What are Gilt Funds?

Mutual funds have a plethora of equity and debt schemes suited for all kind of investors. Gilt fund is a debt scheme of mutual fund. In this article, we will study about Gilt funds in detail.

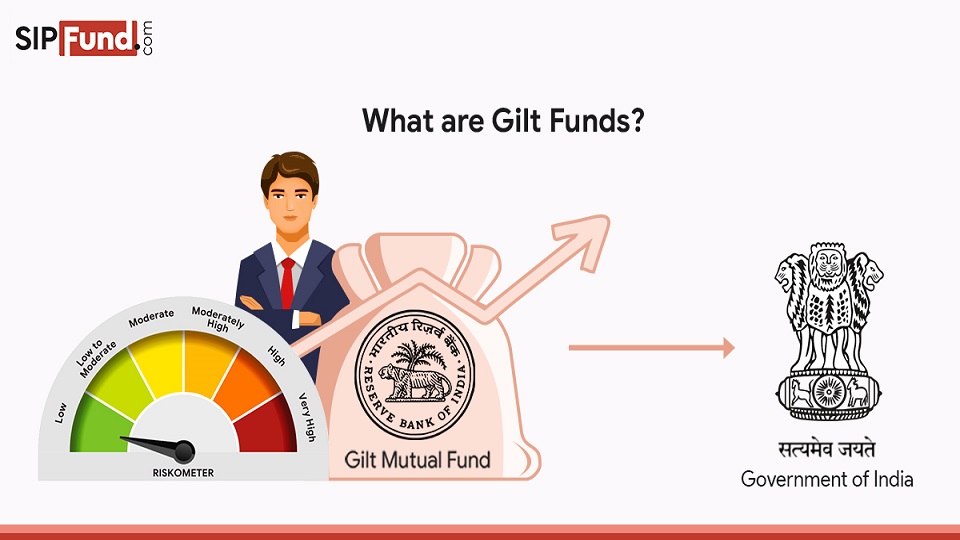

What are Gilt Funds?

Gilt Funds belong to the debt mutual fund category. These funds can invest only in Government bonds and securities of medium to long term duration. In earlier days, Government used to issue bonds in golden-edged certificates that is how the name gilded edge certificates or gilt funds became popular, also known as G-Sec Government Securities. SEBI requires gilt funds to invest a minimum 80% of total assets in Government securities. Gilt funds are of two types; one that invests in Government securities of all maturity period and the other one which invests for 10 years.

What is the importance of Gilt funds?

There are many ways that Indian Government uses to finance its money requirement like increasing tax rates, borrowing from financial institutions, disinvestment etc. The Reserve bank of India also acts as a banker to Government. It means that government also borrows from RBI for short as well as long term. Advances are the tool used by RBI for advancing loans to Government for short term. RBI borrows from the economy and issues fixed term securities to these creditors in return. RBI advances this pooled money to government for long term. Gilt Fund managers subscribe these securities and return them on maturity in return of money from the government. This is how gilt funds work. They play a crucial role in fulfilling the money requirement of the government. Government uses this money for funding infrastructure projects which creates employment in the economy.

What are the features of gilt funds?

Interest rate risk

The coupon is fixed at the time of issue of G-Sec Securities. The price of the G-Sec is extremely sensitive to the interest rate movement since they have long duration. A rise in interest rate in the market reduces the price of the G-Sec and vice versa.

Credit Risk

In the category of debt funds, gilt funds are the safest and most liquid instrument because these do not carry any credit risks. These Bonds are backed by Government and Government does its best by fulfilling the obligation.

Taxation

The rate of taxes is determined by the holding period of gilt funds. The capital gain accrued from investing in gilt funds is taxed as per the holding period. Short term capital gains are taxed according to Income tax act while long term capital gains are taxed at 20% with indexation benefits. STCG refers to the gain made by holding the portfolio for less than 3 years while LTCG are made by staying invested in gilt funds beyond three years.

Average returns

Gilt funds have churned out returns as high as 12%. Although, there are no assured returns from gilt funds as they move in tandem with interest rates. Gilt funds performs well whenever there is a slump in an economy.

Investment tenure

This is a long-term investment option as the period of maturity varies between 3 years to 10 years. Investors should have long term horizon if want to opt gilt funds.

What are the advantages of Gilt funds?

As Reserve Bank of India (RBI) reduces interest rates, the demand of earlier issued government securities shoot up if higher interest rate is attached to them. Following simple economics of demand and supply, as the demand for securities go up, their prices go up and yield comes down. Therefore, Gilt funds is considered as a perfect mix of low risk with decent returns for investors. The rate of returns on gilt funds is inversely related to interest rates in an economy. Since RBI is either cutting interest rates or keeping them unchanged, these are working well for gilt fund investors. Secondly, investors are assured that government will not default on the gilt funds so there is confidence amongst investors regarding Gilt funds.

What are the disadvantages of Gilt funds?

These funds do carry an interest rate risk. The net asset value (NAV) of the fund comes down fast when RBI increases interest rates. It means losses to gilt fund investors. Mutual fund experts are of the opinion that gilt funds are not suited to retail investors. Investment in gilt funds require time and knowledge of bond markets and timing the entry and exit becomes difficult for investors as following up interest rates is not an easy task. When economy is in high growth phase then these funds start giving negative returns which means losses to investors. Therefore, having an expert who can guide and take care of your portfolio is necessary to earn profits on Gilt funds.

Given below is the list of some of the top performing Gilt funds:

| Fund Name | 1 Year Return | 3 Year Return | 5 Year Return |

|---|---|---|---|

| SBI Magnum Gilt Fund | 9.62% | 9.49% | 9.39% |

| HDFC Gilt Fund | 7.32% | 7.15% | 7.32% |

| ICICI Prudential Gilt Fund | 10.51% | 8.98% | 8.99% |

| UTI Gilt Fund | 7.80% | 8.54% | 9.20% |

| Nippon India Gilt Securities Fund | 7.85% | 9.28% | 9.30% |

Conclusion

Investors should invest in gilt funds if their financial goals are aligned with the returns gilt funds are expected to fetch. Gilt funds are sensitive to interest rates movement therefore it is required to keep a close watch on economy because sometimes rates also vary on expectations. Investing in gilt funds because of the government security may prove to be a suboptimal decision. Investors who are having long term horizon and tolerance of risk can keep some quantity of gilt funds in their portfolio provided they have an expert on mutual fund market to manage the portfolio.