How to choose a debt mutual fund?

To a retail investor debt fund seems like a better alternative to Fixed Deposit primarily due to higher return and tax benefits. But how safe are these debt funds in current market scenario and how should one go about selecting them. Before we go into the selection tips lets understand what a bond is;

Bond: A bond is a debt instrument (aka paper) where company/bank etc (Issuer) borrows money from lender for an agreed period (maturity/duration), defined interest rate (coupon) and defined risk, as measured by credit rating. The credit rating agencies give the Ratings to the paper based on repayment capacity of the borrower, AAA being highly likely to pay back the debt, D being default and cannot repay the debt and therefore recovery process must take its course.

Debt Fund: A debt fund is merely a collection of such bonds where fund manager invests/lends to various issuers, let’s look at the advantages of selecting debt fund over fixed deposit and the underlying risk.

Debt Mutual funds offers high returns compared to fixed deposit in general. The returns on debt funds vary from 6.5% pre-tax to up to 12% pre-tax compared to FD returns of 6.5% -7%

The return on debt mutual fund is subject to long term capital gains if held beyond 3 years and effective tax rate could come to well below 10%.

The fund invests into various instruments thereby offering the diversification of risk of lending to one entity. Often the fund manager spreads it across 20-25 companies, banks or state government or central governments.

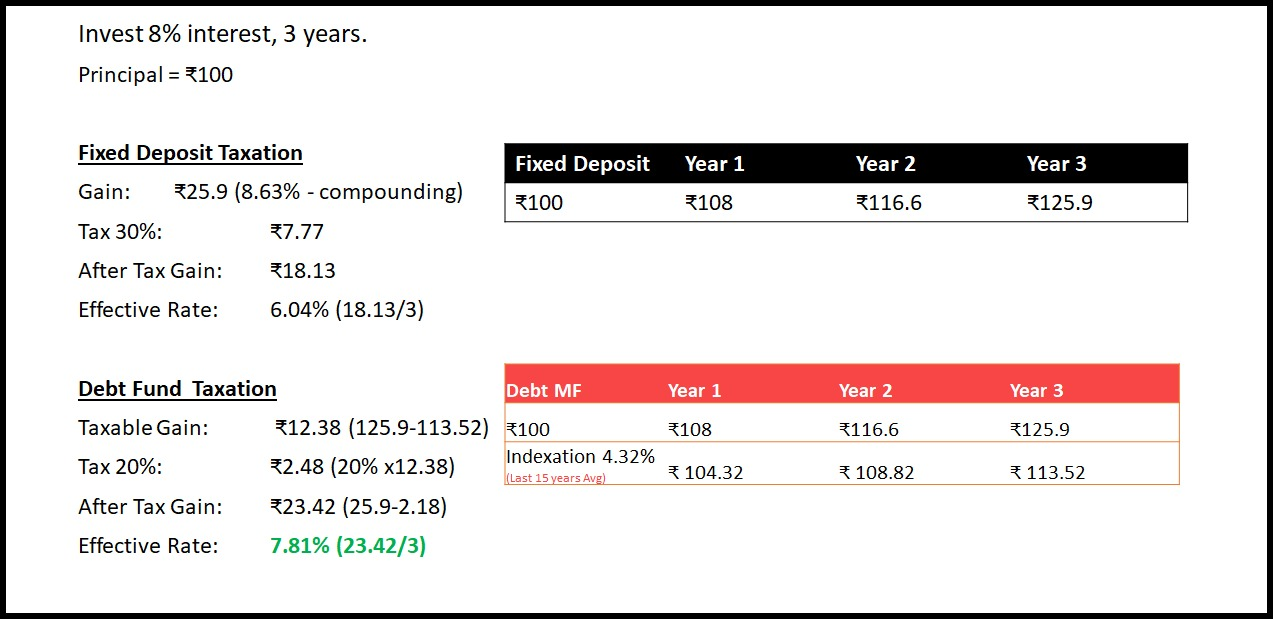

Tax calculation for Debt fund vs. Fixed Deposit;

There are 4 types of debt funds in the market, Credit Risk funds, GILT funds, Duration Funds and Liquid funds. Each fund category has its own defined method of picking the debt where the money will be invested.

Four major factors that govern all the debt funds are 1. Credit rating of underlying, 2. Maturity of the debt 3. Coupon or interest on the debt 4. Market conditions for ease of credit availability

Liquid Funds:

These funds invest in money market instruments which is mostly bank CD’s and treasury bills etc.

These are by far the safest funds and most suitable for parking excess funds for short duration and therefore are favourite with corporate treasury. Typically, give 6-7% returns per annum and can be used as alternative to placing funds in savings bank account.

