Recapitalization of Public Sector Banks

Mrs. Nirmala Sitharaman, Finance Minister of India, proposed a recapitalization of ₹ 20,000 crore for Public Sector Banks (PSBs) in union Budget 2021. A similar proposal of ₹ 70,000 was also announced in the budget of last fiscal year 2020 in order to enhance the credit supply into the economy. In this blog, we will read about recapitalization of PSBs in detail.

What does bank recapitalization mean?

Government of India holds largest share in the State-run Banks. Therefore, whenever Banks are facing the capital crisis, government adopts some measures to strengthen the Banks. Bank recapitalization is one of the methods which Government has been emphasizing more since last 3 years. Bank recapitalization as the name suggest implies that there is new capital which is being infused into Public Sector Banks. This is done so that Banks can fulfill the minimum capital requirements which are laid down by RBI as per Basel norms.

History of bank recapitalization in India

Bank recapitalization is a tried and tested formula which government has been using since 2008. The below mentioned table shows the years in which government increased the capital base of Public Sector Banks through recapitalization.

| Financial Year | Recapitalization in ₹ Crores |

|---|---|

| 2008-09 | 1900 |

| 2009-10 | 1200 |

| 2010-11 | 20117 |

| 2011-12 | 12000 |

| 2012-13 | 12517 |

| 2013-14 | 14000 |

| 2014-15 | 6990 |

| 2015-16 | 25000 |

| 2016-17 | 25000 |

| Total | 118724 |

Having read about the history of bank recapitalization, let us understand the Basel III norm which adjudges a Bank’s performance. Whenever Banks fall short on Basel III requirements, then both Government and RBI work in tandem to improve the financial position of the banks by recapitalization of Banks. Let us read about Basel norms in brief:

Basel Committee on Banking Supervision of Basel, Switzerland provides prudential regulation standards for Banks and a forum for regular cooperation on banking supervisory matters for the Central Banks of different countries. It issues Basel norms or accords which are the international banking regulations that help coordinate banking regulations across the world. There are three phases of Basel norms which shows how norms have improved over time in order to cater the needs of changing economic scenario.

BASEL-III

Basel III norms came up immediately after 2008 financial crisis which shook the entire banking system. These norms are comprehensive in nature since they focus on almost all the pillars of a banking entity.

Recommendations

1. Basel III suggests that Banks must maintain Capital adequacy ratio of 12.9%

2. Minimum Tier 1 capital should be at 10.5% of risk weighted assets and minimum tier 2 capital should be maintained at 2% of Risk Weighted assets.

3. Banks should keep Capital conservation buffer of 2.5%

4. Counter cyclical buffer between 0-2.5% (it suggested to keep more capital in good times so that they can have enough to meet adverse financial situation in bad times)

5. The leverage ratio should be at least 3%. The leverage rate shows how much is the Tier I capital in total capital of the Bank.

6. Liquidity coverage ratio It gives the ratio of Stocks of high-quality liquid assets with respect to the total net cash outflows for the next 30 calendar days and it should be >= 100%. India implemented it pan banking industry from 1 January 2019.

7. Net Stable Fund Rates It shows the amount of available stable funding with respect to the required stable funding for meeting the capital requirements for 1 year. The ratio should be greater than or equal to 100%. Banks will be required to follow it from 1st October 2021.

However, these norms are voluntary in nature, but RBI has adopted the norms in order to improve the resilience of Indian banking industry. Additionally, RBI has been more stringent in the norms as can be seen from the below table

| Minimum Capital Ratios | Basel III of BCBS | Basel III of RBI |

|---|---|---|

| Minimum Common Equity Tier 1 (CET 1) | 4.5% | 5.5% |

| Capital Conservation Buffer (CCB) | 2.5% | 2.5% |

| Minimum CET 1 + CCB | 7% | 8% |

| Minimum Tier 1 Capital | 7% | 7% |

| Minimum Total Capital including buffer | 8% | 9% |

| Minimum Total Capital + CCB | 10.5% | 11.5% |

| Additional counter-cyclical buffer in the form of common equity capital | 0-2.5% | 0-2.5% |

How does the process of bank recapitalization work?

