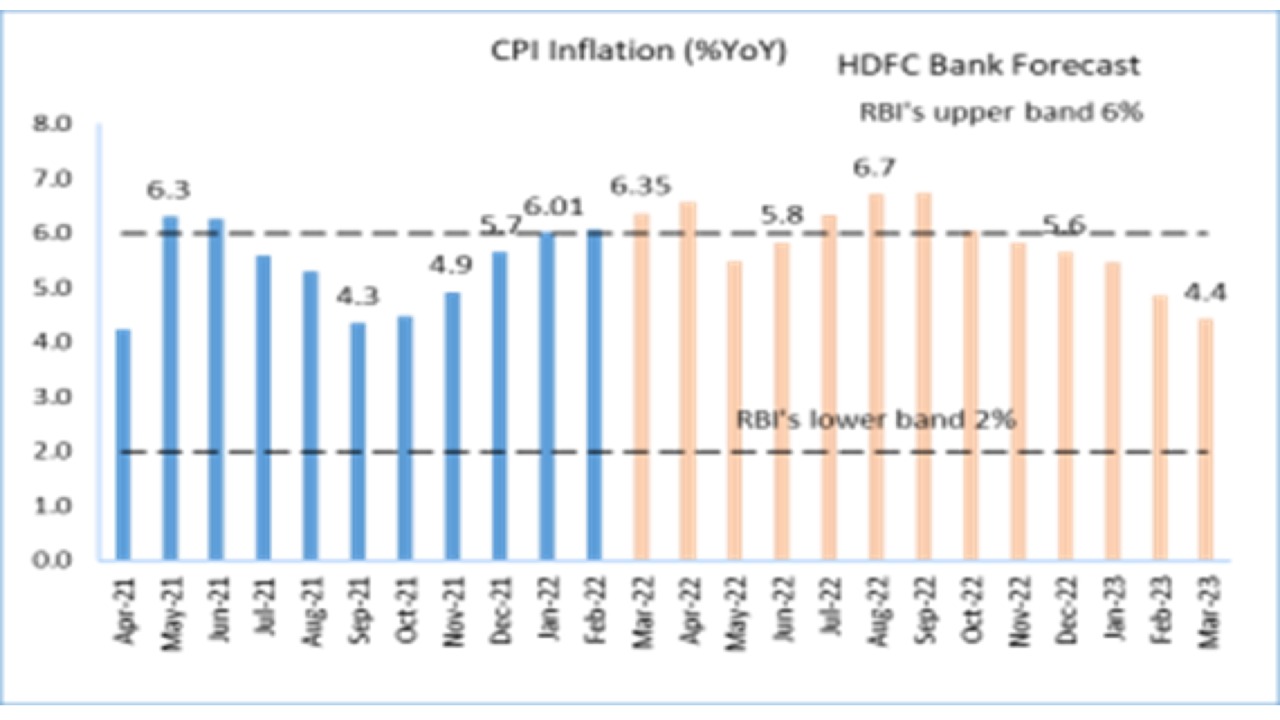

Inflation up, growth down: The upward inflation forecast revision by 120bps to 5.7% for FY23 seems sensible given the broad-based nature of price increases and uncertainty around the evolving geopolitical situation. On growth, the RBI revised down its forecast substantially to 7.2% from 7.8% earlier for FY23.

Committed to slow liquidity reduction: The RBI said that it will be reducing liquidity in a gradual and calibrated fashion over a multi-year time frame. The current average liquidity surplus in the system stands at INR 8.5 lakh crores.

