GROW YOUR WEALTH OVER TIME: HOW SIPS BUILD STRONG FUTURE RETURNS

-sipfund.png)

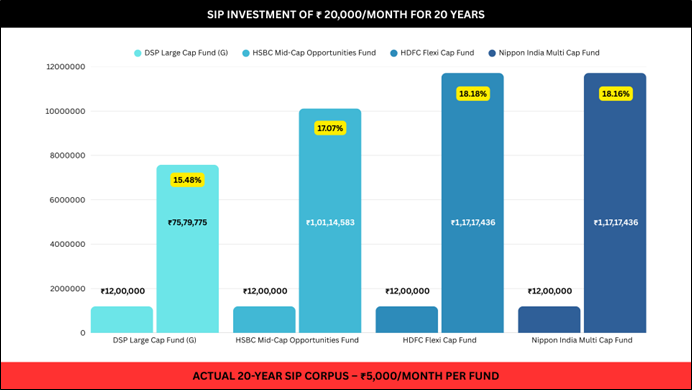

An investor started a disciplined SIP investment of ₹ 20,000 per month, in which he allocated ₹ 5,000 in each in the Mutual Fund Scheme of various categories in four top performances:

- DSP Large Cap Fund (G)

- HSBC Mid-Cap Opportunities Fund

- HDFC Flexi Cap Fund

- Nippon India Multi Cap Fund

Regardless of the market time or reaction to short-term fluctuations, the investor maintained a stable contribution for 20 years

-sipfund-csv.png)

Disclaimer: The previous performance is not a sign of future results. Mutual funds are subject to market risks, and returns may vary depending on future market conditions. Investors are advised to assess their risk profiles and investment horizons before taking decisions.

A total SIP investment of ₹ 48,00,000 - Spread equally into four top performing mutual funds in 20 years - has developed into a fund of ₹ 4,11,29,230 by 6 May 2025. This example highlights the immense value of disciplined investment, strategic diversification, and long-term compounding effect.

From ₹48 lakh to ₹4 core: SIP, diversification, and real strength of continuity.

KEY TAKEAWAYS FOR INVESTORS:

1. Fund selection matters

- The success of SIPs does not only depend on disciplined investing - but it also starts with choosing the right mutual funds.

- Not all mutual funds perform alike. It is important to select plans that best suit your goals, timelines, and risk appetite.

- A well-chosen fund can enhance returns, while a poor fund can obstruct your growth.

- The selection of research-supported funds ensures that your SIP remains consistent and beneficial over time.

2. Bring diversity according to the scheme and category

- Diversifying your total SIP investment - such as large-caps, mid-cap, flexi-cap, multi-cap and more can help to manage the risk associated with your investment in market cycles

- Based on market conditions, each category behaves differently. Diversification ensures that when one segment performs poorly, the second may reduce the decline, leading to a more balanced and flexible development path.

- This is a strategic way to align your portfolio with short-term needs, medium-term goals and long -term money creation.

- SIPFund.com helps you diversify your investment and manage SIPs in one platform as per your needs and goals.

3. Continuity is everything

- The real strength of SIP lies in disciplined, regular investment. By monthly investments - regardless of market conditions - you benefit from the cost average, which helps reduce the average purchase cost of your units over time. Even more importantly, continuous investment promotes the compound effect.

- Stopping SIP can disrupt this cycle, while continuous investment as per the plan creates a strong financial fund. In the investment world, continuity is not only helpful - it is basic.

- The investor focused on completing the SIPs as per plan regardless of market conditions. Just a stable, calm contribution made every month - and the results themselves speak.

That one investment that started as a simple investing habit turned into a fund of crores. It was not magic or luck. This was the result of smart planning, patience and perseverance operated by time and well-chosen mutual fund schemes.

This journey only reflects more than impressive numbers. It represents financial freedom and goal fulfillment - whether it is to raise money for your child's education, child's marriage, dream home, dream car or to retire stress free.

To start your journey, log on to www.sipfund.com or download the SIPFund.com app from Google Play Store. SIPFund.com helps you plan, customize, track, and manage your investment at your fingertips all in one easy to use dashboard.

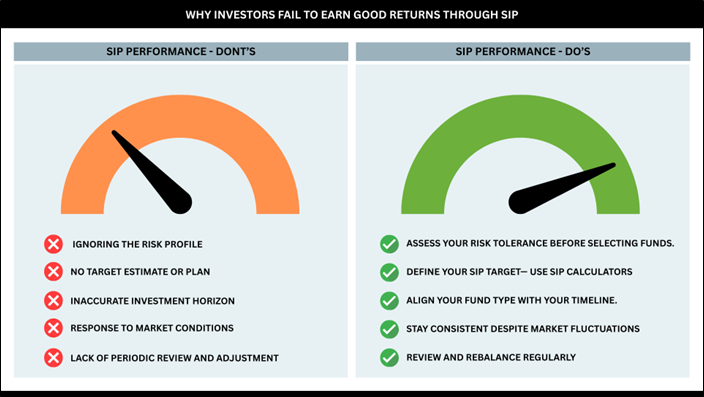

WHY INVESTORS FAIL TO EARN GOOD RETURNS THROUGH SIP

Let's take an example. Ramesh, a 30-year-old salaried professional started investing ₹ 10,000/month through SIP in 2012. A decade later, he was disappointed - his amount did not increase as expected. But the problem was not SIP.

1. Ignoring the risk profile:

Ramesh selected small-cap and sectoral funds due to last year’s high returns. He did not know that he was not compatible with his moderate risk capacity. When the market became unstable, he became nervous and stopped his SIP. Had he had selected mutual fund schemes based on his goals and timelines, he would have been able to manage risks. Also, as he chose to stop his SIP, his SIP performance dropped. If he had remained invested, he would have earned better returns on his investment.

2. No target estimate or plan:

He started investing without a goal and had no clarity about how much money he needed to invest, for how long or why. SIPs perform the best when it is goal focused, such as children’s education, children’s marriage, dream home, dream car or a stress-free retirement.

3. Inaccurate investment horizon:

He was expecting high returns in just 5-6 years and was disappointed when this did not happen. Equity SIPs are designed for long-term money creation - ideally for 10 years or more. Expecting short-term profits from long-term plans is a recipe for failure.

4. Response to market conditions:

During the recession period in 2020, Ramesh had stopped his SIP in fear, missing the opportunity to purchase unit with low NAV. He did not review or reinforce his portfolio. He then invested a higher amount of money, hoping to make up for the investment gap and purchased units when the price was higher. Funds that did not perform very well, reduced his returns on investment. This emotional investment decision resulted in a reduced impact of the cost averaging and compounding effect.

Solution: He should have instead reviewed his portfolio made better investment decisions which would have resulted in better purchasing decisions and better returns on investment.

Investors like Ramesh often struggle to accumulate wealth due to mismatched risk profiles, vague financial goals, investment horizons, and poorly structured plans. To truly benefit from SIP, it is essential to plan your investment strategy based on a goal, stay invested and approach the goal achievement journey in a disciplined manner.