Small Cap Funds – Can you handle them?

Market capitalization is the total value of shares of a company traded on stock exchanges and it is calculated by multiplying the total outstanding shares of a company by the current market prices of shares. Mutual funds are categorized into three broad categories based on the market capitalization. The three categories are Small Cap, Mid Cap and Large Cap funds. In this article, we will understand Small Cap funds in detail.

What are Small Cap funds?

Regulatory body Securities and Exchange Board of India (SEBI) mandates Small Cap funds to invest at least 80% of the total equity assets in Small Cap stocks. Small Cap companies are the companies whose rank lies between 251 to 500 in the NIFTY index. Small Cap companies have a market capitalization of less than INR 5,000 crores. Justdial, India Energy Exchange, CARE ratings, Delta Corp ltd etc. are examples of Small Cap companies. Mutual fund schemes largely investing in these types of companies are known as Small Cap funds. Small Cap companies do have a high potential for growth and Small Cap funds can reap lucrative returns from their high growth capacity. Most of the Small Cap funds allow both systematic investment plans (SIPs) and lump sum investments.

Who should opt for Small Cap schemes?

Small Cap companies ultimately want to graduate to Mid Cap and then to Large Cap by making their businesses profitable. Small Cap funds want to take advantage of Small Cap companies’ huge growth potentials. However, Small Cap schemes are not suited to all investors as they require patience and high degree of risk tolerance from investors.

Long term investment horizon: Small Cap companies need reasonable amount of time to grow in size and be profitable. Investors who are willing to lock their investments for longer duration say at least 8 years can opt for Small Cap funds. Investors should not make an exit due to short term volatility as Small Cap stocks are very sensitive to market turbulences. Investors having short term financial goals should avoid investing in small cap funds.

Risk takers: Investors who are capable and willing to take risks can choose Small Cap funds because these schemes carry a high degree of risks. These Schemes are very sensitive to market movements. Any adverse market movement can have a huge impact on Small Cap funds. It has been observed that an upward movement in stock prices of Small Cap companies can generate huge profits for Small Cap funds but downward trend in stock prices could lead to huge losses because of high volatility. Therefore, investors who can sustain risks should opt for Small Cap schemes.

Thing to keep in mind before investing in Small Caps

Fundamentals should be strong: It is important to look at the balance sheet figures, debt-to equity ratio, cash flows, solvency ratios etc. because studying fundamentals before investing in Small Cap companies can help you to act decisively. Stable balance sheet shows the sustainability of a company and indicate that company may do better than its competitors in long run.

Past returns: Small Cap funds are famous for their ‘multi bagger’ nature which means that these schemes hold a record of generating more than 100% returns in a short duration of time. It is true that Small Cap funds in India have performed exceptionally well in past years. Given their phenomenal performances, it is therefore important to look at the past returns in terms of CAGR and compare them with their competitors before locking money in small cap mutual funds.

Consistency: Consistency in profits and sales matters a lot when it comes to investing in Small Cap funds. Companies who are consistently making profits and accelerating their sales in the last 5 years should be considered for investing.

Corporate Governance: Efficient management plays an important role in making any company profitable. It is important to do a thorough research about management strategies in order to get an information on governance. Fund managers with their exceptional insights of financial markets play an important role to know the future profitability of a company by conducting interviews with top management as information about Small Cap companies are not easily available to public. Small Cap funds invest in companies which are ethically sound and have prospects for growth.

Cost: Expense ratio should be considered before investing in small cap funds. Expense ratio is the fee that fund charge annually for managing your portfolios. SEBI has set the upper limit for this at 2.50% of the average asset under management. A lower expense ratio means higher returns as less fee would be charged by the fund. Therefore, it is important to look for schemes which have lower expense ratios.

Current trends: UTI AMC had come up with NFO for those who want to invest in small cap schemes. The NFO closed for subscription on 16th December 2020 and garnered ₹ 920 Crores. UTI Mid Cap Fund has a stable track record as it has given approximately 30% returns on an annualized basis in the last 1 year. If we look at past 5 years, then it has delivered 10% returns on an annualized basis for each year. UTI Small Cap fund will attract investors since it has a diversified portfolio with well-researched investments processes which may deliver greater returns for investors but what is worrisome is the current trends in markets. Since the markets are trading at all-time high, investors are being optimistic, and they may choose to invest in this newly launched NFO. Unlike company IPOs, Mutual Fund IPOs do not list new entity but invest in the already listed companies with idea to explore new strategy or expectation of growth in the sector therefore investors should not get overwhelmed from such NFO offers inspired by these short term positive sentiments of markets. It is suggested to put a small fraction of their wealth in UTI small cap fund scheme initially.

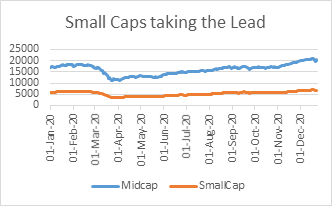

Future trends: Going by the analysts’ views there is huge potential for small-cap funds to grow in 2021 as these schemes are expected to generate higher returns. They believe that overall trend would be in upward direction as Small Caps can experience a new high trend after a lag of few years. Small Caps have been in a stressful time for the past 3 years as small companies were worst affected by the shocks of demonetization, GST and RERA. However, Small Caps are in upward swing as can be seen in the below graph:

For the year 2020, NIFTY Smallcap 100 has given a return of 18.25% till 23rd of December 2020.

Given below are the top performing Small Cap funds:

| FUND SCHEMES NAME | 1 Year Return | 3 Year Return | 5 Year Return |

|---|---|---|---|

| Axis Small Cap Fund | 19.37% | 8.64% | 13.56% |

| Kotak Small Cap Fund | 29.91% | 3.78% | 12.08% |

| Union Small Cap Fund | 27.56% | 0.89% | 7.44% |

| SBI Small Cap Fund | 27.60% | 2.75% | 15.44% |

| ICICI Prudential Small Cap Fund | 19.37% | -0.07% | 8.96% |

Bottom line: Small Cap stocks are attracting foreign institutional investors given the forward-looking trend of markets. So, investors with a long-term investment horizon and high-risk tolerability can make an entry into Small Cap mutual funds. It is important to make a note that investing only a small proportion in Small Cap funds would be advantageous for risk averse investors.

Happy investing!