Some of Liquid Funds;

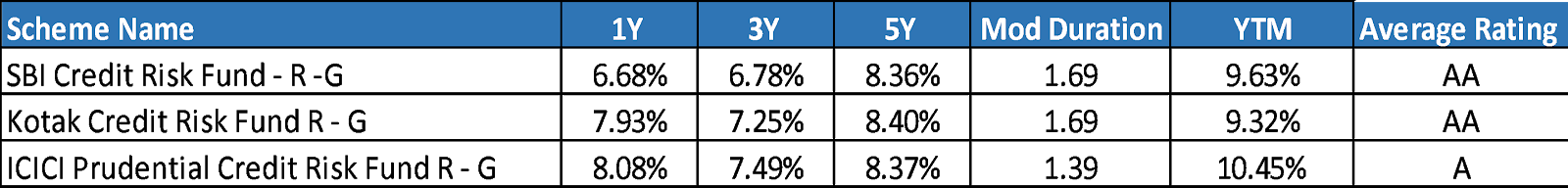

Credit Risk Funds:

These funds invest in various credit quality papers right from AAA to A and usually no fund manager selects a D rating paper. This is a high-risk fund since all the papers carry the credit risk. The chances of default by a borrower, be it AAA rated or A, exists albeit at varying degrees. In September 2018, even the highest rated AAA company ILFS defaulted on its payment. When there is no credit crisis or credit is easily available, this fund is a good alternative to select since it will give higher returns and will be relatively safer. In current scenario, where the credit is squeezed from the banks and NBFC’s, the chances of default by the borrowers are high, therefore these funds are not recommended for investment unless you are high risk taker. One should also not overlook the capacity of the fund manager to manage the papers of low credit rating and their underlying issuer.

Often these funds have bond of varying durations which implies that a 1% reduction in market interest rates leads to price increase by Duration X 1%. Whenever the underlying bond issuer gets its rating downgraded or defaults, the fund manager must record the event by reducing the NAV of the scheme to reflect the reduction. Last calendar year, we have seen a lot of downgrades due to default, in such cases the NAV and returns have gone down but as the debt is recovered in future these same funds will show a big jump in the return as NAV is restored. So, if your credit risk fund is showing a low return in last 1 year please look for YTM of the fund, if it is significantly high then stay invested as it shows that the fund will yield a higher return in next few years.

Some Credit Risk funds;

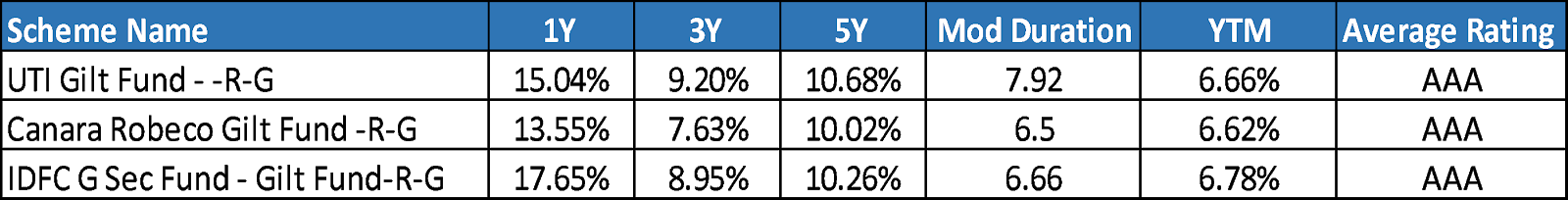

GILT Funds:

The fund manager primarily invests in the government securities, and the risk is sovereign risk which means the government’s credit rating. The chances of government failure to honour the loan are very slim and therefore considered safest from default perspective. However normally government issues long term debt and the duration of these funds is in the range of 7- 10 years, which makes their NAV highly sensitive to the interest rates movement. These funds normally are preferred when the interest rates in the country are headed south. As per the formula, a 1% fall in the interest rate, the price of the bond increases by Duration x 1% . However, in a developing economy like ours the interest rates normally have southward pressure and that makes these funds attractive although it amounts to a directional bet.

Some Gilt Funds;

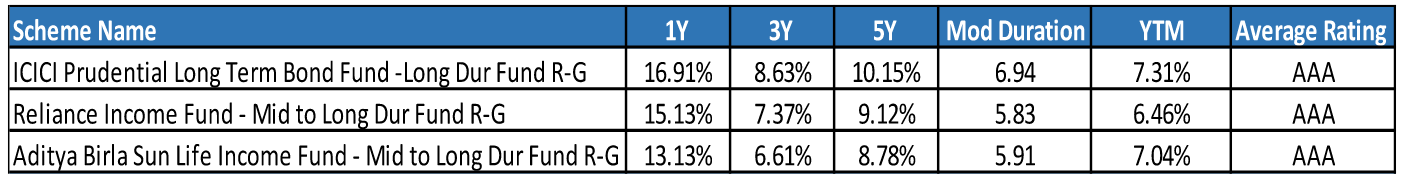

Duration Funds:

The bonds selection has range of duration and idea is to collect long as well as short duration funds. These funds are not immune to credit risk and whereas fund manager tries to shuffle the bond portfolio based on credit, the duration of the underlying is a primary motive for issuer selection. Here the credit risk is often moderate to low and returns are arrived at by managing the duration of the portfolio. There are various sub types in this category like low duration 1-3 years maturity portfolio, short duration up to 1 year of maturity portfolio and long duration etc.

Some Duration Funds;

Other factors that affect debt funds include the general economy of the country, inflation, currency devaluation etc. The debt market is very sensitive to the funds flow from the global markets. Whenever there is a reduction in the interest rates in stable and developed economies the dollar funds flow out of that country in search of equivalent risk return trade. The liquidity (easy credit availability) is a primary determinant of the price movement in the bonds. In India Banks and NBFCs drive the credit supply. Debt Mutual funds are effectively a market-based lending mechanism under the mutual fund structure.