This Diwali Light Up Your Financial Future with SIPFund.com

The festival of lights, Diwali, is a time for fresh starts, wealth, and joyous celebration. It's a wonderful time to tidy up your finances and lay the foundation for a better future. Investing in a Systematic Investment Plan (SIP) is among the most intelligent and efficient way to accomplish this. A SIP enables us to methodically and systematically plan for a financially secure future, much like we do with Diwali.

This Diwali, learn how SIP investments may light up your financial path.

Why Diwali is the Perfect Time to Start an SIP

Diwali represents the victory of hope over despair, good over evil, and light over darkness. This is regarded by many as an auspicious period to start new businesses, buy property, or make large investments. In addition to being in line with the spirit of prosperity and fresh starts, starting a SIP during Diwali will help you gradually increase your wealth.

1. Season of New Beginnings: Since Diwali signifies new beginnings, it's the perfect time to start developing sound financial practices. You can choose a disciplined investing approach that fits with the long-term nature of this joyous time by initiating a SIP.

2. Festive Bonuses and Savings:A SIP is a great way to get started, as many people receive bonuses over the holiday season. Consider allocating a portion of the bonus for long-term investments rather than using it all on festivities.

3. Put Prosperity First:We celebrate Goddess Lakshmi, the representation of wealth and prosperity, during Diwali. We encourage you to start saving and invest in this Diwali so that your actions result in financial abundance.

How SIPs Operate: An Easy Way to Build Wealth

You can invest a certain amount of money in mutual funds on a monthly, quarterly, or annual basis with a Systematic Investment Plan (SIP). It is a methodical approach to investing that can eventually help you build money.

SIPs are regarded as a wise investment solutions for the following reasons:

Compounding Power: The power of compounding increases with the length of time you invest through SIPs. Consistent investing produces a snowball effect that gradually increases your wealth as your returns produce their own returns.

Rupee Cost Averaging: This is one of the main benefits of SIPs; it implies that you purchase more units at low prices and fewer at high ones. This lessens the effect of market volatility and averages out the cost of investing.

Flexibility and Accessibility: SIPs can be easily started, stopped, or modified as needed. Starting with a modest sum, you can progressively raise your contributions as your income rises. Because of their adaptability, SIPs are available to all kinds of investors.

Diwali Gift of SIP: A Smart Choice for Your Loved Ones.

Consider giving your loved ones a SIP investment in addition to Diwali presents like candy, clothing, electronics, and other treats. This investment will last a lifetime. It's a considerate method to demonstrate your concern for their long-term financial security.

1. Establishing a Legacy: You can gift a financial legacy for your parents, spouse, or kids by giving them a SIP. It can act as a foundational base for reaching their long-term objectives, like retirement, schooling, or the house of their dreams.

2. Empowering Financial Independence: Giving your loved ones a SIP gives them the confidence to begin investing and achieve financial independence. It's a gift that gains value over time.

3. Simplifying the Process:With just a few clicks, you can easily set up a SIP for a friend or family member (Refer a Friend). To make sure your gift is suited to their requirements, you can even choose funds according to their risk tolerance and financial objectives.

Top Mutual Fund Categories for SIP this Diwali

Your financial objectives, investment horizon, and risk tolerance all play a role in choosing the best mutual funds for your systematic investing plan. Goals like a child’s education, dream home or dream car, retirement, or child’s marriage can all serve as the foundation for your SIP. Consider the following mutual fund categories for your Diwali SIP investments:

1. Equity Mutual Funds: Equity mutual funds, which invest in equities of different firms, are ideal for long-term growth. They are appropriate for investors that have a longer investment horizon and a greater tolerance for risk. Start a systematic investment plan (SIP) in a diversified stock fund this Diwali with the goal of building long-term wealth.

2. Debt Mutual Funds: Debt mutual funds may be a good option for investors looking for steady earnings at a lower risk. They make investments in fixed-income instruments such as corporate and government bonds. One strategy to balance your investing portfolio is to begin a systematic investment plan (SIP) in a debt fund during Diwali.

3. Hybrid Mutual Funds: Hybrid funds provide a balanced approach by investing in a combination of debt and stocks. They are appropriate for those seeking modest profits with a modicum of risk. You can benefit from the best of both worlds with a hybrid fund SIP.

4. Tax-Saving Mutual Funds (ELSS):An Equity Linked Savings Scheme (ELSS) is a good option if you wish to increase your wealth while reducing your taxes. It has a three-year lock-in term and provides tax benefits under Section 80C. You can ride on the capital appreciation and save taxes by starting an ELSS SIP this Diwali.

