Master Your Wealth: How to Use Systematic Investment Calculator (SIP) for Smart Investments

.png)

When it comes to creating long-term wealth or working towards meaningful life goals, many people get into investment with this vague hope that everything will be fine. Problem? Without a clear strategy or direction, it is easy to lose confidence or deviate from the way. It is here that SIP (Systematic Investment Plan) Calculator is useful and serves to be your personal financial plan guide, which helps you plan with accuracy and peace of mind.

What is a SIP Calculator?

SIP Calculator is a financial compass. It helps you find out where you are going - and how to get there - on the basis of how much you can invest every month. SIP (Systematic Investment Plan) is a tool that helps you plan your regular investments, usually in mutual funds or equity stocks or gold.

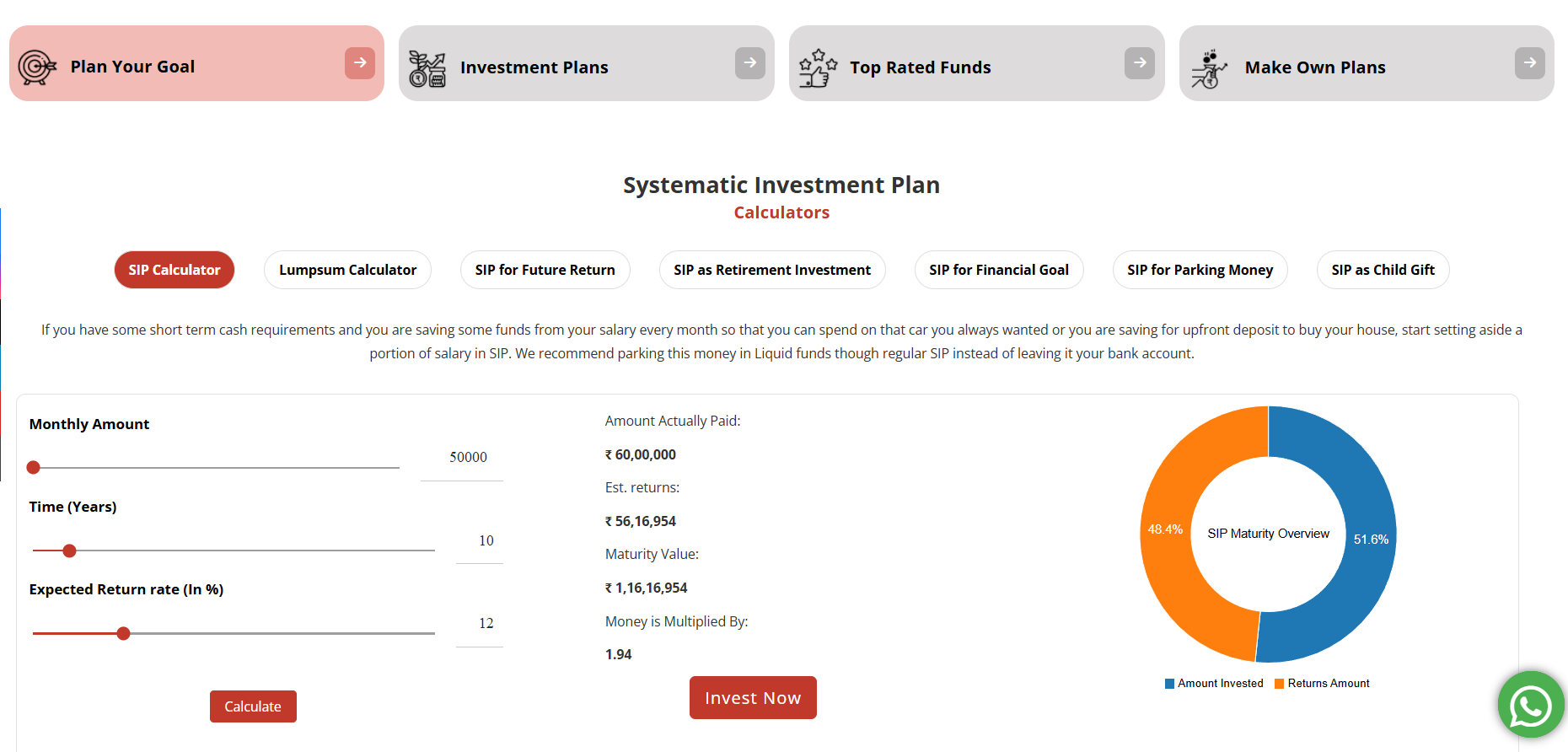

All you have to do is enter three basic details:

