Systematic Withdrawal Plans- A good strategy to meet regular pay out needs?

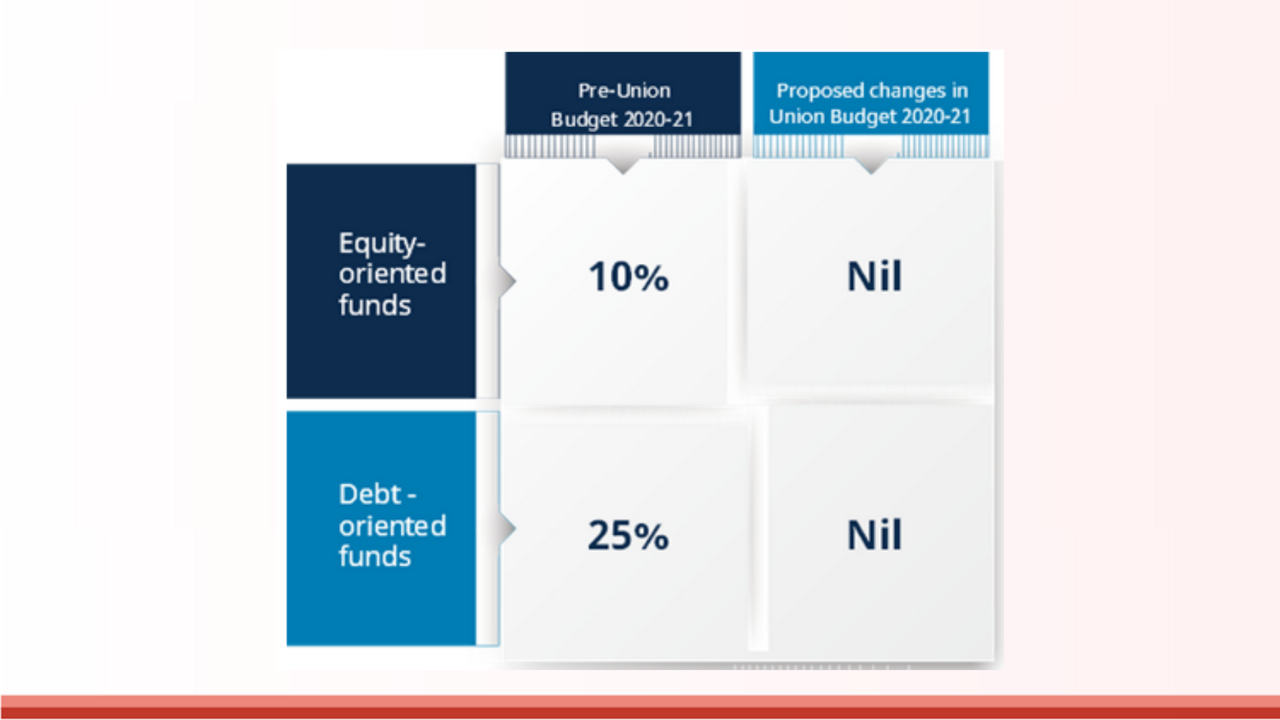

Financial planning is not only about saving and investing. In fact it is an art of planning your investments in such a way that it yields the expected cash flows which are required to meet the planned expenses every month ensuring that you never fall short of cash liquidity. On this account, mutual funds with the dividend option have been one of the preferred go-to investment vehicles for the investors. But, the Union Budget 2020-21 has put a wrench to dividend disbursements and especially for the investors in the highest tax bracket.

With effect from 01 April 2020, the Dividend Distribution Tax (‘DDT’) was abolished and a withholding tax (‘WHT’) was introduced on the payment of dividend. As a result, the dividend is now only taxed in the hands of the recipient. Apparently with the repeal of the dividend distribution tax in the Budget, passing the tax liability of the dividend amount to the investors has resulted in more money in the hands of the investors but the devil lies in the fine print of the act that the tax incidence for investors has effectively increased, especially for those in the highest tax bracket.

Against this backdrop, Systematic Withdrawal Plans (SWP’s) offered by mutual funds can be a prudent alternative for investors looking to generate cash flows from their investments at a regular frequency. Here, with the help of SWP’s not only is the investor able to quantify the cash flow and frequency but the plan can also aid in reducing the tax liability.