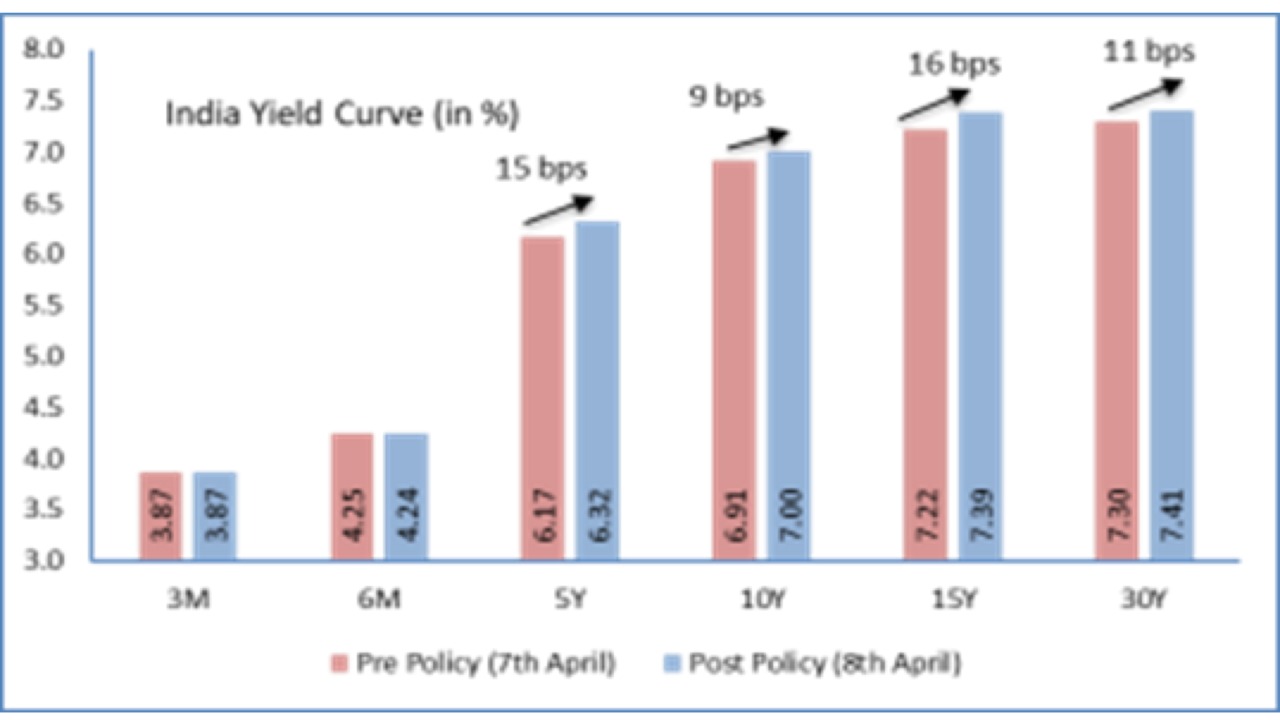

Bond yields: The RBI’s intention of gradually normalizing liquidity is likely to limit its capacity to cap bond yields beyond a point. Although the central bank is expected to intervene through OMOs and OTs, the quantum of plain vanilla OMOs could be constrained by the large liquidity surplus in the system and a move towards reducing it over the coming months by the RBI. The announcement of the increase in HTM limit to 23% of NDTL from 22% is likely to provide some support at the long-end of the yield curve but is unlikely to be a game changer especially with credit growth likely to pick up. On balance, the bond yields are seen moving up (with pressure from the large borrowing program and rising global yields) and the 10-year is expected to trade between 7.00-7.25% in H1 FY23. The 10-year yield was up by ~10bps post policy (trading at 7%) at the time of writing.

View: The market reaction to the policy was sharply negative with benchmark 10year G-Sec yield trading at 7.05%, up 15 bps. While RBI has not raised the reverse repo rate, it has introduced standing deposit facility (SDF) at 3.75% (25 bps lower than repo rate) as the floor of the LAF corridor. Indirectly, the reverse repo rate hike is at 40 bps as overnight rates will now be pegged at 3.75% apart from VRRR rate that is variable in nature and currently hovers around repo rate levels. Since VRRR currently hovers just below 4.0%, the introduction of SDF at 3.75% may not have much impact on short term rates.

The major negative implication from the monetary policy was the sharp upward revision in inflation forecast by around 80-140 bps. RBI now projected at CPI inflation for FY22-23 at 5.7% compared to 4.5% in February policy meeting. Similarly, for Q3 and Q4, inflation is now projected at 5.4% and 5.1% compared to 4.2% and 4.0%, respectively, in February. While the focus of RBI remains on growth citing that the expected positive benefits from the ebbing omicron variant have been offset by the sharp escalation in geopolitical tensions, the tone of the RBI Governor sounds hawkish in citing that the priority has changed from growth to inflation in this policy meeting. Also, RBI said that now the focus would be on withdrawal of accommodative stance rather than focusing on continuing the stance.

Effectively, this policy marks the rate hike of lower end of the LAF corridor (now SDF instead of reverse repo) at 3.75% and the next policy meeting may change the stance to “neutral” from “accommodative” and the MPC meeting following that may mark the first repo rate hike of the current rate cycle.