- How much you want to invest each month?

- How long you want to stay invested?

- The expected rate of return (usually 10-15% for equity mutual funds)

The calculator shows you how to strategically increase your money over time. It's not just about the final corpus—it's about understanding how much came from your own contributions and how much was generated through returns. That's what truly measures the power of your investment. This gives you a realistic picture of what your financial future can look like.

Why You Need a SIP Calculator

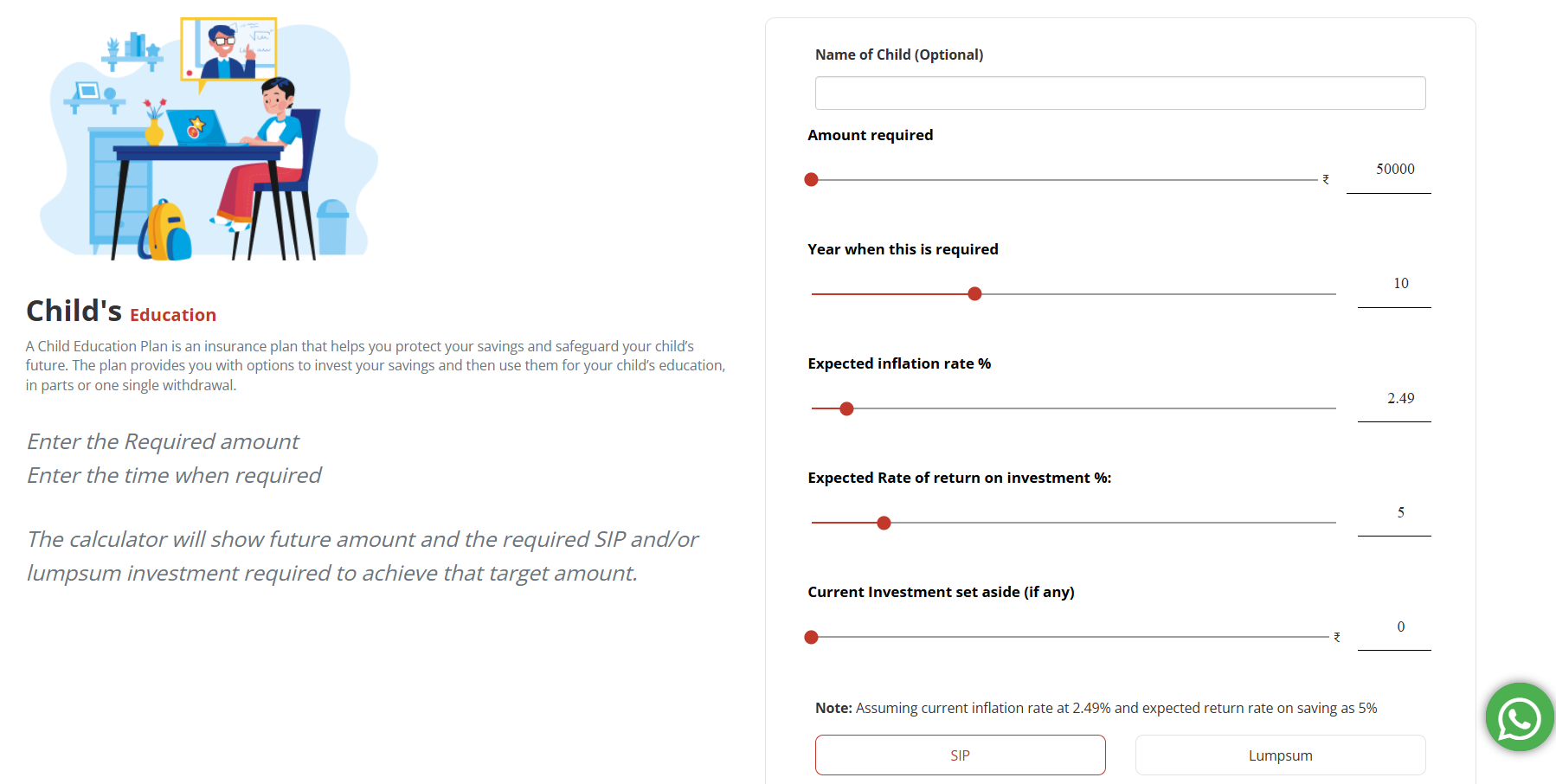

Suppose you want to save for your child's education or buy a house in 10 years. You might have an idea that how much it will cost, but you really have to know: How much should you invest every month to complete it?

This is where SIP calculator becomes your best friend. Instead of estimating or expecting the best, you can put in real numbers and see how much it will cost.

It answers big questions like:

- “Am I on track?”

- “Do I need to increase my SIP?”

- “What if I start a few years later—how much more will I need?”

Once you calculate and analyze these numbers, you will realize how powerful it can be to plan your goal, calculate and invest continuously. And that clarity? It is a game-changer

The Power of Time in Your Investments

When it comes to investment, time is your most powerful property. The sooner you start, the greater your money can increase - due to the magic of compound interest.

For example, suppose you want to deposit ₹ 50 lakh on the expected returns of 12% in 15 years. You will need to invest around ₹ 12,000 every month. But if you postpone that plan for only five years, then you have to double your monthly investment to ₹ 24,000 to achieve the same goal.

Conclusion? Start early, invest regularly and remain invested. The longer your investment horizon, the less pressure you will feel every month and the easier it will be to achieve your goal.

Eliminate Stress with a SIP Calculator

Whatever your goal may be, your dream is achievable with a good savings scheme and a clear, consistent strategy to bring it to life. This is where the SIP calculator proves to be really effective.

This helps you answer some important questions:

- How much I have to invest every month to reach my goal?

- Are you saving enough, or I need to adjust?