In this article, we seek to understand the meaning of SWP and how SWP can be more beneficial than the dividend option in mutual fund investments?

What is SWP in mutual funds?

A Systematic Withdrawal Plan is a facility which is extended to mutual fund investors allowing them to regularly withdraw a fixed amount of money in a systematic manner from a mutual fund investment. It’s entirely upon the investors to choose the frequency of withdrawal whether monthly, quarterly or annually. While, they can also choose to just withdraw the gains on their investment and keep their invested capital intact. At the set date, units from the investors portfolio are sold and funds are transferred to the investors account.

Listed below are some of the important features of SWP:

- It is a facility to redeem units from a particular mutual fund investment on a systematic and regular basis.

- Investors get the benefit to choose the frequency of withdrawal according to their needs.

- They also have an option to either withdraw a fixed amount or only the capital appreciation.

- It is ideal for investors who are seeking regular income from their investments and is a beneficial facility for retirement planning.

Unlike lump sum withdrawals, SWP enables investors to withdraw their money in installments. It is the mirror opposite of a systematic investment plan (SIP) . An SIP is systematic investing, but what if the investors want to withdraw systematically? That is where systematic withdrawal plans (SWP) come in handy. Instead of the option for a tax-inefficient dividend plan, you can as well opt for a systematic withdrawal plan. Now let’s look into why dividend plans are tax inefficient and SWP’s are preferred over them?

Apparently abolition of DDT increases money in investor’s pockets but may also increase tax liability?

As mentioned earlier also, the elimination of DDT puts more money in the hands of investors while removing the incidence of double taxation. The instance of double taxation would come when DDT is first applied when the dividend was received by the mutual fund, and then when it is passed onto the investor.

*Excludes applicable surcharge and cess HUFs: Hindu undivided family

Source: Pwc tax report post budget 2020-21

Title: DDT payable by mutual fund schemes for individuals / HUFs

With the help of an example, let’s try to understand this better. If we assume that Rs 5,000 dividend was paid to an equity and debt fund investor, the investor in the lower tax bracket is likely to benefit more from the abolition of DDT. However, for those falling in the higher tax bracket, the tax outgo increases as seen from the table below.

| Pre-Union Budget 2020-21 | Post Union Budget 2020-21 - Net dividend income after deducting tax as per tax slabs | |||||

|---|---|---|---|---|---|---|

| Type of fund | Tax rate* | Net dividend income post tax | 0% | 5% | 20% | 30% |

| Equity-oriented funds | 10% | Rs. 4,500 | Rs. 5,000 | Rs. 4,750 | Rs. 4,000 | Rs. 3,500 |

| Debt-oriented funds | 25% | Rs. 3,750 | Rs. 5,000 | Rs. 4,750 | Rs. 4,000 | Rs. 3,500 |

*Excludes applicable surcharge and cess. Notes: 1) Assumed dividend of Rs 5,000

Source: Union budget 2020-21 annual report.

Title: illustration of removal of DDT and its implication across tax slabs.

SWP – An ideal strategy for investors in need of regular cash flow.

Karan and Raj both have a corpus of Rs 15,000,000 each and are keen on receiving a monthly income of Rs 35,000 from the subsequent month for payment of the course tuition fees of their daughters.

Post this discussion, both invest their money in liquid mutual funds, the difference being Raj invests in the growth option whereas Karan opts for the dividend option.

Note of Tax structure: *If held for more than one year in the case of equity-oriented funds (10% on gains above Rs 1 lakh per year), and if held for more than three years in the case of debt-oriented funds (20% after indexation).

Example: SWP versus dividend plans

Assumptions:

| Details | Other Assumptions | |||||

|---|---|---|---|---|---|---|

| Investment | Rs. | 15,000,000 | Face Value | 10 | Rs / unit | |

| Buy Price | Rs / unit | 10 | Increase in value | 5% | per year | |

| Units allotted | 1,500,000 | Dividend rate | 5.0% | |||

| Dividend | 0.5 | Rs / unit | ||||

| Required money | Rs 35000/ per month | Cost inflation | 4% | per year | ||

| Inflation | 4% | Income Tax rate | 20% | |||

| Long term capital gains rate | 20% | |||||

* all increments in value are distributed via dividends

* usually determined by the Income tax department, assumed value.

