The unfading charm of Gilt Funds: Are they a good investment option in today’s scenario?

After the IL&FS crises of 2018, the fixed-income domain has been through frequent up’s and down’s due to various downgrades and defaults. The liquidity freeze induced due to Covid’19 and credit dislocation has consequently led the Franklin Templeton Mutual Fund to wind-up all six of its debt schemes. Concerned with these defaults and downgrades in the ratings, the credit risk funds have witnessed some big outflows as investors are worried about their holdings. Hence, given these reasons, investors are looking to invest in those funds that do not have liquidity and credit issues and can keep their principal safe.

For these types of investors who are conservative and avoid risking their capital for high rewards, Government backed securities are known to be one of the safest investment options that has neither liquidity issues nor credit default risks.

The transition in business cycles and some amount of market risk is always going to pose a risk, but the good thing about Gilt funds is that they offer a dynamic blend of decent returns and low risk by investing into government backed securities.

To understand the advantages of Gilt funds let’s understand the meaning of Gilt funds;

What are Gilt funds?

Gilt funds are considered to be as safe as the US treasury bonds which offer the lowest risk than that of any other type of investment. It is highly suitable for risk-averse or conservative investors whose prime focus is to preserve their capital at the cost of higher returns. High returns come with the possibility of taking unknown risks, whereas conservative investors prefer lower returns with known risks.

Essentially by definition, Gilt funds invest the money of the investors in debt securities like government bonds which are issued by the government and in various fixed-income bearing securities issued by the state and central governments.

The government bonds represent the debt which is issued by a government and some of the bonds call upon investors to support their spending with a promise of paying out a coupon payment at regular intervals which is like the interest which we pay on loans. While, some of them are also issued at discount. But apart from the interest paid, it returns the principal initially invested over the maturity date of the bond. As these securities are backed by the government itself, they are considered to have lower default risk since the case of the government defaulting is very rare.

Moreover, SEBI has instructed the Gilt funds to invest a minimum 80% of total assets in Government securities. There are two types of Gilt funds; one that invests in Government securities for all maturity periods and another that invests for 10 years.

Yields of these funds are often affected by their maturity period, greater the maturity period, stronger the sensitivity to yield or returns received on the investment. While this can seem a bit simple to hear, but is more complex as longer the duration of the maturity the risks of interest rate fluctuations and inflation are higher, which in turn affect the yield and make it unattractive for investors.

The markets for direct G-secs are largely dominated by institutional investors and there is also a direct platform called RBI Retail Direct for retail investors to invest into these government backed securities . It was launched by our Prime Minister Shri Narendra Modi on 12 November 2021.

But, Gilt funds also offer a convenient means for the retail investors to invest indirectly into these securities, if the investors are not well-versed with the new platform and its usage.

Why are the Gilt funds being preferred today as an ideal fixed income investment option?

The debt securities generate interest income through the coupon payments on regular intervals due to which the gilt fund investors can earn their returns. The performance of any Gilt fund majorly depends upon the interest rate movements. These funds are highly recommended to investors during the falling interest rate regime,since when interest rates fall, the prices of the G-sec start rising. This also leads to an increase in the NAV of the Gilt funds. Moreover, there is a negative correlation between the yields and the Gilt fund NAV as can be seen from the graph below plotting the negative movement of yields and Gilt fund NAV.

*Source: Investing.com

Over the last two years, given the economic slowdown due to the spread of the Covid’19 pandemic the RBI has cut the repo rates multiple times, to bring back economic stability and support economic growth. Due to these developments, the prices of the government securities have become attractive and the funds have delivered the highest return of 11.98% as of July 2020 for the one-year category. Generally, you would have seen equity funds delivering returns of this kind, but it seems the ace’s are with the Gilt fund investors.

