What is Credit Rating?

Introduction

A credit rating is a point of view of a specific credit agency that talks about the capabilities and readiness of an individual, government, or business to complete its financial responsibility in integrity and done on the given due dates. There is also a rating grade in credit rating from AAA to D which tells how safe your investment will be. There is a credit rating agency and credit bureau, credit agency expresses their opinion about the debt repayments in the future by a panhandler and credit bureau talks about the debt repayments of the panhandler that has been done in the past. In this article let us discuss about credit rating and its importance, rating scales and different credit rating agencies available in India.

What Is Credit Rating?

Credit Rating refers to the assessment of financial instruments, particularly the debt instruments which are offered by Organizations, Corporations, Governments, etc., To understand it better, credit rating judges whether the organization is worthy to take the credit or not. For the rating purpose, credit rating agencies analyze the business risk, financial risk, and credit risk of the company they rate. Some of the financial instruments that the credit rating agencies rate are Non-Convertible Debentures (NCDs), Fixed Deposits (FDs), Company Deposits (CDs), etc.

The credit rating agencies consider the financial statements, cash flows, historic lending and borrowing transactions of the entities to assess their abilities to repay financial obligations. In India, Securities and Exchange Board of India (SEBI) regulates and authorizes rating agencies under SEBI Regulations, 1999 of the SEBI Act, 1992.

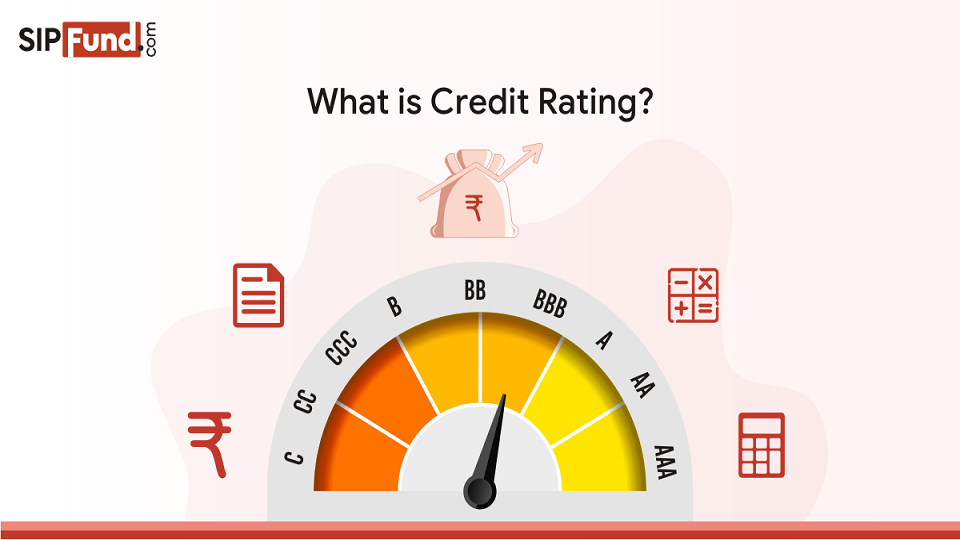

Under the credit rating process, Organizations are assessed both qualitatively and quantitatively. Credit rating thus shows the risk associated with investing in debt instruments. Credit rating not only helps companies to raise funds to finance their projects, it also provides a clear picture to the investors to make investment decisions. In India, the highest Credit Rating scale is AAA , means least risk and the lowest rating scale is D means an extremely poor credit rating. An entity with a rating of AAA is less likely to default in its payments and the entity with a rating of D is more likely to default or is already in default.

Among the different types of credit ratings, short term credit rating and long-term credit rating has widely been referred. In short term credit rating, the probability of a borrower to default within one year is determined whereas in long term credit rating the probability of a borrower to default in the extended future is determined. Under the current pandemic scenario, investors are more focusing on short term ratings of the entities than long term ratings.

What is the importance of credit rating?

Since credit rating helps an investor to access the credit worthiness of the borrower,

(a) Safety is assured : If the credit rating is high, investors get an assurance about the safety of the money they are investing, and that the money will be paid back with interest on time by the borrower.

(b) Better investment decision : As risky customers are mostly not considered by banks or money lending companies, credit rating gives them a better idea about the credit worthiness of an individual or company, thereby allowing them to take better investment decisions.

Similarly for borrowers,

(a) Rate of Interest : As lenders decide on the interest rate based on the credit history of the borrowers, a high credit rating should help the borrower avail a low interest rate loan

(b) Quick loan approvals : If a borrower is having a good credit rating, he/she is perceived to be low risk or no risk customer. So, loan approvals are easier.

What are the different credit rating scales?

The below table depicts the different rating scales and their meanings.

| Symbol | Meaning (level of safety with respect to timely servicing of financial obligations |

|---|---|

| AAA | Highest degree of safety |

| AA | High degree of safety |

| A | Adequate degree of safety |

| BBB | Moderate degree of safety |

| BB | Moderate risk of default |

| B | High risk of default |

| C | High risk of default |

| D | In default or expected to be in default soon |

As per the SEBI’s guidelines, rating symbols should have Credit Rating Agency’s first name as prefix.

What are credit rating agencies in India?

The following are the major credit rating agencies operating in India:

- Credit Rating Information Services of India Limited – CRISIL

- Investment Information and Credit Rating Agency of India Limited – ICRA

- India Ratings and Research Private Limited

- Credit Analysis and Research Limited (CARE)

- Brickwork Ratings India Private Limited

- Infometrics Valuation and Rating Private Limited

- Acuité Ratings & Research Limited

How does Credit Rating work in India?

Since there are multiple credit rating agencies in India, each agency has its own set of criteria to rate financial instruments and entities. As rating agencies rate any entity that raises money from public to finance its projects, countries, governments, companies, Special Purpose Vehicles (SPVs) and non-profit organizations get rated.

Credit rating agencies consider many aspects before determining the credit quality of any entity. Some important points are summarized below:

- Financial Statements like Balance Sheet, Cash Flow, etc.,

- Past borrowing history and lending transactions of the entity.

- Debt position of the entity.

- The type of credit and the reason of raising a new debt.

- The entity’s ability to repay the financial obligations.

Is there difference between credit rating and credit score?

Credit rating and credit score often sound similar and are noticed as the same but their meaning is different.

Credit rating:

It tells the creditworthiness of a company, and it does not apply to individuals. The ratings help in the understanding of the company and its capability to repay the debts. One thing which is important here is the ratings are designated alphabetically. Example: AAA, AA, A, B, D, etc.

Credit Score:

It is a number that is calculated by the credit bureau. The credit bureau is the agency that collects the data; it gathers the information from different creditors and gives that information to consumers who report to the agency. The credit score is assigned based on their information report of credit. The bureau judges the credit history and all the repayment history. The score of the credit is from 300 to 900 it is important if one is applying for a loan or a credit card. The company checks the score of the person before they give a loan or service.

Conclusion

Credit Rating is an inquiry of an organization whether they are certified for credit or not and their quality of credit. There are different gradings in credit rating that differentiate their levels. For borrowers, it is especially important because it helps them to avail funds for their further projects. It also helps the investors as well. There are different factors that one should keep in mind while evaluating for credit rating. The risks include the financial condition of the borrower, the size of the credit, what is the historical background, the default rates, etc. There is a possibility where the borrower does not pay back the loan. It is especially important to check the credit history, their repayment history, and all.

#CreditRating #CreditAnalysis #CreditScore #FinancialRating #Creditworthiness #CreditRisk #CreditAssessment #CreditGrading #BondRatings #FinancialHealth