| Karan choses dividend option | Raj’s SWP in growth option | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| End of Year | Dividend | Tax on Dividend | Net Amount | Shortfall | Withdrawal for expenses | Per unit value | Units redeemed | Balance Units | Cost of units for taxation | Capital Gains | Capital gains Type | Capital gains tax | |

| 1. | 750,000 | 150,000 | 600,000 | (150,000) | 750,000 | 10.50 | 71,429 | 1,428,571 | 714,286 | 35,714 | Short Term | 7,142.86 | |

| 2. | 750,000 | 150,000 | 600,000 | (150,000) | 750,000 | 11.03 | 68,027 | 1,360,544 | 680,272 | 69,728 | Short Term | 13,945.58 | |

| 3. | 750,000 | 150,000 | 600,000 | (150,000) | 750,000 | 11.58 | 64,788 | 1,295,756 | 728,775 | 21,225 | Long Term | 4,245.03 | |

| 4. | 750,000 | 150,000 | 600,000 | (150,000) | 750,000 | 12.16 | 61,703 | 1,234,054 | 721,834 | 28,166 | Long Term | 5,633.17 | |

| 5. | 750,000 | 150,000 | 600,000 | (150,000) | 750,000 | 12.76 | 58,764 | 1,175,289 | 714,960 | 35,040 | Long Term | 7,008.809 | |

| 6. | 750,000 | 150,000 | 600,000 | (150,000) | 750,000 | 13.4 | 55,966 | 1,119,323 | 708,150 | 41,850 | Long Term | 8,369.92 | |

| 7. | 750,000 | 150,000 | 600,000 | (150,000) | 750,000 | 14.07 | 53,301 | 1,066,022 | 701,406 | 48,594 | Long Term | 9,718.78 | |

| 8. | 750,000 | 150,000 | 600,000 | (150,000) | 750,000 | 14.77 | 50,763 | 1,015,259 | 694,726 | 55,274 | Long Term | 11,054.79 | |

| 9. | 750,000 | 150,000 | 600,000 | (150,000) | 750,000 | 15.51 | 48,346 | 966,913 | 688,110 | 61,890 | Long Term | 12,378.08 | |

| 10. | 750,000 | 150,000 | 600,000 | (150,000) | 750,000 | 16.29 | 46,043 | 920,870 | 681,556 | 68,444 | Long Term | 13,688.76 | |

| 11. | 750,000 | 150,000 | 600,000 | (150,000) | 750,000 | 17.10 | 43,851 | 877,019 | 675,065 | 74,935 | Long Term | 14,986.96 | |

| 12. | 750,000 | 150,000 | 600,000 | (150,000) | 750,000 | 17.96 | 41,763 | 835,256 | 668,636 | 81,364 | Long Term | 16,272.80 | |

| 13. | 750,000 | 150,000 | 600,000 | (150,000) | 750,000 | 18.86 | 39,774 | 795,482 | 662,268 | 87,732 | Long Term | 17,546.40 | |

| 14. | 750,000 | 150,000 | 600,000 | (150,000) | 750,000 | 19.80 | 37,880 | 757,602 | 655,961 | 94,039 | Long Term | 18,807.86 | |

| 15. | 750,000 | 150,000 | 600,000 | (150,000) | 750,000 | 20.79 | 36,076 | 721,526 | 649,713 | 100,287 | Long Term | 20,057.31 | |

| 16. | 750,000 | 150,000 | 600,000 | (150,000) | 750,000 | 21.83 | 34,358 | 687,167 | 643,526 | 106,474 | Long Term | 21,294.86 | |

| 17. | 750,000 | 150,000 | 600,000 | (150,000) | 750,000 | 22.92 | 32,722 | 654,445 | 637,397 | 112,603 | Long Term | 22,520.62 | |

| 18. | 750,000 | 150,000 | 600,000 | (150,000) | 750,000 | 24.07 | 31,164 | 623,281 | 631,326 | 118,674 | Long Term | 23,734.71 | |

| 19. | 750,000 | 150,000 | 600,000 | (150,000) | 750,000 | 25.27 | 29,680 | 593,601 | 625,314 | 124,686 | Long Term | 24,937.24 | |