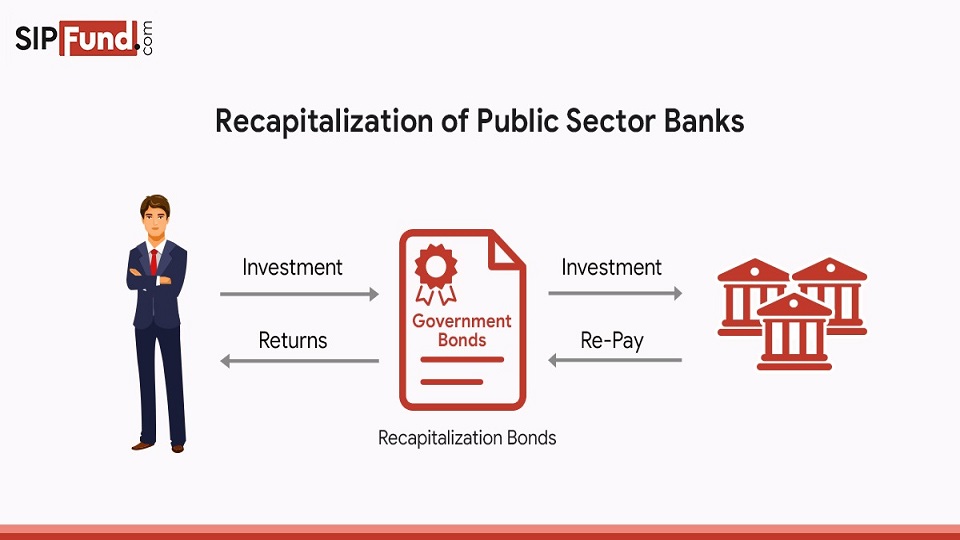

Recapitalization bonds are issued by the government and subscribed by the Banks. Let us understand the process in a simple manner:

There are two kind of Banks that exist in an economy – Surplus Banks which have more capital than required by RBI while on the other hand there are deficit Banks which are struggling to meet the minimum capital requirements. Government works as a mediator between surplus Banks and deficit Banks. Government raises loan by issuing bonds to the surplus Banks and pays coupon rate to these Banks. These bonds are issued at par and cannot be transferred. Government collects money by issuing bonds which are subscribed by the surplus Banks. This collected money then gets infused into the deficit Banks in the form of equity. This equity infusion helps the deficit banks to increase their capital reserves. In simple terms, government collects money from surplus Banks and use it to provide liquidity to the deficit Banks. Government pays coupon rates to surplus Banks and raises its equity shareholding in deficit Banks.

Does recapitalization help both government and State-run Banks?

Yes. It is beneficial to banks as well as government.

Advantage to government

Since government is not infusing money from its coffers, recapitalization will not have an impact on fiscal deficit. Whatever the costs have been incurred in recapitalization process will be offset by the increased credit supply and private investment since Banks will be able to finance new projects.

Advantage to Public sector banks

Deficit Banks will get huge corpus of funds which they will utilize to increase their capital reserves. These banks will be able to lend to private companies and retail borrowers for new projects and earn interest on loans. Their profitability will get increased.

In addition to the Banks and Government, it also helps in economic growth and employment generation. After recapitalization, Banks will be having enough funds to augment the credit supply into the economy. People will take loan for consumption and investment purposes which will increase the aggregate demand in the economy. In order to the meet this demand, producers have to produce more by hiring more employees. Therefore both GDP and employment will shore up.

Conclusion

Public sector banks in India account for 70 percent of the total Indian banking industry, it becomes the responsibility of government to strengthen the banks by adopting accurate measures. Many State-run Banks are struggling with burgeoning bad loans. Therefore, Government keeps announcing recapitalization of Banks to revive them. It is a good measure for government because it does not take a toll upon Government deficit and has multiplier effect on economic growth.

Referred links

https://www.indianeconomy.net/splclassroom/what-is-recapitalisation-of-public-sector-banks/

https://www.youtube.com/watch?v=eAH_AZGAfQg&t=1428s