New Riskometer tool for Mutual Funds

The Securities Exchange Board of India (SEBI) recently brought a few new measures for the mutual fund industry into the picture for making mutual funds more investor-friendly and bring transparency in the risk associated with mutual funds. SEBI has given enough time for fund houses to comply with the new guidelines. These rules will apply to mutual funds from January 2021.

In today's read, we will unravel all you need to know about Riskometer, and the recent changes done in the Riskometer tool. We will first discuss these changes and then move to how this will affect fund houses and investors. Keep reading.

What is a Riskometer?

Riskometer is the visual and pictorial representation of the risk associated with a mutual fund scheme. It shows the visible risk the principal amount will go through. Today, the riskometer consists of five risk levels, which from January 2021, will be replaced by six groups of risk

What is the new rule?

SEBI introduced detailed guidelines for determining a new place for mutual funds in the riskometer tool. In the more original system, the SEBI introduced a new category of "very high" risk. It will replace the older model based on the scheme's type without considering the actual portfolio. The circular released as of 5th October says that the riskometer should be evaluated monthly. Asset Management Companies (AMCs) will have to disclose the updated portfolio within ten days from each month's closure. Along with that, mutual funds will also have to publish a history of riskometer change every year.

Below are the three significant changes brought in the riskometer by the SEBI:

- Apart from the existing five risk categories, a new type of "very high risk" is added

- Fund Houses are bound to update the riskometer every month.

- Mutual funds must disclose the scheme's risk level every year along with the number of times the risk level has changed in a fiscal year.

How are the risk categorized?

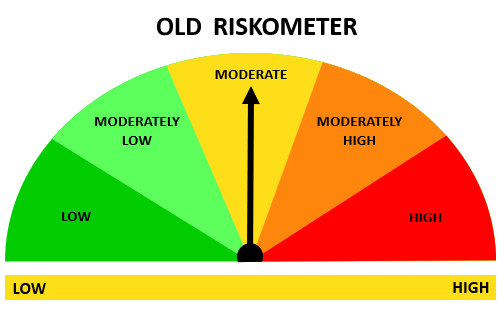

Based on the risk involved in a mutual fund scheme, the Association of Mutual Funds in India (AMFI) issued a set of guidelines. Before we move on to that, below is the earlier riskometer that was used for risk categorization.

Picture: Old Riskometer

Previously, the riskometer had five levels of risk – Low, Moderately Low, Moderate, Moderately High and High.

However, now the riskometer will be acquainted by the sixth level of risk, i.e., "very high risk."

Picture: New Riskometer

Below is a tabled chart of how mutual fund schemes are categorized on the five-risk level and the requirement for schemes to fall under the new risk category.

| RISK LEVEL | RISK SCORE AS PER NEW METHOD | SUITABLE FOR | PRODUCTS UNDER THIS CATEGORY | INVESTOR PERSONA |

|---|---|---|---|---|

| Low | <=1 | Conservative | Gilt funds / Income fund with maturity less than 90 days | Risk-averse and people who give priority to their investment |

| Moderately Low | >1 to <=2 | Moderately Conservative | 91 to 3 years short term bonds | Normal risk-takers who also prioritize the safety of investment |

| Moderate | >2 to <=3 | Moderate | MIPs, / Hybrid debt-oriented funds | Long-term investors willing to take a certain degree of risk in a change of lucrative returns |

| Moderately High | >3 to <=4 | Moderately Aggressive | Index Funds / Gold ETFs / Balanced equity funds up to 20% in the portfolio / Generally large cap funds | Long term investors ready to expose to some degree of risk |

| High | >4 to <=5 | Aggressive | Micro-cap funds / International funds / Sectoral funds | High net worth individuals who want long-term investment and do not mind the risk of incurring a loss. |

| Very High | >5 | Overly aggressive | Not yet specified | - |

New "Risk-o-meter" for Debt Mutual Funds

In a debt mutual fund, the risk is categorized at three different levels

- Credit Risk - Based on the rating of each Security

- Interest Rate Risk - Based on the Macaulay Duration of the portfolio

- Liquidity Risk - Based on Credit Rating and Structure of Debt instrument

The average of all the three risks or liquidity risk values, whichever is higher, will be considered. For ex- the average of the three is four, and liquidity risk is three, then the final score will be 4.

New "Risk-o-meter" for Equity Mutual Funds

In the equity Mutual Funds is assessed at three-level.

- Market Capitalization

- Volatility

- Impact Cost

The weighted average of the three based on the Assets under Management (AUM) of each instrument is the final score.

How will this affect AMCs and fund houses?

Well talking about the new risk-level addition in the riskometer, the fund houses will not be adversely affected by this. Previously, all the fund houses had to categorize their mutual fund scheme concerning the five risk levels. With the addition of a new risk level, “Very High Risk," a few high-risk portfolios with a risk score of more than five will be shifted to this category.

In contrast, the new rule of monthly updating the riskometer in a portfolio will boost investors' confidence and encourage them to invest more. Fund houses will now have to calculate their risk every month, helping them maintain and make frequent changes in their portfolio. This will also ensure that the investor loses the least amount of money through the mutual fund scheme they choose.

How will the new SEBI rule of riskometer affect investors?

A few changes brought in the riskometer that will apply to fund houses and mutual fund schemes will have an incredibly positive impact on the investors. The SEBI has now improved transparency when it comes to high-risk portfolios and makes mutual funds more investor friendly.

With the availability of the updated mutual fund risk every month, investors can scrutinize their portfolio better. This will ensure the exact level of risk associated with the mutual fund at the end of every month. Investors can better plan their investment journey. This might be an excellent chance for new investors to understand the risk associated with mutual funds and those who rely on the meter or a financial advisor.

For example, suppose any investor is willing to take risks according to the present riskometer. In that case, he has no option to distinguish between two different high-risk mutual fund schemes. With the arrival of the sixth level of risk, the investor will then be able to make better decisions regarding investment in high-risk profiles.

Although the risk of mutual fund does not only depend on the riskometer level, it depends on several other things. Hence, you always need to take care before you get into investment.