Product Review: HDFC Life Sanchay Plus

Guaranteed Return & Tax Free – HDFC Life Sanchay plus.

On 9th, March 2019, HDFC Life launched a guaranteed return product which offers Guaranteed and Tax-Free income for 99 years of age.

Insurance companies often come up with products which offer guarantee feature, but if we study a given product carefully you will see that most of these products offer guarantee on one or two parameters like guaranteed addition, guaranteed waiver, guaranteed 40% payment and guaranteed bonus. You will come across cases where it says guaranteed bonus, but the percentage of declared bonus is discretion of insurance company.

HDFC Life Sanchay Plus is one of the very few products which offers guaranteed return. Let’s look at features, advantages, disadvantages and suitability of this product for investment.

For age group 50 – 60 years old

Name: HDFC Life Sanchay Life Long Income Plan

Product Feature:

Outflow:

- You pay ₹1 lakh for 10 years, cool off period 1 year

Total outgo: ₹10 lakhs (over 10-year period)

Inflow: Guaranteed & Tax-Free Income

- You get ₹1 lakh per year from 12th year till your age 99 years

- + get your ₹10 lakhs returned on 99th year

Total inflow: ₹49 lakhs (over 39 years) – fixed and guaranteed. - All the payment will continue to be made to the nominee (in case of death of life insured)

- Option to take all the future payments as lump sum.

During the payment term of first 10 years, the proposer is insured between 10-15 times annual premium.

For age Group 5-50 years old (options available)

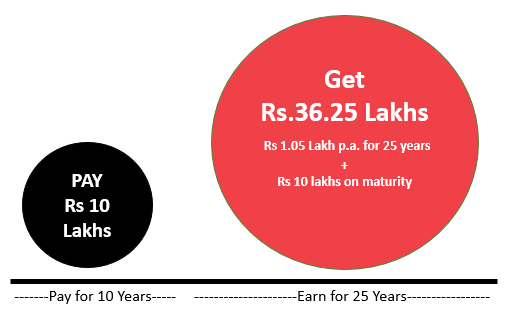

Option I:HDFC Life Sanchay long term Income Plan

Product Feature:

Outflow:

- You pay ₹1 lakh for 10 years, cool off period 1 year and

Total outgo: ₹10 lakhs (over 10-year period)

Inflow: Guaranteed & Tax-Free Income

- You get ₹1.05 lakh per year from 12th year till next 25 years

- plus get your ₹10 lakhs returned.

Total inflow: ₹36.25 lakhs (over 25 years) – fixed and guaranteed. - All the payment will continue to be made to the nominee (in case of death of life insured)

- Option to take all the future payments as lump sum.

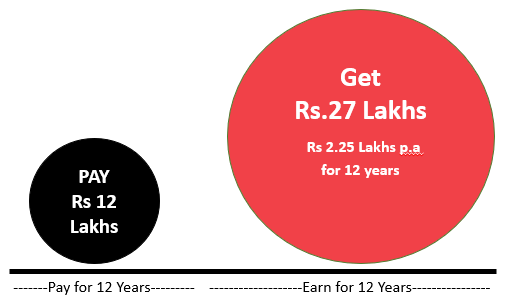

Option II:HDFC Life Sanchay Guaranteed Income Plan

Product Feature:

Outflow:

- You pay ₹1 lakhs for 12 years, cool off period 1 year

and

Total outgo: ₹12 lakhs (over 10-year period)

Inflow:Guaranteed & Tax-Free income

- You get = ₹2.25 lakh per year from 14th year till next 12 years

Total inflow: ₹27 lakhs (over 12 years) – fixed and guaranteed. - All the payment will continue to be made to the nominee (in case of death of life insured)

- Option to take all the future payments as lump sum.

Advantages:

- Guarantee: There are no products in the market that will give you guaranteed return for such a long period like Sanchay Plus

- Income is tax free: Since the returns come under proceeds from life insurance the amount received is completely tax free in the hands of the receiver as per Section 10(10D) of IT Act.

- Returns are fixed for long period. For example, if your 10 years payment term finishes on 60th year then you are getting fixed return for next 39 years.

Disadvantages:

- You must pay for 10 years else the policy lapses, just like any other insurance policy

- The IRR comes up to 9% pre-tax which appears low given that there are mutual fund products which give more than 10-12% per year easily for equivalent time horizon.

Suitability: is best assessed by comparing with similar products, variability of income and taxation.

Re investment risk: Indeed, mutual funds give better returns than Sanchay, albeit without guarantee, and we may accumulate much more in mutual fund if 12% returns are calculated for the same payment profile. However, once we have accumulated the desired corpus and it is time to take regular income, we may or may not get the desired 9% return on the corpus and it will certainly not be fixed till your age of 99 years. So, when time comes to withdraw fixed amount every year, we face a re-investment risk. It is therefore a trade-off between getting high returns and guaranteed returns. It is also an established principle that if you are getting guaranteed return then you are not taking any risk and therefore there is no premium on your return. Sanchay Plus removes this re-investment risk.

Taxation: A triple A rated bond is closest to a guaranteed return product. If we were to compare Sanchay with other Tax-free bonds, the returns on AAA (Guaranteed) bonds is close to 6.4% which comes to pre-tax return of just over 9% for high tax bracket investors. However, these bonds do not have such long tenure like Sanchay, they do not exist for long period of 39 years without the option/risk from issuer to pay you back your sum and close the bond. It is also unlikely that the credit rating of AAA bonds will be same for next 39 years. If rating of a given bond comes down, then guarantee feature of bond disappears.

If one buys a monthly pension plan, known as annuity, at the age of 60 years with the accumulated corpus, the monthly payments are taxed, since annuity is taxable in the hand of receiver. In HDFC life Sanchay, the monthly income is tax free since it is proceeds of maturity of insurance policy which comes u/s 10(10D) of Income tax Act.

Flexibility:Unlike mutual funds or senior citizens scheme where funds can be withdrawn anytime, investment are locked in HDFC Life Sanchay till the income period starts. Sanchay does offer an option to withdraw all the future payments at a discounted value. Early withdrawal does mean forgoing tax-free & fixed future income and therefore not recommended. In mutual fund also we can set a systematic withdrawal on some funds, but it means that withdrawal could eat into the corpus.

Inflation: Since the income period in this scheme is so long, the inflation shall reduce the buying price of your income after 12 years, so imagine a scenario where Sanchay starts paying income of ₹100,000 a year, in twelve years’ time from now and then continues to pay for next 12 years. It means, the investor shall continue to get ₹100,000 per year 24 years from now, certainly the buying power of that amount will not be same as ₹100,000 now. This product does not protect you from inflation.

Sanchay is an excellent product to plan your retirement. It offers guaranteed tax-free returns and therefore needs to be in your portfolio but since it does not guard one against inflation it cannot get huge allocation. So, if you have mutual fund, gold, real estate, term insurance and FD’s then this product can easily replace your FD’s and certainly the RD’s.

We recommend at least 20-25% of your portfolio to this product especially those between age group of 50 to 60 years. In case you are planning monthly retirement income of say ₹2 lakhs per month in 10 years from now, at least ₹45,000 to ₹50,000 per month should be guaranteed through Sanchay. This means a minimum investment of 6lakh per year for next 10 years in Sanchay will suffice.

A must for your retirement planning, Sanchay is the best insurance endowment product so far!!!