Safety through Structure of Mutual Funds

A lot of speculation persists when it comes to the security of a mutual fund. However, most investors do not know how and what a structure of mutual funds looks like and how it operates. This might be due to the reason that a lot of investors are new to mutual fund concepts.

In simple language, mutual funds mean investors are pooling tons of money to the fund managers who expertise in investing in the market and rewarding with a good return.

A myth associated with a mutual fund is safety. And to understand the instrument of security of a mutual fund, it is necessary to understand the structure of the mutual fund and the roles of different organizations and regulations made by the Government through SEBI.

Today, in this article, you will know all the critical aspects that you must have information on when it comes to the safety of Mutual funds. Read on!

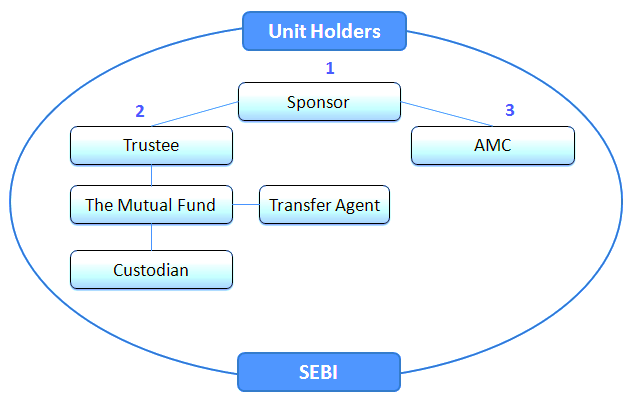

THE THREE-TIER STRUCTURE OF MUTUAL FUNDS

The structure of Mutual Funds in India is of three-tier. These three distinct entities in the process are -the sponsors (one who creates the mutual funds), Trustees, and the AMCs. However, when you study the history of mutual funds in India since the 1960s, you will learn that this structure came into existence due to SEBI Mutual fund regulations, 1996.

Let's understand the various role of various entities involved, SEBI, the part of AMFI, who a custodian is, and what roles RTAs play. In contrast, we will also talk about the power of the fund managers.

1. The Sponsors

A fund sponsor is the first layer in the three-tier Mutual fund Structure. A fund sponsor is any person, organization, or entity that sets up a mutual fund to earn money by fund management. A sponsor can be a national promotor, a foreign entity, or a joint venture. A sponsor is the promotor of the company and has to seek permission from SEBI to set up a mutual fund. If all the things go right, and the company (Sponsor) passes the eligibility, public trust is formed following the guidelines of the Indian Trust Act, 1882. Not just that, it is also registered with SEBI.

ELIGIBILITY CRITERIA BY SEBI TO BECOME A FUND SPONSOR

- A minimum of five years of financial service experience with positive net worth for all previous years is mandatory.

- The sponsor's net worth in the last year should be greater than the capital contribution of the AMC.

- Profit in at least three out of five years, including the last year.

- The sponsor should hold a minimum of 40% share in the net worth of the AMC.

2. Trust and Trustees -The next layer

Once the sponsor gets a nod for forming a mutual fund, right wings must be constituted for a smooth, safe, and secure function. Hence, for the same, the sponsors of mutual funds form a trust, the second layer of the mutual fund structure. Like, the board of directors, this trust has a "Board of Trustees." The BOT is formed following the norms by the SEBI. The minimum strength of the board must be four members, of which two-third member of the BOI must be independent Directors. This two-third of people should have no relation with the sponsor in any way.

The trustees work to monitor all the activity of the Mutual fund and check the compliance with SEBI regulation. Without the prior consultation of the trustees, the AMC cannot float any scheme in the market. They need to publish a report before SEBI every six months about the activities of the AMC. Also, the trust monitors the procedure systems and overall working of the Asset management company.

3. Asset Management Company (AMC) -Third Layer

After trustees, the next important entity is the AMC. AMCs are formed by the norm of the Companies Act, 1956. Hence, the AMC must be registered with the Government of India. The AMC works as the fund manager or an investment manager for the trust, and a small fee is paid to the AMC to manage funds. It is then bound to collect funds and provide service to the investors or the beneficiaries. It solicits these services with other elements like brokers, auditors, bankers, registrars, lawyers, etc.,

When the trustees form the AMC, it is also their job to appoint the CEO, Chief Investment Officers, and Fund Managers. They also appoint the Chief Marketing Officers, etc.

SECURITY & EXCHANGE BOARD OF INDIA (SEBI) -A STEP TOWARDS MORE SECURITY

The 1996 regulation of the SEBI mutual fund states that all the mutual fundsare registered with the Indian Trust Act, 1882. The net worth of the AMC or the parent firm must be at least Rs. 50 Crore. It also holds the right to penalize mutual funds for violating norms.

IMPORTANT SEBI REGULATION FOR MUTUAL FUNDS

The Security and Exchange Board of India (SEBI) has built comprehensive sets of rules and regulations for mutual funds. However, some of the major conventions and guidelines that ensure the proper functioning of the market are as followed-

1. According to the SEBI, for a mutual fund, the AMC should consist of 50% independent directors, a separate board the trustees.

2. SEBI says that all the AMCs should manage the funds and trustees hold the custody of the assets.

3. SEBI takes care of the Sponsors and financial soundness of the fund and integrity of the business.

4. Mutual funds should follow the principles of the advertisement.

5. SEBI takes care that the open-ended scheme and closed-ended scheme, a minimum of 50 crores, and 20 crores corpus are needed to be maintained.