The Specifics:

Inflation: The RBI revised up its inflation forecast by 120 bps to 5.7% for FY23 (from 4.5% earlier) assuming a normal monsoon and average crude oil prices (Indian basket) at USD 100 pbl. The RBI highlighted that input cost push pressures stemming from a broad-based surge in prices of key industrial inputs and supply chain disruptions are likely to persist longer than earlier expected.

View: The inflation is expected to average in the range of 6.0-6.2% in H1 FY23 and ease to 5.1-5.3% in H22FY23. For the full year, CPI inflation is expected to average at 5.8%, assuming crude oil prices (average) at USD 95 pbl.

| %YoY | Q1 FY23 | Q2 FY23 | Q3 FY23 | Q4 FY23 | FY23 |

|---|---|---|---|---|---|

| RBI (February forecast) | 4.9 | 5.0 | 4.0 | 4.2 | 4.5 |

| RBI (April forecast) | 6.3 | 5.8 | 5.4 | 5.1 | 5.7 |

Source: RBI and Money control

Growth outlook: For FY23, the RBI revised down its growth forecast by 60 bps to 7.2% amidst geopolitical tensions, rising commodity prices, tightening of global financial conditions, supply side disruptions and weaker external demand. On the support side, the RBI reckons that good prospects of rabi output augur well for rural demand. Besides, contact intensive services and urban demand is expected to be sustained with dwindling COVID cases and expanded vaccination coverage.

| %YoY | Q1 FY23 | Q2 FY23 | Q3 FY23 | Q4 FY23 | FY23 |

|---|---|---|---|---|---|

| RBI (February) | 17.2 | 7.0 | 4.3 | 4.5 | 7.8 |

| RBI (April forecast) | 16.2 | 6.2 | 4.1 | 4.0 | 7.2 |

Key Announcements:

Liquidity Management

- The RBI has introduced the Standing Deposit Facility (SDF) as the floor of the LAF corridor, through which it intends to absorb the excess liquidity in the system without offering collateral to the banks. The collateral free facility of SDF strengthens the operating framework of monetary policy.

- The SDF rate will be at 3.75% (25 bps below the policy rate). On the other hand, MSF rate will continue to be 25 bps above the policy repo rate. By introducing SDF, the RBI has restored LAF corridor (width 50 bps) with SDF at the base of 3.75% and MSF at 4.25%.

- The SDF facility will be applicable to overnight deposits at the stage. The SDF will have the ability to absorb longer term liquidity as and when required.

Other measures:

- The RBI enhanced the present limit under held-to-maturity (HTM) category to 23% from 22% of NDTL (net demand and time liabilities) till 31st March 2023. In addition, it has been decided to allow banks to include eligible SDL securities acquired between 1st April 2022 and 31st march 2023. The HTM limit would be restored from 23% to 19.5% in a phased manner starting from the quarter ending 30th June 2023. Enhancement of HTM limit is expected to provide some support at the long-end of the yield curve.

Source: Reuters, Note: SDF= Standing Deposit Facility

Source: Reuters, Note: SDF= Standing Deposit FacilitySo, what’s the final takeaway and what should investors consider doing with their investments?

- When you look at the history of geopolitical events, they tend to have a short-term impact on the markets, and as long as they don't drive you into recession, then the markets tend to rebound.

- What we need to watch out for therefore is the impact on oil, which impacts India's inflation and the risk of killing demand to the extent of a recession. Doubled with the above-stated political disruptions and weakened global financials, markets are increasingly susceptible to another vertical fall where seasonally, too, the cycles are pointing down.

- It is counterproductive to sell into a panic like this without logic, but if you’re someone looking to buy the fear you may consider getting high-quality Balanced Advantage and Arbitrage funds to reduce the impact on volatility on the portfolio. Long-short strategies are also a good bet for creating value on the upside in the next market cycle.

- Fixed Income markets can be trickier since Central banks around the world are considering tightening liquidity by raising interest rates. Coupled with the war, bond yields shall spike significantly resulting in low returns.

- An ideal solution may be to consider Gilt securities maturing over the next 2-4 years since the YTMs here are encouraging. Shorter duration funds will help investors stabilize the interest rate risk which will be a hindrance for the long-term funds. Floating rate bonds will help get stable returns over a longer period ahead of the peak of the cycle and keep your returns stable as the RBI now aims for withdrawing the accommodative stance gradually.