| 20. | 750,000 | 150,000 | 600,000 | (150,000) | 750,000 | 26.53 | 28,267 | 565,334 | 619,358 | 130,642 | Long Term | 26,128.31 | |

| 21. | 750,000 | 150,000 | 600,000 | (150,000) | 750,000 | 27.86 | 26,921 | 538,414 | 613,460 | 136,540 | Long Term | 27,308.04 | |

| 22. | 750,000 | 150,000 | 600,000 | (150,000) | 750,000 | 29.25 | 25,639 | 512,775 | 607,617 | 142,383 | Long Term | 28,476.53 | |

| 23. | 750,000 | 150,000 | 600,000 | (150,000) | 750,000 | 30.72 | 24,418 | 488,357 | 601,830 | 148,170 | Long Term | 29,633.90 | |

| 24. | 750,000 | 150,000 | 600,000 | (150,000) | 750,000 | 10.50 | 71,429 | 1,428,571 | 714,286 | 35,714 | Short Term | 7,142.86 | |

| 25. | 750,000 | 150,000 | 600,000 | (150,000) | 750,000 | 32.25 | 23,255 | 465,102 | 596,099 | 153,901 | Long Term | 30,780.25 | |

Final Summary

| Comparison | Karan's Dividend Option | Raj's SWP plan |

|---|---|---|

| Likely Portfolio value (after 25 years) | Rs 15,000,000 | Rs 15,000,000 |

| Total tax | Rs 3,750,000 | Rs 447,587 |

As can be seen from the final summary table, Raj’s tax liability of Rs 4,47,587 is far lower as compared with Karan’s dividend option which is taxing a liability Rs 37,50,000 considering their investments in liquid funds they fall into the tax bracket of 20% because of the benefit of indexation. But even with the same tax rate, why are dividend options tax inefficient than that of SWP?This is because, unlike dividends, the entire SWP proceeds will not be taxed – only the capital gains portion will be taxed. Thus we have a higher tax out-go on the dividend option as the entire dividend proceeds are taxed. Moreover in the SWP plan, Raj has a left-over of Rs 4,42,954 which is his profit.

Hence, with this discussion we can conclude that SWP’s are considered to be more tax effective than the dividend option.

As we have answered the question as to why SWP’s are preferred over plain dividend options today especially after the Union Budget 2020-2021. We will now look at some of the benefits of SWP.

Benefits of SWP’s

SWP’s are considered to have a great tax advantage over other dividend option plans. Now, we move on to see an example where we seek to compare between equity, debt SWP’s and bank FD to note as to why they are more tax efficient than other investment instruments like the bank FD.

Let us imagine a scenario wherein a retired government official has received a retirement corpus of Rs.10 lakhs. He can invest in an equity fund and withdraw Rs.20,000 every quarter which he requires for his personal expenses. Alternatively, he can invest the corpus of Rs.10 lakhs in a debt fund and withdraw Rs.20,000 each quarter. If he wants more safety, he can invest the entire corpus in a bank FD which pays Rs.20,000 as interest each quarter at the rate of 8% interest annually. Let us first look at the equity SWP option. Then we shall compare the debt fund SWP with the bank FD and evaluate the relative merits.

For that we need to understand SWP tax implications vis-à-vis bank FDs.

SWP on an equity fund

Let us assume that the retiree invests Rs.9,20,000 in an equity fund and Rs. 80,000 in a liquid fund. For the first year, the retiree withdraws Rs.20,000 each quarter from the liquid fund. At the end of the first year, the equity fund becomes long term capital gains and hence regular withdrawals will neither attract capital gains tax nor will it attract any exit loads. But the real challenge arises due to the volatility in equity funds.

Remember, there is no assurance that equities will go up. For example, if you invest your money at the peak of the market, as we saw in 2008, your equity corpus could depreciate substantially over the next one year. With negative returns on equities, you will end up withdrawing and depleting your principal. That is not a wise thing to do. Additionally, it will be a long-term capital loss and you cannot even get a tax credit against those as long-term gains on equity are not tax free. That is why SWPs are rarely structured on equities. The volatility is the key issue and defeats the entire purpose of regular and assured returns on the corpus.

