What is the best way to plan for goals related to child's future?

Raising a child comes with enormous financial and emotional responsibility. No matter how expensive it gets, as a parent, you will always look for the best quality education and child's sophisticated grooming. For this, having an effective plan is a must. The cost of education is increasing rapidly, and finance is the last thing that you will consider that pulls your child from pursuing the career of his choice. Not only that, in your child's life, a lot of special events like marriage, starting a business, etc. may come. So, it would help if you were prepared for that as well.

Only when you have the right planning with your savings will you cover all the aspects. As a parent, you will have to have to be financially secure and comfortable. Today, we will help you with all the things you need to consider before planning your finance related to a child's future. As this is a significant financial goal that cannot be deferred, we will discuss it in detail. We will also help you with giving you a brief insight into how you can pull it over.

Read on!

Things to consider before planning

1. How late or early are you?

Planning finance for the education of your child is a long-term financial goal. Hence you must start investing your savings at an early stage. The best time would be when your child is born. However, you must know how early you are starting or how late you are. This will be directly proportional to your child's age. For example- you're reading this when your child is just a few months old. In that case, you have nearly two decades until he/she will go to college (if your child attends college at the age of 18). In investment, time is an important variable, and it will mostly impact the compounding.

Marriage will be another segment and generally comes much later, so you will also have a longer time to invest. Again, starting a business or your child's foreign trips might come during the early days for studies or job offers. The earlier you start, the less burden it will have on your current finance.

2. Keep in mind the devil named Inflation

Due to growing Inflation, a course that used to cost six lacs in 2008 was costing 21 lacs in 2018. So, you see, the cost of education is increasing magnificently every year at an average 13% rate. Assuming the same rate in the future, the same degree will be around 69 lacs in 2028. Therefore, you must consider this point while assessing the future cost of your child's education.

3. Also plan about insuring yourself

Now, many parents, while planning their child's future, do not consider the insurance plan. Though we're not going to discuss this in this blog, you must know this. Life insurance is a protection cover for your family in case of your untimely demise (we hope for your long life, but you never know what's in the future). In case this happens, your life cover will help your family income. It will keep them in a better position financially. Every financial expert suggests that your life cover should be at least 10-20 times your current income. You can use a term life insurance plan to achieve this coverage, ensuring your family's financial safety.

4. You don't know about what your child's goal

Many parents are adamant that their child will be an engineer, a doctor, or a chartered accountant. But the thing is you don't know! When your child grows old, he might not be interested in a goal you will plan for him. He may want to be a scientist, an astronaut, an artist, or an investment banker.

The point is you should not plan your future thinking of a goal for your child. Be independent while you invest. The first rule of investment is that you should never be in an emotional state of mind while planning your investment.

Let's talk about how to plan your investment for the best goal related to your child's future

• Never doubt the power of compounding

We have always talked about the compound interest in your money. Compounding is a considerable benefit that gives high returns in the long term. Many market funds help you avail of higher education by building a colossal corpus for your child's education planning. As discussed above, you must now know that knowledge will be much more expensive in the future, especially in decades to come.

Therefore, instead of relying on the traditional investment options, i.e., FDs, you should always go for investments in mutual funds or Sips. These tend to compound your principal amount to a massive extent. Your plans should be in such a way that is should be enough for your child even without extra addition. Hence, for your child's better education irrespective of their goals, choosing Systematic Investment Plans (SIPs) is a great and the most pocket-friendly option for you.