6. SEBI checks mutual funds twice in every year to make it in compliance with the regulation and guidelines.

SEBI Colour-code Guidelines on mutual funds

The SEBI has played with colours to ease mutual fund investing, making the label colourful and meaningful. To determine the different levels of risks, the SEBI uses three main colour variants, i.e., Blue, Yellow, and Brown.

1. Blue is used to denote low risked loans. These are mainly debt schemes like debt mutual funds, fixed maturity plans, liquid funds, and gilt funds.

2. Yellow is for a medium level of risk associations. These are hybrid mutual funds like monthly income plan, balanced mutual fund, etc.

3. Brown implies that the risk is invariably higher. However, for higher chances, the return is high too. Funds falling into the brown category are diversified equity funds, mid-cap and small capital funds, and index funds.

ASSOCIATION OF MUTUAL FUNDS IN INDIA (AMFI) AND ITS ROLE IN SAFETY OF MUTUAL FUNDS

AMFI is another non-profit organization working in tandem with the SEBI and stock exchange for promoting investment habits and investment protection in India. AMFI's main objective is to promote and protect the interest of Mutual Funds and its unitholders. It is also responsible for maintaining high ethical and professional standards and enhancing public awareness of Mutual Funds.

Much like SEBI, all the activities of the AMFI is closely monitored by the Ministry of Finance. Hence, the AMFI is dedicated to developing the Indian Mutual Fund Industry on professionaland ethical lines enhancing the maintenance standard in all areas intending to protect and promote the interest of the shareholders.

OTHER COMPONENT IN THE STRUCTURE OF MUTUAL FUNDS

Apart from all the things discussed above, the conclusion of this topic is still far. As you see, there is no two or three layers of security that prevail in the safety of the mutual funds.

As we move forward, we will now learn more about the different components in the three-tier structure of the mutual fund.

1. Custodian

A custodian is the one responsible for the safekeeping of the security of the Mutual fund. It manages the investment account of the mutual Fund, ensuring the safe delivery and transfer of the deposits. The Custodian or the depository is held responsible for holding all the financial assets safely in custody. A suitable synonym for a depository is the bank locker.

A custodian keeps an eye on all corporate actions like when it is a stock declaring dividend, bonus issues, etc., in the stock where the mutual fund has invested.

Do note that, Sponsors and Custodians must be separate entities, which makes mutual funds a very safe instrument, and the chances of fraud is negligible.

2. Auditor

As per the Companies Act, all companies must get their accounts audited and scrutinized by an external financial auditor. These auditors are certified, chartered accountants. Every AMC hires an independent auditor to analyze their performance and to keep their transparency and integrity intact.

At the end of the year, these auditors also check and certify the financial reports prepared by the mutual fund companies.

3. Brokers

AMCs takes the help of the brokers to purchase and sell securities on the stock market. The AMCs uses reports on research and recommendation from many brokers to plan their market moves.

All this is done keeping the fiduciary nature of the three-tier structure of mutual fund in mind. It also makes sure that every element of the system is moving independently and efficiently.

RTAs AND THEIR ROLES IN SECURING A MUTUAL FUND

Registrars and Transfer Agents (RTAs) are organizations or companies that register detailed records of investor transactions and keep a record of all the things. As investors carry out multiple transactions like buying, selling, exchanging, redeeming funds, updating specific personal info, etc., all the details must be kept together.

The necessary work of the RTAs is to scrutinize and manage the back-end operation of the AMCs. AMCs outsource the job of maintaining day to day operations like purchase and redemption request, making the KYC, and account statement. CAMS and Karvy are the two main RTAs in the country. Some of the AMCs in the country also manage their back-end operation on their own without an RTA.

HDFC, Birla, ICICI, SBI are provided RTA services by CAMS. In contrast, Reliance, Axis mutual funds, UTI have chosen Karvyas RTA.

ROLE OF A FUND MANAGER

A fund manager is generally responsible for implementing a fund investing strategy and managing its portfolio. One person can manage a fund, two or even a team of managers. It is the fund manager who monitors the market, economic trends, and tracks security to make informed investment decisions.

A fund manager is responsible for a fund's performance. He looks at optimizing returns while managing risks for the portfolio. He needs to focus on a quantitative parameter such as price-to-earnings ratios, sales, earnings, dividends, and other parameters.IT is the job of a fund manager to decide which stocks will form part of schemes and build a portfolio of assets to accomplish the aims of the mutual funds.

How do fund managers maximize the safety of your mutual funds

In the market, there are many risks that your mutual fund is exposed through. These may be market risks, business risk, currency risk, etc. You do not have the power to control the market. These are instead based on macro factors such as economy, global crisis, trends, politics, policies, etc.

You will get a plethora of information available on the internet about business risks. However, what about the small and mid-capital companies we don't know about? This is precisely where the fund manager comes into the picture. These professionals, through meetings and conversations with top management, see the business plan of those companies. After clearly studying the market and its potential, fund managers which stocks will form part of the scheme and builds a portfolio of assets to accomplish the aims of the mutual fund.

If you think this is simple as only to do some market research and getting started, you are mistaken. These are highly complicated things and are only learnt from years of practice and experience.

WRAPPING UP!

To summarize, if we look at the 3-tier structure and the regulations a mutual fund company must strictly adhere, we can say with 100% surety that the investors’ money is safe in mutual fund investments. As mutual fund investments are subject to market risks, the only risk the investors take on their investments is the risk of market fluctuations. As the structure is fool proof, there are obviously no scams or fake schemes in mutual funds that make investors lose their money.

So, happy investing!