How to Get Started with a SIP This Diwali

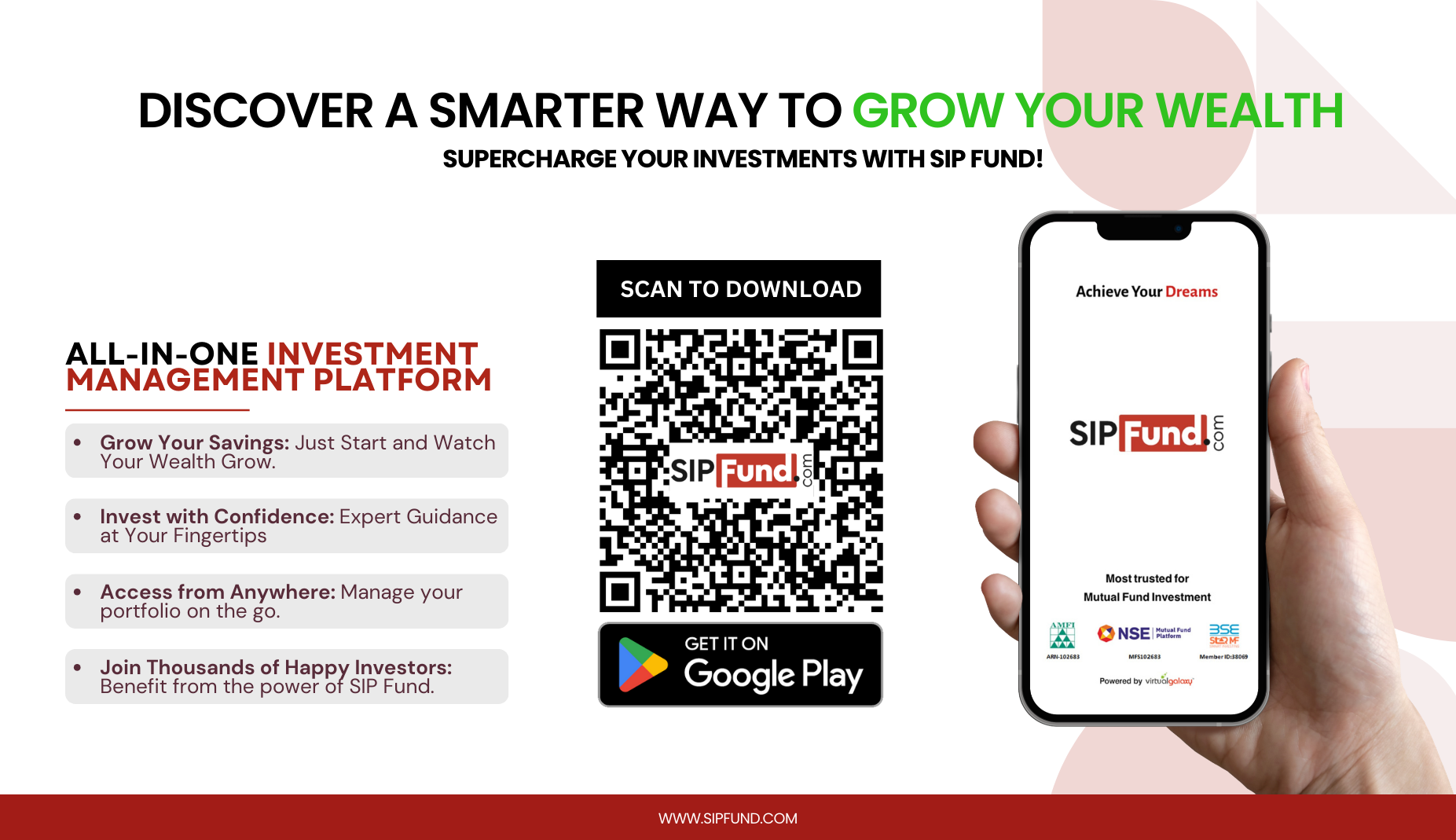

You can easily invest from the comfort of your home with the SIPFund.com app. Download the SIPFund.com App and complete onboarding.

1. Select the Goal or Mutual Fund: Select a mutual fund or goal that fits your investment objective, risk tolerance, and ambitions. Analyze different funds according to their portfolio mix, expense ratio, and historical performance. You can utilize reports in the SIPFund.com app or even get personlized assistance through the assigned Dedicated Relationship Manager.

2. Decide the Investment Amount: Decide how much you would like to contribute to your SIP each month. If you invest consistently, even a small sum can grow dramatically over time.

3. Set Up Automatic Payments: Set Up the auto-debit from your bank account to streamline the procedure. This guarantees that you maintain discipline in your investing strategy and never miss a SIP installment. Even if you do miss a SIP Installment, you can always pause or connect with the Relationship Manager to manage your account.

4. Consult with a Financial Advisor: Our Expert Financial Advisor can help you decide which funds to invest in or how much to invest. To meet your financial needs, they can assist you in developing a personalised investment plan.

Diwali is a time for celebrations, but it’s also an opportunity to reflect on our financial journey and make decisions that can lead to lasting prosperity. By starting a SIP this festive season, you can build a brighter financial future for yourself and your loved ones.

Just as the diyas light up our homes, let SIP illuminate your path to wealth creation.

So, this Diwali, take a step closer towards financial freedom— invest in a SIP and watch your wealth grow over time. It’s a small but meaningful investment that can lead to big rewards in the future. Happy Diwali and happy investing!