Quarterly pay-outs on a bank FD:

Before understanding the tax implications of SWP on a debt fund, let us look at similarly quarterly pay-outs on a bank FD. Bank FDs typically pay around 8% interest annually. So, the deposit of Rs.10 lakhs can be structured so as to yield Rs.20,000 each quarter. What about taxes? The table below captures the tax implications of the bank FD with quarterly pay-outs

| Quarter | Interest income | Tax (@30.9%) |

|---|---|---|

| Year 1 Q1 | 20,000 | 6,180 |

| Year 1 Q2 | 20,000 | 6,180 |

| Year 1 Q3 | 20,000 | 6,180 |

| Year 1 Q4 | 20,000 | 6,180 |

| Year 2 Q1 | 20,000 | 6,180 |

| Year 2 Q2 | 20,000 | 6,180 |

| Year 2 Q3 | 20,000 | 6,180 |

| Year 2 Q4 | 20,000 | 6,180 |

| Year 3 Q1 | 20,000 | 6,180 |

| Year 3 Q2 | 20,000 | 6,180 |

| Year 3 Q3 | 20,000 | 6,180 |

| Year 3 Q4 | 20,000 | 6,180 |

| Total | Rs 2,40,000 | Rs 74,160 |

In the table above we can see that the FD interest of Rs.20,000 per quarter gets taxed at the peak rate of 30.9% in the hands of the retiree. So, while the retiree does earn Rs.20,000 each quarter and holds the principal value of Rs.10 lakhs, he ends up paying a massive tax of Rs.74,160 in the process over a 3-year period. The question is whether there is a more tax efficient way to structure the SWP? The answer could lie in doing an SWP on a debt fund with very little credit risk.

SWP on a debt fund:

A tax efficient systematic withdrawal plan lies at the core of designing a good SWP. If structured as a debt-oriented scheme, the SWP tax implications can actually be favourable to the retiree. Here is how; let us understand from the table below.

| Quarter | NAV | SWP | redeemed for SWP | as per Tax Calculations | Capital gains |

|---|---|---|---|---|---|

| Purchase date | 100 | - | - | - | - |

| Year 1 Q1 | 102 | 20,000 | 196 | 392 | 121 |

| Year 1 Q2 | 104 | 20,000 | 192 | 777 | 240 |

| Year 1 Q3 | 106 | 20,000 | 188 | 1,154 | 356 |

| Year 1 Q4 | 108 | 20,000 | 185 | 1523 | 471 |

| Year 2 Q1 | 110 | 20,000 | 181 | 1,885 | 583 |

| Year 2 Q2 | 113 | 20,000 | 178 | 2241 | 692 |

| Year 2 Q3 | 115 | 20,000 | 174 | 2589 | 800 |

| Year 2 Q4 | 117 | 20,000 | 171 | 2930 | 905 |

| Year 3 Q1 | 120 | 20,000 | 167 | 3,265 | 1009 |

| Year 3 Q2 | 122 | 20,000 | 164 | 3593 | 1110 |

| Year 3 Q3 | 124 | 20,000 | 161 | 3915 | 1210 |

| Year 3 Q4 | 127 | 20,000 | 158 | 4230 | 1307 |

| Total | N/A | 2,40,000 | 2115 | 28492 | 8804 |

While debt funds can earn as much as 11-12% annualized returns, for the sake of simplicity and comparison here, we assume that the debt fund also gives approximately the same return as the bank FD. Thus, the NAV of the debt fund will roughly move in the manner explained in the above table. Instead of getting interest, you regularly redeem units. Since units are redeemed in FIFO format, we are assuming that all the gains will be short term in nature for which we are only considering a period of 3 years. Look at the total tax pay out. As against a total tax of Rs.74,160 that you will pay in the case of the bank FD over a period of 3 years, in the case of SWP you will only pay a total tax of Rs.8,804 over a 3-year period. It is this tax advantage that is the big benefit of the SWP structure.

Now many of you might ask this question, what about the holding principal value?

That is a good question. While the bank FD has paid Rs.20,000/- per quarter the principal of Rs.10 lakhs is still intact. On the other hand, in the case of SWP on debt funds you have been withdrawing units from the fund corpus.

Let us also understand that aspect.