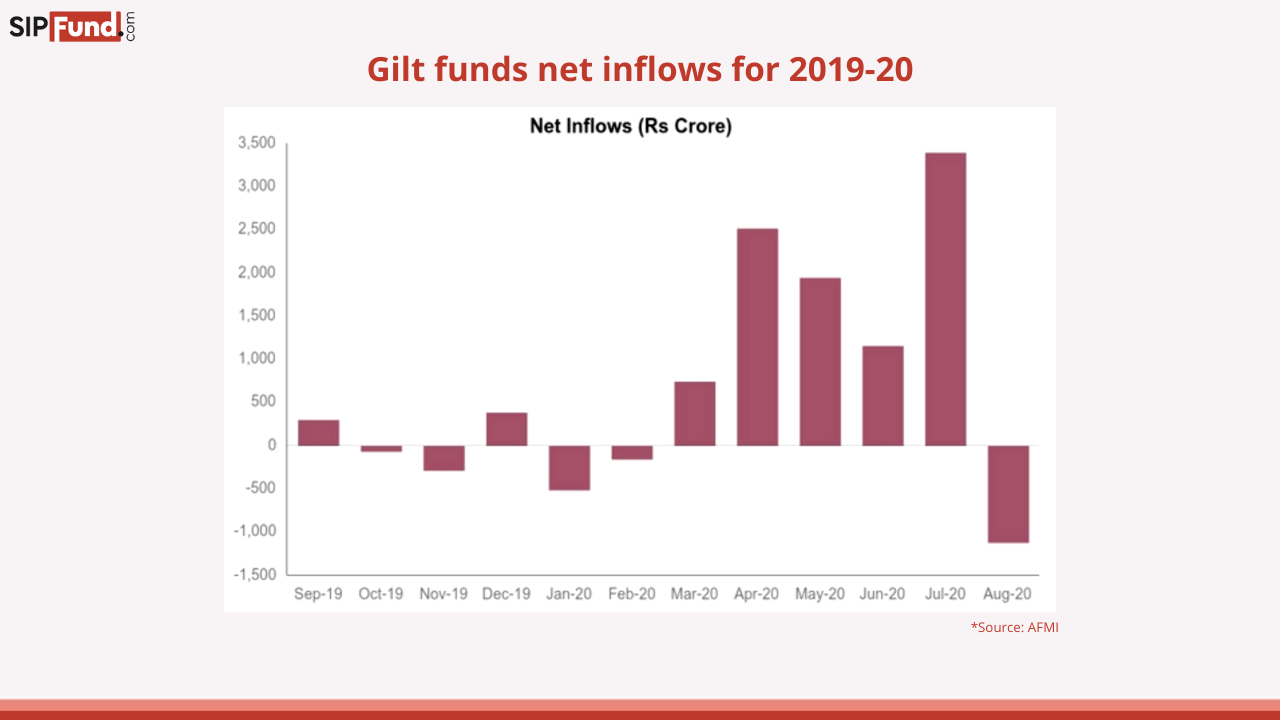

The higher returns from these funds have led to the greater inflows into the gilt-funds category. The AUM of these funds have surged by over 133% in the last two years, reaching to about 19,000 crore as on 31st July 2020 according to the AFMI report 2020.

Hence as we can see from the graph below, Gilt funds have recorded the highest inflows as of July 2020 due to the consistent performance of some top funds delivering a constant return in the range of 11% to 15% and above over the last two years. This is considerably higher than any other fixed income investment options.