- What will happen if I delay a few years?

This kind of clarity can make a lot of difference. You are not blindly investing. With guidance from a SIP calculator, you are strategically working towards something solid, and this strategy makes it stronger.

How to Use SIPFund.com's SIP Calculator

Using SIP calculator is simple and straightforward. Choose your goal and follow these steps to get a systematic investment plan strategy to achieve your goal:

| STEP 1 | STEP 2 | STEP 3 | STEP 4 |

|---|---|---|---|

| STEP 1 Enter the monthly SIP amount Decide how much you can invest really every month. Choose an amount that fits comfortably in your budget that aligns with your long-term goals. | STEP 2 Enter the investment period Choose how many years you would like to invest. In the long term, the compound interest works its magic. Match the timeline with your goals - such as 15 years for child education or 20 years for retirement. | STEP 3 Enter the expected annual returns Based on your chosen SIP strategy, enter a realistic expected annual return. Equity mutual funds are usually around 12% on average in a longer period. | STEP 4 Review your results The calculator will show:

|

The calculator will also present a visual graph that will show how your investment increases over time, which gives you a clear picture of your future financial success.

Documents Required for SIP Investment

Minimal paperwork is required to start SIP investment, making it an accessible investment option for most people. To start, you will need the following documents:

| KYC VERIFICATION: DOCUMENTS | |

|---|---|

| KYC VERIFICATION: DOCUMENTS To invest in SIP, you must complete the KYC (Know Your Customer) process. Permanent account number (PAN) card is a mandatory document, for an adult residing in India to become an investor and start investing in mutual funds. This document serves as your identity for tax-related purposes. You will also have to provide your bank account details to enable the auto debit feature for the SIP. This will allow a fixed amount to be auto debited at fixed intervals like weekly / monthly / quarterly / annually. This ensures that your investment contribution is deducted from your account and invested accordingly in your chosen plan. |

Once your KYC and onboarding process is completed, your IIN number will be activated, and you can easily start your SIP on SIPFund.com.