In our SWP example, you had purchased 10,000 units of Rs.100 each on the purchase date by investing Rs.10 lakhs. As our SWP redemption table shows, you have redeemed a total of 2115 units. That means you are now left with 7885 units in your debt fund (10,000-2,115). At the closing NAV of Rs.127 your corpus value is Rs.10,01,395/- (127*7885). In other words, your corpus of Rs.10 lakhs is still intact. That is the power of a tax-efficient SWP that is smartly designed!

As now by this example we have got an idea that SWP’s are tax efficient, there is one more benefit which is called as Rupee Cost Averaging. Let’s take a quick rundown on this SWP benefit.

Rupee Cost Averaging

Whether you purchase or redeem units in installments you benefit from Rupee Cost Averaging. Since the markets are volatile, when you are redeeming all your units together, the timing of the sale needs to be when the markets are performing well. This will ensure that you book good profits. If you end up selling during a slump, your profits will be impacted.

When you opt for a SWP, a certain number of units held by you are redeemed regularly. Therefore, there will be times when the market strikes highs on the date of your redemption and even strikes low on that date. If the markets are doing well and you have opted for a SWP of a fixed amount, then lesser units will be redeemed as compared to the time when the markets are low. This averaged your returns and protects you from potential losses which can arise if you sell your units during a bear-run.

Let’s take an example to understand this better:

Akshaya invested Rs 5 lakh in a mutual fund scheme in April 2019. The NAV of the scheme was Rs 500 and she gets 1000 units. At the end of 5 months, she withdrew Rs 2.5 lakh from her investments. On the other hand, Akshaya invested the same amount in the same scheme and at the same NAV. However, she opted for a SWP option of Rs 50,000 per month, for 5 months.

Now let’s understand what happens?

Let’s say the NAV for the scheme over 5 months was as follows:

| Month | NAV |

|---|---|

| April | 500 |

| May | 515 |

| June | 510 |

| July | 525 |

| August | 530 |

| September | 498 |

In September, when Akshaya withdrew Rs 2.5 lakh from her investment, 502 units were redeemed i.e. (2,50,000/498). Hence, she has now 498 units left and net value of her holdings is Rs 2,48,004.

Now, let’s look at what happens to Akshaya’s holdings since she has opted for an SWP of Rs 50,000 for 5 months, here is what he receives:

| Month | NAV | SWP Amt (Rs.) | No of units redeemed | Units left | Remaining fund value (Rs) |

|---|---|---|---|---|---|

| April | 500 | - | - | 1000 | 500,000 |

| May | 515 | 50,000 | 97 | 903 | 4,65,045 |

| June | 510 | 50,000 | 98 | 805 | 4,10,550 |

| July | 525 | 50,000 | 95 | 710 | 3,62,750 |

| August | 530 | 50,000 | 94 | 616 | 3,26,480 |

| September | 498 | 50,000 | 100 | 5,16 | 2,56,968 |

Hence, here we can see that Akshaya gains by opting for a SWP through Rupee cost Averaging. She also has a remaining balance of Rs 2,56,968 which is also her profit.

Sketch SWP in accordance with your financial goals

Investors should sync the SWP with their financial goals. For instance, as illustrated in the case study, Raj managed his regular cash flow requirement for his daughter’s school fees through SWP. Another important financial goal that investors can map through SWP is to fund their retirement money flows.

Investors can use the combination of systematic investment plan (SIP) and SWP to meet their retirement goal requirements. They can use the SIP vehicle during the investment phase by investing in equity-oriented mutual funds for the long term which may generate optimum returns, and subsequently move the accumulated corpus into a debt mutual fund, and then employ SWP to meet their cash flow requirement during retirement.

Some other goals that investors can look at mapping through SWP include paying off their loans, such as house loan, car loan, etc.

Summing up:

SWP can, therefore, help investors design a more customized investment strategy and ensure cash flow from their investments at regular frequencies. Investors, however, should take a note of the following before opting for an SWP:

- Build a healthy investment corpus to facilitate adequate cash flow from SWPs

- If possible, consider withdrawing smaller amounts via SWP so that the amount that is deducted is largely that of capital appreciation, ensuring that the capital invested stays intact

- Evaluate the tax incidence and exit loads of schemes before settling for the SWP

- Mutual funds are market-linked. Fluctuations in the underlying market can impact the investment corpus.