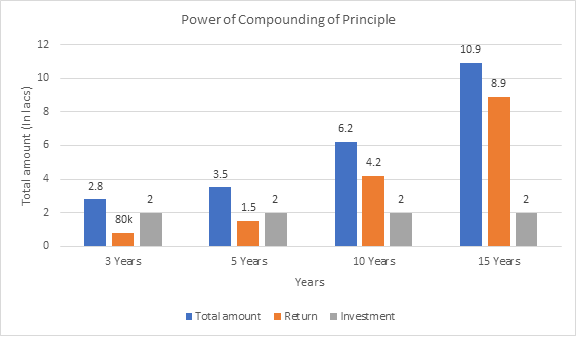

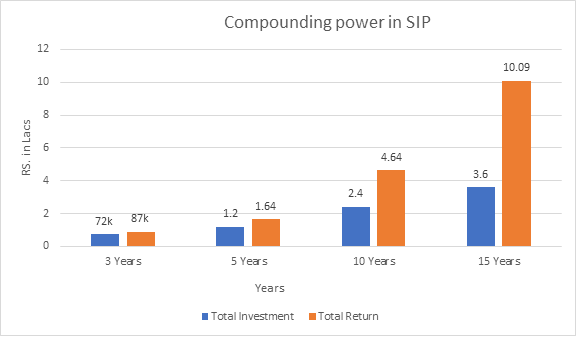

Below are two charts to help you understand the power of compounding in a better and practical way.

Example 1- you plan to invest a lump sum amount of 2 lac rupees in a fund. Now, you will be amazed by how much your principal grows. We have taken an average annual return of 12%.

Compounding power over a lump sum amount.

Example 2- Assume that you're willing to invest in a SIP of Rs. 2000 every month. Taking an average return of 12% annum, let's see how your investment will move over decades to come.

Compounding power in terms of SIP (Systematic Investment Plan)

• Invest in High Yielding Mutual Fund Schemes

Mutual funds are the best alternative for investment, thanks to their history of exponential growth and outperformance. Mutual funds are considered useful in creating the right corpus for you in both the long and short term. In case of emergencies as well, there are schemes of partial withdrawals.

We have collated a few best mutual funds schemes that can benefit your needs for your ease. Check them out below in the table below:

| Scheme Name | 5 Year Return | 10 Year Return | 15 Year Return |

|---|---|---|---|

| HDFC Children's Gift Fund | 10.80% | 12.36% | 13.34% |

| SBI Magnum Children's Benefit Plan | 10.17% | 10.32% | 9.69% |

| UTI Children's Career Fund | 7.16% | 8.98% | 9.66% |

• Review your plans regularly and appoint a nominee

For a better result with your child's educational plans, make a routine to review your plans on a quarterly basis. This will help you modify your investment planning. You can adjust your investments, savings, and strategies and keep them synced with your goals.

Besides, you're also advised to appoint a nominee. The person you are nominating should be an integral part of your family, like your spouse. In case of any mishappening with you, he/she will be able to claim the amount until your child is an adult.

• Evaluate your risk precisely

Now, as a parent, you will always look for the best. As an individual, you will try to minimize the risk associated with your investing in the mutual fund. Hence, you should always evaluate the amount of risk you're willing to take and make sure it's a rational decision. It is right that the more chance your take higher will be the return. However, as an investor, everyone has a limit for that.

If you see that the risk is too high for you to take, but the returns are also exceptional, do not give up on your greed. Always evaluate the right option and have a backup plan ready for yourself. Diversification of your funds can be a practical option.

• How to Invest in Mutual fund for Child's future

As we have already discussed, compounding helps achieve massive returns, and how SIPs in Mutual funds are an excellent option for investments. You also now know the importance of risk assessment in mutual funds. Here are a few more suggestions before we put an end note.

1. When investing, invest across two or three different funds instead of investing in a single fund.

2. Start with a minimum SIP of Rs. 2000 in each fund. This will make sure that different fund managers and various funds maintain the portfolio.

3. Diversified equity funds provide you with the key benefits of low volatility in the long term. Hence, it would help if you always started with smaller investments in different small and mid-cap funds.

4. Also, time is an essential factor as you must have learned about this in the first chart. Always calculate the time you have, to decide on behalf of your child.

5. If you're highly risk-averse or need your pay-outs immediately, the lowest risk debt funds are the best alternative.

Wrapping Up!

Securing your child's future is one of the most significant financial responsibilities you will have as a parent. Therefore, to save and accumulate enough funds it is always advised to start your investment as early as you can. This will make sure that you have ample time in your hand, and your investment does not bother your current expenses.

Investment in Mutual Funds for your child's future has a lot of different options to consider. One should always do ample market research to pick the right mutual fund scheme for himself. Also, only picking up the right plan won't work as you will have to do robust scrutiny on all the blockages that have potential threats of hurting your funds. This can be Inflation, increasing education cost, etc. Evaluating the risks associated with your investment is of utmost importance and going for monthly SIPs are always advisable for a hassle-free investment journey.

Happy Investing!