Title: Gilt funds net inflows for 2019-20

* Source: AFMI

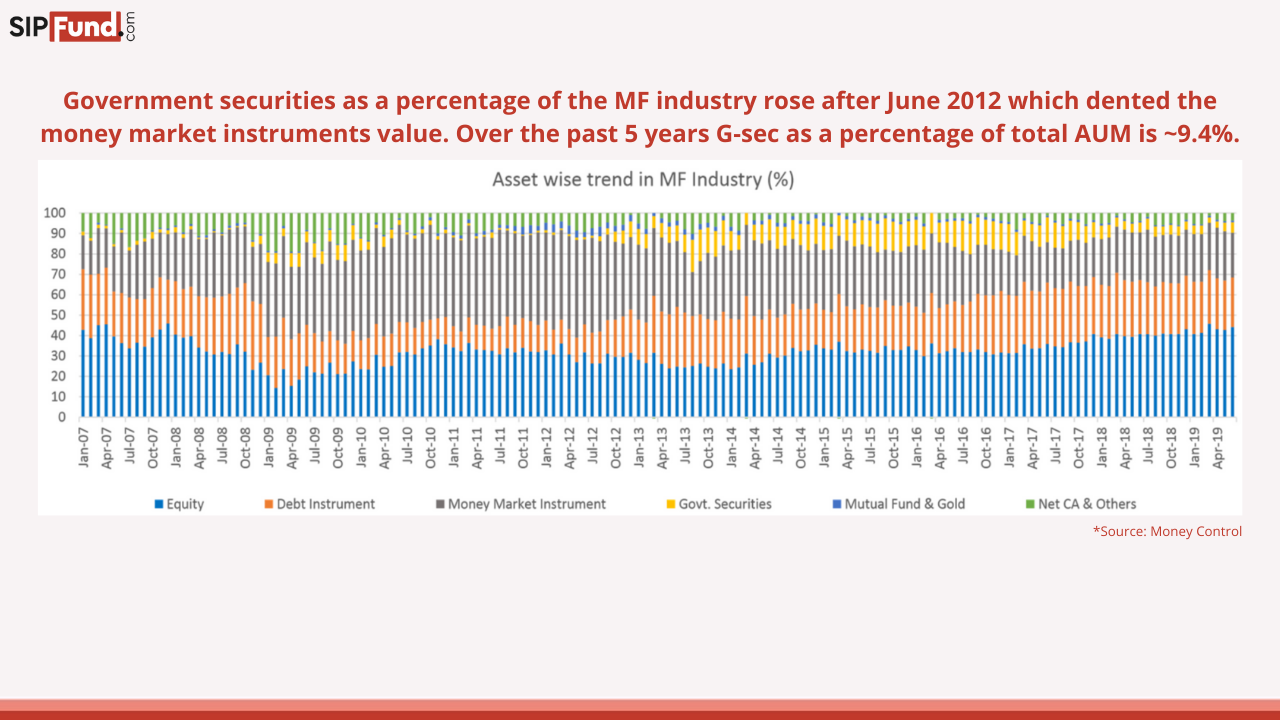

Title: Government securities as a percentage of the MF industry rose after June 2012 which dented the money market instruments value. Over the past 5 years G-sec as a percentage of total AUM is ~9.4%.

*Source: Money control

Now let's move on to see what are the benefits to investing in Gilt funds?

- Diversification: Gilt funds offer a convenient way for retail investors to enable them to invest in G-sec which help them in maintaining a diversified portfolio. Consisting of various Government Securities with varying maturities. Investors are always recommended to keep a small portion of debt investments, say about 5-10% in G-sec to shield their portfolio against any sort of market turbulence.

- Downside trend: When the economy is going through a slowdown or a recessionary period like it happened due to lockdowns during the Covid’19 pandemic. A portion of your investment in Gilt funds would provide stability to your portfolio in terms of returns and provide security to the initial principal invested.

- Effective risk-adjusted returns: As the funds are actively managed by the fund managers, hence their risk management strategies and taking a note of the duration play on the underlying securities to mitigate the risk of fluctuating interest rates help in gaining effective risk-adjusted returns.

- No credit risk: The Gilt funds have no exposure to credit risk like that of the credit-risk funds. However, Gilt funds are not entirely risk-free, it might have lower risk associated with it because there is a lower probability that the government could default. But, being debt-oriented the funds are exposed to macroeconomic risks, interest rate risk, liquidity risk and reinvestment risk.

- Taxation: As Gilt funds come under the category of debt funds, the taxation of the debt funds is applicable to it as well. Only the Capital gains from the Gilt funds are taxable. A capital gain made in a period of less than three years is a Short Term Capital Gain (STCG) and is taxed as per tax slabs. A capital gain made above the period of three years or more is termed as Long Term Capital Gain Tax (LTCG) and it is taxed at 20% after the indexation benefit and at 10% without the indexation benefit.

As we have now understood the benefits of investing in Gilt funds, let’s look at why a SIP is more beneficial than investing lump-sum.

Why SIP?