How is Money Invested through SIP?

Through SIP, the desired amount is auto-debited from your bank account at regular intervals - usually on a monthly basis - is invested in selected mutual funds.

Benefits include:

- Stability: Encourages discipline and consistency in investing habits.

- Rupee cost average: When prices are low, you buy more units, when prices are high, buy fewer units - which makes the average cost less over time.

- Power of compounding: If small amounts are invested regularly and are given enough time to grow, it can result in a large corpus.

SIPFund.com SIP is a great platform to start the journey. It simplifies the entire with an easy to use interface, provides a wide range of mutual fund options, and personalized plans based on your financial goals and risk appetite.

SIP Calculator Statistics for Different Age Groups and Aspirations

Let's take a look at how much you should invest in different stages of life, keeping in mind the 12% CAGR expected return rate:

| Target | ₹ 1 crore in 20 years |

| Goals | Premature retirement, luxurious house or long-term property |

| Monthly SIP required | ₹ 10,009 |

| Estimated return (maturity) | ₹ 1 crore |

| By starting investing early, the monthly investment is significantly reduced due to the power of compound interest. | |

| Target | ₹ 50 lakh in 15 years |

| Goals | Children's education, down payment or business fund or dream home |

| Monthly SIP required | ₹ 9,909 |

| Estimated return (maturity) | ₹ 50 lakh |

| You can still create a strong financial basis with a managed monthly investment. | |

| Target | ₹ 25 lakh in 10 years |

| Goals | Higher education, major family program or renewal of home. |

| Monthly SIP required | ₹ 10,760 |

| Estimated return (maturity) | ₹ 25 lakh |

| Regular investment for 10 years will help fulfil your goals. | |

| Target | ₹ 5 lakh in 3 years |

| Goals | Emergency Fund, Buy Car or Family Festival |

| Monthly SIP required | ₹ 11,492 |

| Estimated return (maturity) | ₹ 5 lakh |

| Short-term goals require more commitment, but SIP still provides a disciplined passage to achieve them. | |

These examples give you an idea of how your investment needs change on the basis of your age and financial goals. The sooner you start investing, the less monthly investments have to be made to achieve your goal.

How to Start an SIP on SIPFund.com

Sipfund.com is easy to start SIP. Here is told how:

| STEP 1 | STEP 2 | STEP 3 | STEP 4 |

|---|---|---|---|

| STEP 1 Log onto www.sipfund.com or download the app from Google Play Store Create a user account using your mobile number and email ID. | STEP 2 Activate Investor Account Complete the account set up process by doing KYC verification, adding your personal identification information, income and nominee details. Complete the bank auto debit set up to proceed to the next step to activate your investor account. | STEP 3 Start Investing Use the SIP calculator to analyze your investment or choose goal-based investment strategy for the same. Enter details such as : How much do you want to invest each month How long do you want to stay invested The expected rate of return | STEP 4 Review and Confirm Investment The calculator will show:

Once you are happy with your investment plan, simply click on invest to activate the process and begin your investment journey. |

You can track your progress anytime through your SIPFund.com account dashboard.

Start investing with the help of SIP calculator

SIP calculator is a tool that helps you plan the roadmap of your financial future. By helping you analyze how much you need to invest and by showing you the performance of your investment, you gain the clarity and confidence to take responsibility for your financial goals. Whether you are saving your child’s education, child’s marriage, dream home, dream car or for a stress free retirement, SIPFund.com's SIP calculator can help you plan effectively.

With the minimum paperwork, flexible investment options and the power of compounding, SIP with SIPFund.com is one of the smartest ways to continuously increase the corpus over time. Start early, invest regularly and let your money work for you.