What is NPS?

- Individual savings are pooled in to a pension fund.

- Invested by PFRDA regulated professional fund managers.

- Fund managers invest in diversified portfolios comprising of government bonds, bills, corporate debentures and shares.

- These contributions will grow and earn for the individual.

Advantages:

- Flexible

- Simple

- Regulated

- Tax savings

- Transparent cost structure

- Portable

"Deduction up to ₹.50,000 u/s 80 CCD(1B)"

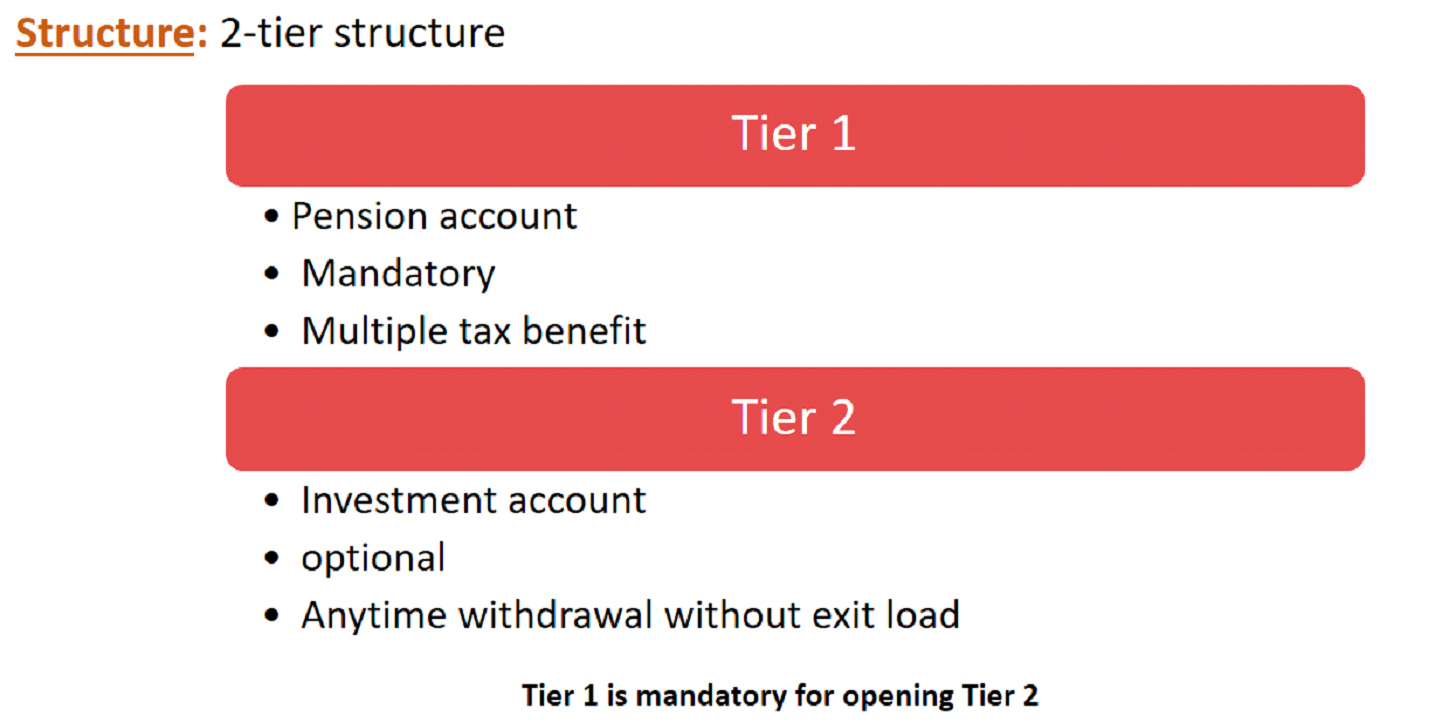

Structure: 2-Tier Structure

Investment under NPS:

Minimum amount per contribution is ₹.500 and the minimum contribution in a financial year is ₹.6000. “No maximum limit”

Active choice

Minimum amount per contribution is ₹.500 and the minimum contribution in a financial year is ₹.6000. “No maximum limit”

Auto choice

Funds managed on the pattern of a lifecycle

Exit from NPS:

On reaching the superannuation age of 60 years

- The subscriber has to use at least 40 percent of the accumulated corpus to buy an annuity.

- The remaining funds can be withdrawn as a lump sum either at once or in a phased manner before 70 years.

Exit before turning 60 years

- An option to withdraw 20 percent of the accumulated savings

- Compulsorily buy an annuity with the remaining 80 percent

Call us today at +91 9513355661/62/63/64 or Email us at info@sipfund.com

Our experts will be happy to guide you for National Pension Schemes. For free advice enter your number and we will çall you.+91