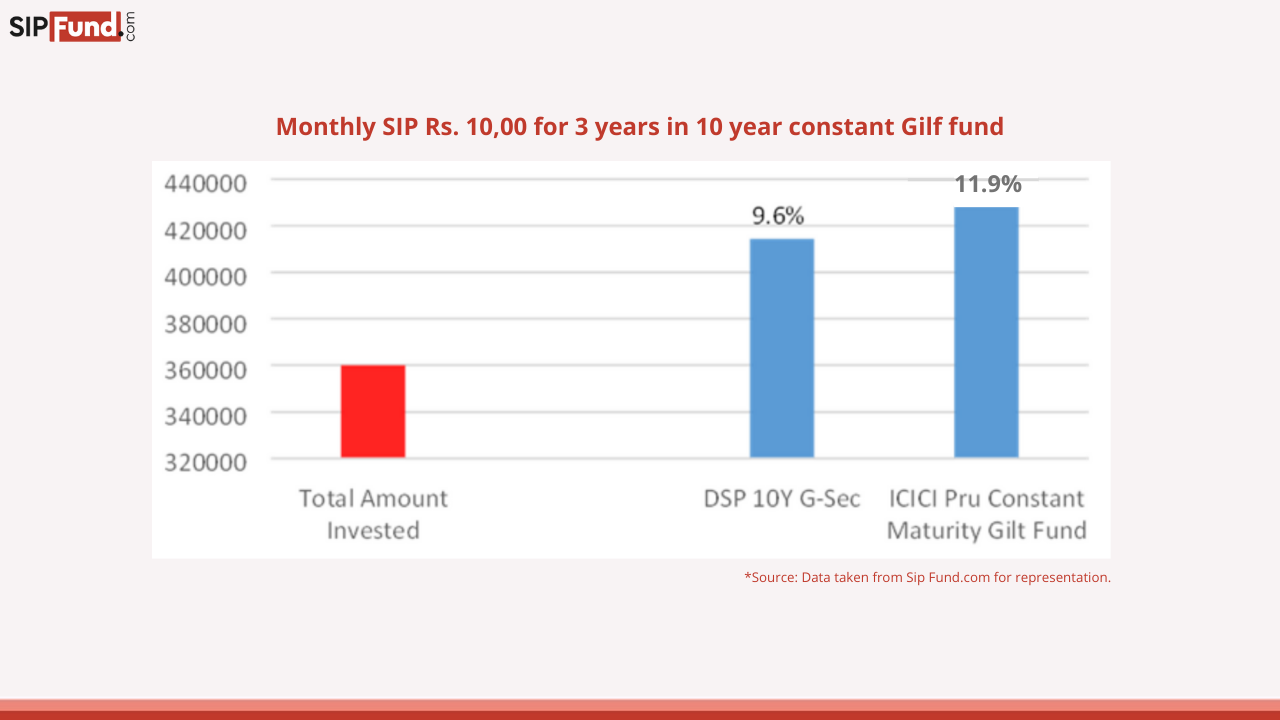

As the Gilt funds have exposure to long term papers as well, it is affected by the interest rate fluctuations. The standard deviation of 10 yr Gilt funds is usually higher as compared to debt funds. Due to this volatility is always in favor of the SIP investors . Investors prefer to do SIP because when the market is volatile they would be able to buy more units and fewer units when less volatile. They can thus take advantage of the Rupee Cost Averaging principle.

It is suitable for Investors with conservative to moderate risk profile looking for diversification benefit and no credit risk with a time horizon of minimum 3 years.

Let’s take an example to understand this better. If you have invested Rs 10,000 in a monthly SIP for 3 years in 10-year constant Gilt funds namely DSP 10-year G-sec fund and ICICI Prudential constant maturity Gilt fund. As shown in the graph below, you might receive an appreciation of 9.6% and 11.9% on your Gilt investments respectively. While getting the benefit of compounding and rupee cost averaging.

*Source: Data taken from Sip Fund.com for representation.

As the interest rate scenario has been changed today as the RBI has prioritized inflation over growth. But, despite this investors are recommended to maintain their positions in Gilt funds and investors seeking to invest in it today can as well opt for it. As when the cycle undergoes changes and the interest rates are bottomed out, you may benefit from it as the prices turn attractive and you can get a good yield of returns accumulated for yourself in the course of this time. But for new investors who want to hold positions today, it is recommended to invest in the short term Gilt funds through SIP to lower their exposure to interest rate risk and to hedge over the inflation and liquidity risks.

Let’s look at some of Gilt funds to invest in today:

Returns comparison among Gilt funds

| Trailing return | ||||||

|---|---|---|---|---|---|---|

| Scheme Name | Corpus(Rs in cr) | Average Maturity (Years) | 6 Months Absolute | 1 Year CAGR | 3 Years CAGR | 5 Years CAGR |

| UTI-Gilt Fund (G) | 557 | 6.72 | 7.4 | 12.7 | 9.86 | 10.31 |

| Reliance GSF - (G) | 1,040 | 7.96 | 7.33 | 14.83 | 9.83 | 10.59 |

| Aditya Birla SL Govt Securities Fund (G) | 231 | 8.88 | 6.66 | 13.68 | 9.33 | 10.38 |

| IDFC G Sec Fund - Invst Plan - Regular (G) | 405 | 9.38 | 7.6 | 15.52 | 9.28 | 9.79 |

| ICICI Pru Gilt Fund (G) | 1,073 | 6.04 | 5.88 | 11.27 | 8.45 | 9.73 |

The highlighted funds have performed well among their peers with respect to low expense ratio and good past performance. These have also given good returns in the 5 year period of time as seen in the table.

Conclusion

As investors always look at debt funds from the perspective of a safe investment option which the Gilt funds offer. But, these funds are sensitive to changes in interest rates, so we have to keep a close eye on the possible macroeconomic risks that could impact the changes. Overall, investing in a Gilt fund from a security perspective to safeguard your portfolio due to low default risk as compared to other debt funds is a very prudent investing decision. “Moreover, timing is a very important factor to consider before investing in these funds”.